Welcome to this post, where we are going to see the different staking options you can do with your Luna to maximize your profits by staking.

If you have Luna tokens in an exchange like Binance in your balance without making a profit, you are losing money. Because there are alternatives to staking your Luna tokens and get even more Luna. So if you want to start getting more Luna by just putting your tokens to work, stay until the end of the post to learn about all the different alternatives.

It is very likely that the % that we will see will vary when you are reading this, so I recommend you to go to the platform where you are interested in staking your Luna and see where you can get better returns. Although the % will vary, usually the strategies or platforms that we will mention that usually have higher annual %, will continue to be so.

In this post we will focus on the different options, and not so much on how to do it step by step to have your tokens staked on the platform. For this, you will be able to find links to a guide for each platform so you can better understand how each of these platforms work.

If you want to learn how to find these opportunities and platforms on your own, I have created a guide detailing the tools and aspects you should consider to find the best staking and farming opportunities for any cryptocurrency, which you can find here. So you can’t miss this guide if you want to be updated on the best opportunities.

Best place to Stake Luna

Below, you can see some of the options discussed in the article, but there are many others that are not in the video. So I recommend you to read the post to know all the possible options.

Let’s first look at the options for staking with Luna, which is much simpler and has less risk. Although we will also discuss some options for farming with LP tokens, after covering the staking options. Farming with LP tokens is more complex if you are new and have never used it, but it offers good returns at the moment.

The farming with LP tokens that we will see do not have impermament loss, and for this reason we will comment on them, as they do not have one of the main risks of creating an LP, and are very similar to staking with your Luna. If you are interested in getting the maximum possible profitability, do not hesitate to see the last part.

Staking

Terra Station

The first option we found is staking in terra station, in exchange for 6.68% at present. This % will vary and is likely to be lower in the future. This form of staking is very safe, since you will have to use terra station, terra’s own network platform and it does not have many risks. If you are looking for a safe strategy, this may be your best option.

In addition to the annual % that you can find in terra station in staking, sometimes the terra network makes airdrops and gives out tokens to users who have Luna tokens staked in terra station. So don’t miss out on the extra tokens you can receive as an airdrop, plus the annual % for delegating your tokens. If you are interested in knowing the safest way of staking Luna with terra station, you can find a step-by-step guide on how to stake your tokens here.

Anchor Protocol

Let’s go with the main strategy that Anchor protocol uses, and have more risk. If you are new to DEFI, I recommend you to get informed before following this strategy. The strategy revolves around bluna, which is bonded luna, with the same value of Luna that you can get in Anchor, and you can change your Lunas to blunas.

This strategy consists of placing bluna as collateral, and borrowing UST. The maximum you can borrow is 75% of the bluna value, and if the price of bluna falls and reaches 80%, they can liquidate half of your bluna. This is the main risk. By putting bluna as collateral, and borrowing UST, you are going to receive a % anchor to the total you have borrowed. It is currently around -5.89%. In addition to having your USTs to use, for example in anchor, in the earn tab and get an extra 19% annual return for the time being.

So basically if you place $1,000 in bluna, equivalent to luna, you can borrow up to 75%, $750, although it is not recommended. To be safe and avoid being liquidated, you can borrow 50%, so it would be $500. Of this $500, you could place it in anchor at 19.48% per annum, subtracting the 5.89% that you currently have to pay for borrowing. This leaves 13.59% on the $500. If we look at the % on $1,000 of Luna’s $1,000 that we have deposited in Anchor, it would come out to about 7% per annum.

Keep in mind that the % you get will depend on the borrowing cost you will have to pay, and the % Anchor gives for staking with UST. It is actually very similar to the 6% you can get in terra station, although in Anchor you can get a little more.

You can find the Anchor Protocol guide here.

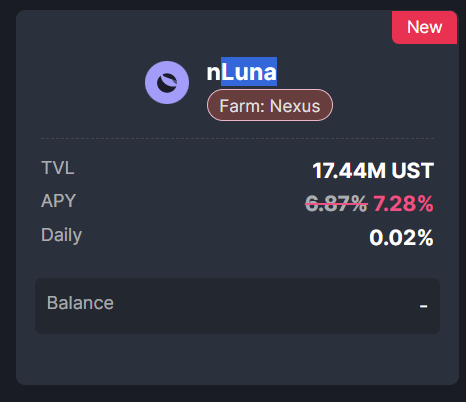

Nexus protocol

Nexus protocol is a way to optimize your staking strategy that we have discussed in Anchor Protocol. You will obtain higher profitability by limiting the risk of being liquidated. Since the Nexus platform is constantly using the maximum LTV or Loan to value ratio, which is the amount you can borrow in Anchor to maximize profits.

In addition, avoiding being liquidated when the Luna price drops by paying a portion of the loan to avoid being liquidated. It is a way to optimize the Anchor strategy and reduce risk.

Nexus protocol what it does is to deposit the Luna that you deposit in its platform in Anchor, with the deposited luna it obtains bluna, and asks for a loan of UST with the maximum possible avoiding to be liquidated. With the UST received as a loan, it deposits them in Anchor to obtain the 19.55% that this platform gives when staking UST.

As you can see, you can get 6.87% currently, but it tends to fluctuate if Anchor’s rewards for borrowing increase or it’s cheaper to borrow with bluna. You can also see that it uses an LTV or loan to value ratio of 65%, so it means that if you deposit $1,000, it’s going to borrow $650 in UST. If Luna’s price falls and the LTV rises to 70% Nexus automatically uses the borrowed USTs to repay part of the loan and always maintain a 65% LTV balance.

The main disadvantage Nexus has, is that the % you can see in APR is paid on their native token, psi, and if psi drops in price and you don’t sell it, you are actually getting less annual % with your Luna. Still, you avoid the risk of being liquidated in Anchor and you optimize profitability to the maximum with this platform.

You can learn more about how Nexus Protocol works here.

Stader

Stader has similarities with Nexus Protocol, but instead of optimizing Anchor’s staking, it optimizes the staking you make by delegating your Luna Station. You can see below the different 3 strategies, and the annual % and compare it with what you get in terra station.

As you can see, with Stader you get 1% more, since in terra station at this moment you get 6.68% and with stader you get 7.80% with the airdrops plus strategy. Basically stader what you are seeing is an APY, and in terra station an APR without reinvesting the gains. What stader does is to use the rewards you receive every day or few hours and put them back into staking. This is known as compound interest, and therefore the annual % you get at the end of the year is higher. In addition, the airdrops you receive for staking Luna, you can also use them to sell them and continue making compound interest with the airdrops you receive.

They also have liquid staking, LunaX with a very similar annual % and that can be useful to maximize your profits with their LunaX-Luna LP and get even more profitability. But this is LP, not staking.

You can learn more about how Stader works here.

Lido

Lido is one of the leading liquid staking platforms for Luna, Solana and Ethereum. Although in this case, we will focus on Luna. The main advantage is that you can use the tokens you have placed in staking, unlike if you delegate them to terra station. Usually the annual % you get is lower than terra station, but for very little %, in exchange for having a liquid token, with the advantages it unlocks.

Usually the annual % you get is lower than terra station, but for very little %, in exchange for having a liquid token, with the advantages it unlocks.

In Lido you can staking with bluna and stluna, although it is more common to use stluna, since bluna can be staked directly in Anchor Protocol. As you can see, there is a difference of about 0.10% per year between the % we have seen in terra station. This is due to the liquid staking provided by Lido. If you don’t know what liquid staking is and what advantages it has, let’s take a quick look at it.

When you delegate or staking in terra station, you don’t have access to your Luna, and when you want to stop delegating them and get them back in your wallet, you will have to wait 21 days to do so. On the other hand, with Lido, when staking Luna, your Luna are also blocked, but you receive an equivalent token called stLuna. stLuna appreciates the annual % with respect to Luna, so you do not receive rewards. Rewards are compounded within stLuna and its price. When you want to get Luna again, you exchange your stLuna for Luna, and you will get more Luna. But you will also have to wait 21 days to get Luna again.

The main advantage is that, if you don’t want to wait the 21 days, you can use your stLuna in an Exchange like astroport and exchange them for Luna directly. You will not receive the same amount as if you wait the 21 days in Lido to get your Luna, but maybe it is a 1-2% difference, in exchange for having it whenever you want. In addition to the advantages of farming as a liquid token, but we’ll leave that for later.

You can learn more about how Lido works here.

KuCoin and Binance

Finally, we find the centralized exchanges, of which we can find Luna’s staking in KuCoin and Binance among many others. But these are the most used centralized exchanges that have this option. Actually at this moment, Binance offers a good profitability for staking with your Luna, although you must block them, while Kucoin offers a lower interest. Even so, it is another great alternative if you don’t want to use a wallet and you want to have your cryptocurrencies in a trusted centralized Exchange.

If you use another centralized Exchange, you can also look for Luna’s staking. And if not, use one of these two alternatives. Just below you can create an account with these exchanges if you don’t have one yet and stake your Luna.

It is possible that new platforms such as Nexus, Stader or Lido will continue to come out with different approaches and improve Luna’s staking, so I recommend you always look at the new platforms and the most used platforms on the Terra network if you are interested and have time. It is possible that we have left out some less used platforms, but these are currently the most used. Although if you want to maximize your annual % you get with Luna, you can not miss what we are going to see now.

Platform: KuCoin

Min. Deposit: $30

License: Cysec

Very low commissions

Exchange with a wide variety of cryptocurrencies

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies

LP Tokens without impermament loss

With the emergence of liquid staking such as bluna or stluna, farming opportunities have appeared with LP Tokens that have very little or almost no impermament loss, as they are linked to the price of Luna. This allows you to get a good return by creating the LP, higher than staking your Luna with up to 15-20% per year.

The only disadvantage is that you will not receive the airdrops from staking Luna, and that there is a risk that some tokens may become detached from the price of Luna and then you may suffer impermament loss. Although this is unlikely, it is a risk to consider.

If you are not experienced in creating LP tokens and farming, you can find a guide on our site before you put your money in without really understanding what you are doing.

The LP tokens we will look at are bluna-luna, stluna-luna, lunax-luna and a few others. But as you can imagine, bluna is very difficult to stop being linked to the price of Luna, since it has Anchor protocol behind it, and the same with stluna, being Lido one of the leading platforms in liquid staking and more TVL or total value locked in its platform. Still, it is important to mention and be aware of the risks. With that said, let’s see where we can find these opportunities.

Astroport

The first platform we will look at is the main DEX of the Terra network, and which I personally use with the stLuna-Luna LP. Below, you can see the annual %’s at the time of making this article.

As you can see, currently the highest annual % in stluna-luna, but bluna-luna is quite similar. While lunax-luna, has a much lower annual %. Mention that the annual % vary quite a lot every day, and from my experience stluna-luna, usually has a better average annual % than bluna-luna, besides there is more capital in bluna-luna, and therefore the commissions are divided between more.

Astroport being the main DEX of terra is very likely that you can always find the best % of LP’s of Luna with another pair of luna as can be bluna or stluna. You also have to consider that in bluna-luna you receive the astroport platform token, while in stluna-luna, you will receive a small part of the annual % in LDO, the Lido token. If you remove that reward, the annual % is very similar.

So just see which LP you are more interested in considering the risk and annual %, and you can get a good annual %, without the impermament loss or a very small one compared to staking with Luna.

You can learn more about how Astroport works here.

Spectrum Protocol

Spectrum protocol is the same as Stader, but with the farming of LP tokens and the rewards of other platforms such as Nexus, where we will maximize our annual % with this platform. Spectrum uses the rewards that we receive and returns them to the LP, in this case bluna-luna which is the only one currently available of those mentioned above.

As you can see, you can also place your nluna here, which is the token you get when you deposit your luna to Nexus protocol, and it automatically sells the psi and places more to Nexus staking. This way you can mitigate the risk of psi price drops, and get a lower annual % than what Nexus shows.

Regarding LP, right now you can maximize your annual % with bluna-luna, with almost 4% more per year than what you get in Astroport. The only risk you have, is that the platform gets hacked. This is why many people do not use farm optimizers like spectrum, although in this case it does not seem to be a platform with bugs or possible hacks. But it is something to take into account, and usually a platform like astroport is much more secure than a platform that optimizes the staking or farming of other platforms.

At DEFI we have seen both sides. Platforms like beefy that are farm optimizers that have never been hacked and have not had any problems, and more than one farm optimizer platform that was hacked in the past, like grim finance.

You can learn more about how Spectrum Protocol works here.

Saber

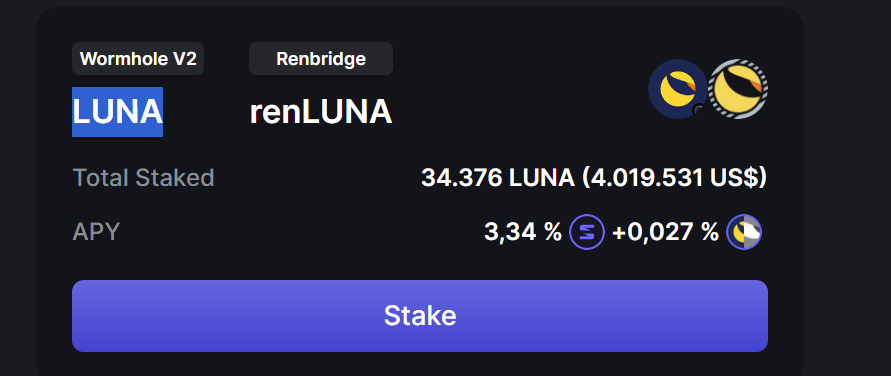

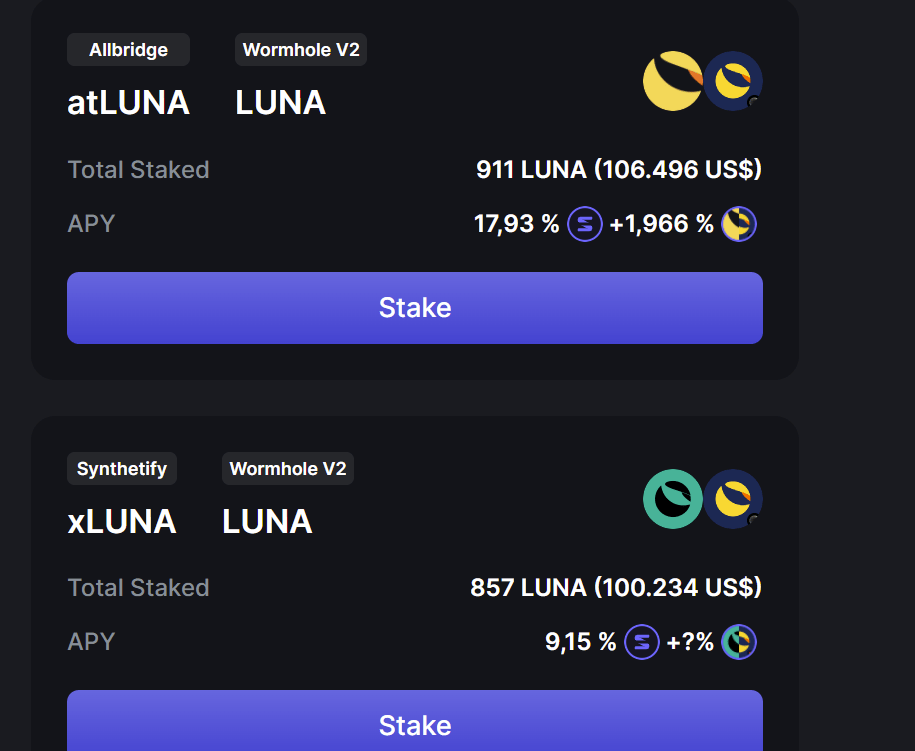

Finally, let’s look at saber, which unlike everything seen above, is in the Solana network. Even so, sometimes there are good annual % that can be worth moving our Luna to this network to do farming and get a good annual return. In this case, we find pairs like Luna-renLuna, atLuna-Luna or xLuna-Luna that are in the Solana network. Below, you can see some examples.

Saber is a platform that provides liquidity to bridges between networks, and therefore needs liquidity and LP’s of different tokens. As there has been a lot of collaboration between Terra’s network and Solana, we find Luna tokens and different derivatives such as xLuna or renLuna in this network. Saber makes sure to keep the price balanced on the Solana network with the LPs that you can bring liquidity. The process is the same as any DEX for this, but on the Solana network.

Also, above the token you can see where that Luna comes from, for example with atLuna, it uses allbridge, which is a fairly popular bridge. So by providing liquidity in atLuna-Luna, you help maintain the price of Luna when tokens are passed from one network to another using allbridge.

The aspect you need to be more aware of is that the %’s vary quite a bit in my experience using Saber. In some weeks they can be maintained but usually vary quite a lot, so you should go looking if the % have decreased a lot, or on the contrary and if it is more interesting to continue in saber or move your Luna to another site. You can also see two percentages. The first one is the annual % paid in Saber, the token of the platform, and the second one is the % you will be paid in Luna, as an incentive of the network you launched. So, for example, with atLuna-Luna, you’ll be getting 1.966% on the Luna token.

So Saber is another good opportunity, but you will need to do more active management if you want to maximize your annual return with Luna, as the annual %’s vary a lot. Also, always try to understand which two pairs of Luna you are using and where it comes from, like the case we have seen with atLuna from allbridge.

You can learn more about how Saber works here.

If you’ve made it this far, congratulations. In closing, it’s worth mentioning that there are and will be good opportunities to use Luna, and it’s a matter of keeping up with new platforms and protocols. A few months ago, there were only 3 interesting options, and you have already seen the list that exists at the moment. So, if you have time and interest, I recommend you to keep looking for new opportunities every few months. If not, you can use some of the strategies mentioned above, which will surely remain as effective and good for a long time.

I hope this post has helped you to know the different ways of staking with your Luna and you can maximize your annual %. If you want you can find here the guide to find the best staking and farming opportunities. Remember that just below you can find the links to create your account with the mentioned exchanges.

Platform: KuCoin

Min. Deposit: $30

License: Cysec

Very low commissions

Exchange with a wide variety of cryptocurrencies

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies