Welcome to this post, where we are going to see the best options for staking Solana that exist and that you can find.

We will focus on the main and most secure platforms, so we may not cover all the existing options, as new platforms are released every so often. But we will cover the most used and main ones currently available.

We will see both options that use DEFI and you will have to use a wallet like phantom, as well as options that are easier to use with centralized platforms. In all of them, we will see how they work, and you can find a more detailed guide of the platforms that we will discuss in this article. So, if you have Solana and you want to get the best annual profitability, I recommend you to stay until the end to know all the alternatives.

If you want to learn how to find these opportunities and platforms on your own, I have created a guide detailing the tools and aspects you should consider to find the best staking and farming opportunities for any cryptocurrency, which you can find here. So you can’t miss this guide if you want to be updated on the best opportunities.

Best place to Stake Solana

Before we start, we will first focus on classic staking options, and then we will look at another form similar to staking with LP tokens and farming that has the same risk as staking. But we will leave this for later.

Mention that you will see during this article the term APY and APR, which are not the same. APY, refers to the maximum profitability that we can get, when reinvesting in staking the rewards we get. And APR is what we will get in rewards. So, if we use the rewards we get and put them back into staking, we will be getting more profitability, and that is the APY.

Although if it sounds confusing, most of the time there is not much difference in % between APR and APY, so you can use any of them as a reference to avoid complications. Although if you want to analyze it in more detail, it is important to keep this difference in mind.

Staking

Marinade Finance

The first option we are going to see is Marinade Finance, as it is the most used with 700million $ in Solana within its platform, and I personally use it.

Marinade Finance is a liquid staking platform, where when we deposit our SOL, we will receive mSOL. mSOL appreciates in value with respect to SOL, and in this way we will get the 6.07% APY that is currently there.

By exchanging msol for SOL again, we will receive more SOL than we placed. If the 6.07% APY was maintained, and we place 100 SOL to Marinade and receive its equivalent in mSOL. After 1 year, when we exchange the mSOL for SOL again, we will receive 106.07 SOL.

The liquid staking you do not receive rewards as in other platforms, but the value of the token you receive, in this case msol is appreciating in value. The main advantage of this type of liquid staking is that you can use it on other platforms to get a higher annual %.

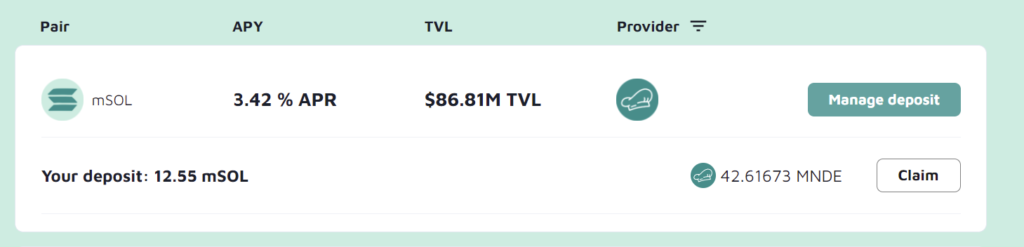

In the marinade finance platform itself, in defi we can stkaing the msol and get a 3.42% APY at this moment. Although from my experience, it’s usually lower around 1-1.5% APY. But still, it’s a way to increase your annual % thanks to liquid staking.

In addition to farming options with other platforms, or placing it as collateral on a lending platform, although we will leave this for later.

You can find the Marinade Finance guide here.

Lido

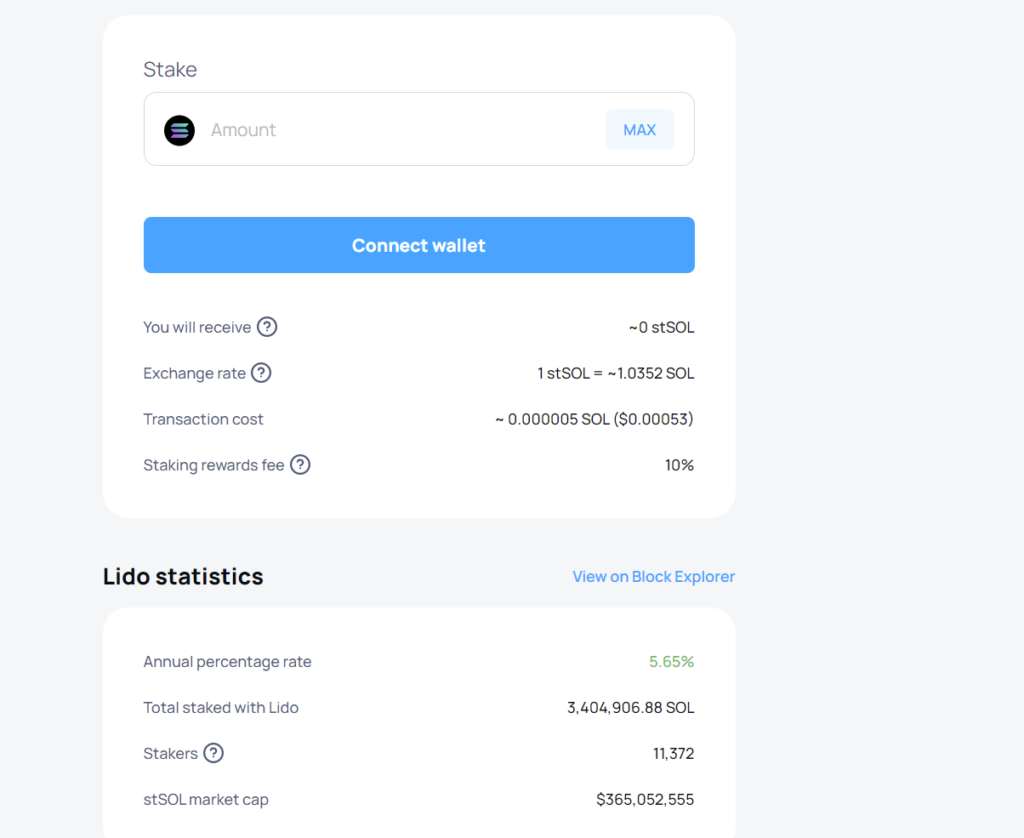

Lido is another liquid staking platform that has Solana as an option and is very similar to marinade finance. The main difference is the token you receive, where instead of being mSOL, you will receive stSOL.

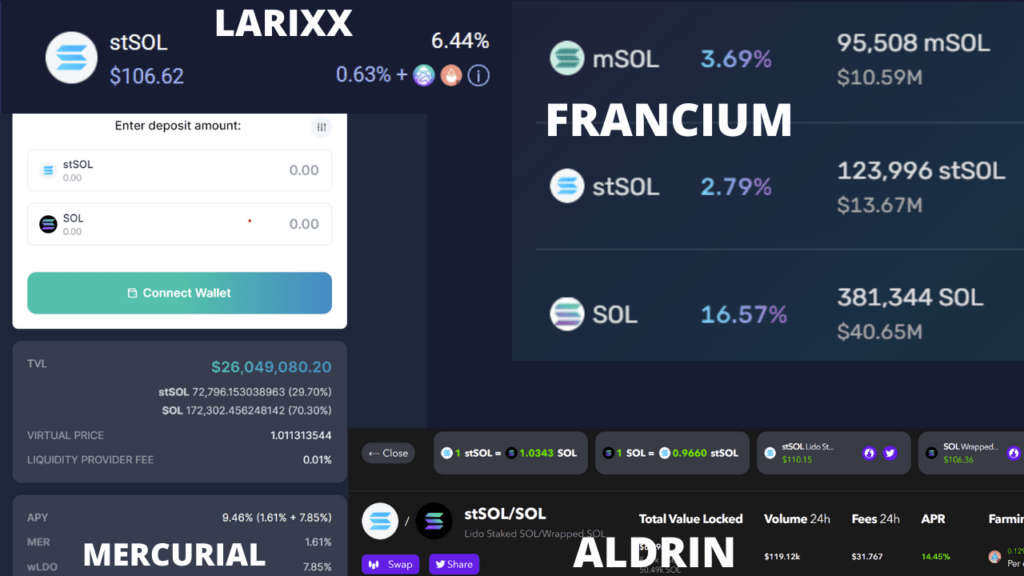

Currently, the annual % is 5.65% APY. So it is somewhat lower than what we have been able to see in Marinade. Still, stSOL has many applications on other DEFI platforms to increase the annual % you can get with your liquid staking.

Even on the platform itself, there is a Solana DEFI section. Here, you can see all the different opportunities that stSOL has and that you can use your liquid staking to get a better annual return. The options you see are on other platforms, and by clicking you will be able to see which platform is the one that offers that % for placing your stSOL or your stSOL with another cryptocurrency.

Note that when you want to exchange your stSOL for SOL you will have to wait 2-3 days to be able to withdraw your SOL again. The same way it happens in Marinade Finance.

You can find Lido’s guide here.

Solend

Solend is a lending platform, where it is not exactly staking, but the operation and mechanics are very similar. If you have used or seen AAVE, it is a very similar platform, but in the Solana network.

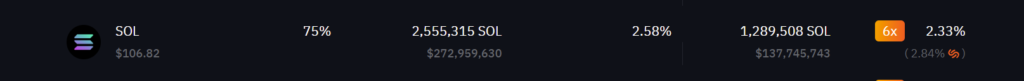

Here, we can deposit our SOL in exchange for an annual %, and use it as collateral to borrow another cryptocurrency. Although if we just want to place it for the annual %, you can simply deposit it and receive an annual % for it. Currently, the annual % is 2.58%. Lower than the ones we have seen, although with the advantage that you will be able to use it as collateral to borrow within the platform.

Also keep in mind that this is not staking, since you basically deposit your SOL so that another user can borrow it and get the profitability that it indicates.

Even so, it is very similar since you deposit your SOL in exchange for an annual %. One of the great advantages of Solend is that you can deposit mSOL and stSOL and get an extra return. So, the best option is to use one of the alternatives we have seen above, and deposit stSOL or mSOL here. With 3.19% for depositing stSOL, and 2.68% for depositing mSOL.

As you can see, with this extra interest you can get from Solend, it makes stSOL and mSOL one of the best options currently on the Solana network for staking.

You can find the Solend guide here.

Centralized Exchanges

Finally, there are the centralized exchanges where you can find Solana staking and even good returns. In the case of Binance, we find a return of 13.47% if we block our SOL tokens for 90 days. In the case of 60 days, 10.23% and 9.28% if we block the tokens for 30 days.

Binance has locked staking, which offers a good return, in exchange for having to lock the tokens and not being able to withdraw or use them during that time to receive the rewards. Still, it’s a good option if you plan to keep your Solana for a long time, and don’t mind having them in a centralized Exchange.

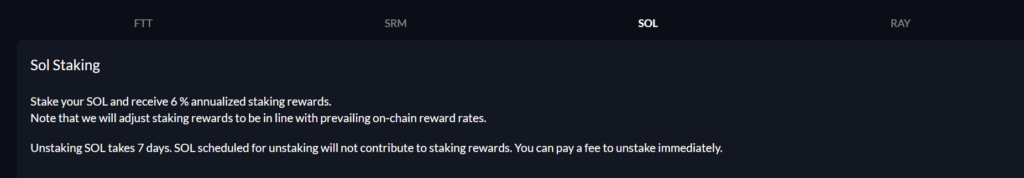

Also, I recommend you look into FTX at 6% per year, as it is the main Exchange that has integrated Solana and its network. Due to the support of the Exchange and its founder to the Solana project, where it has many integrations that you don’t find in other centralized platforms with Serum.

I also recommend you to look at other centralized exchanges, or if you use another one look if it has the option of staking Solana and what profitability you will receive for it. If you don’t have an account with binance, you will be able to create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies

LP Tokens without impermament loss

With the appearance of liquid staking of stSOL and mSOL, many platforms need liquidity to be able to exchange these cryptocurrencies for SOL or others. And this has made LP Tokens available for farming with good returns, even better than staking your SOLs.

Therefore, we could not leave this option without commenting. Besides having a risk very similar to staking, where there is no impermament loss or it is very small. Unlike other pairs. In pairs like msol-sol or stsol-sol, we will be able to obtain a good profitability, at the same time that 50% of the LP is in staking.

If you don’t know the terms farming or impermament loss, I recommend you to take a look at our farming guide to understand how it works. It may seem complicated at the beginning and it is important to know certain aspects before putting your money on it. Also, you can try to do some strategy that we will now see with little capital to better understand how it all works, as it is one of the best ways to learn.

The only risk you have, is if stSOL or mSOL stops being linked to the SOL price for any failure, but this is very complicated to happen, and it is the same risk as when doing liquid staking using these platforms.

Saber

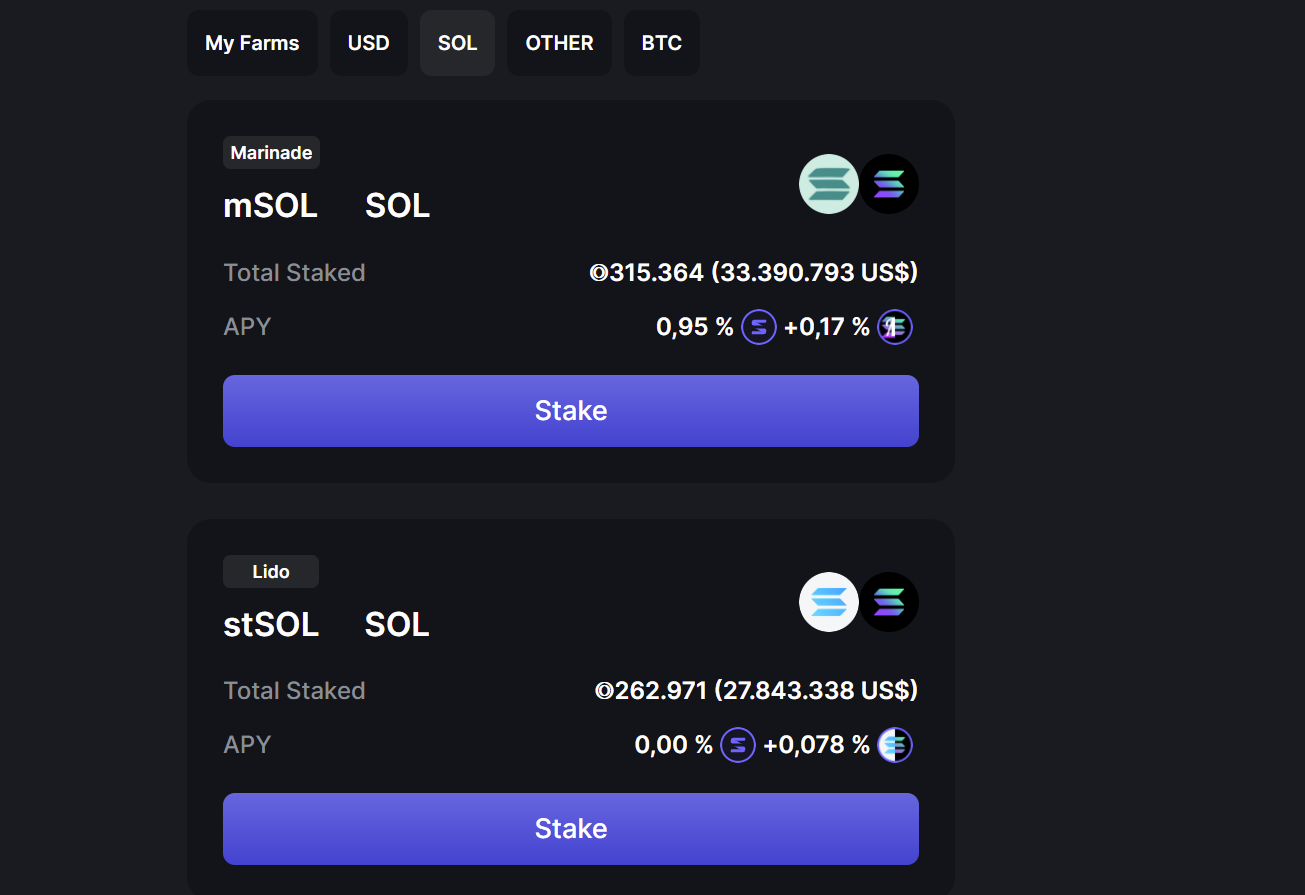

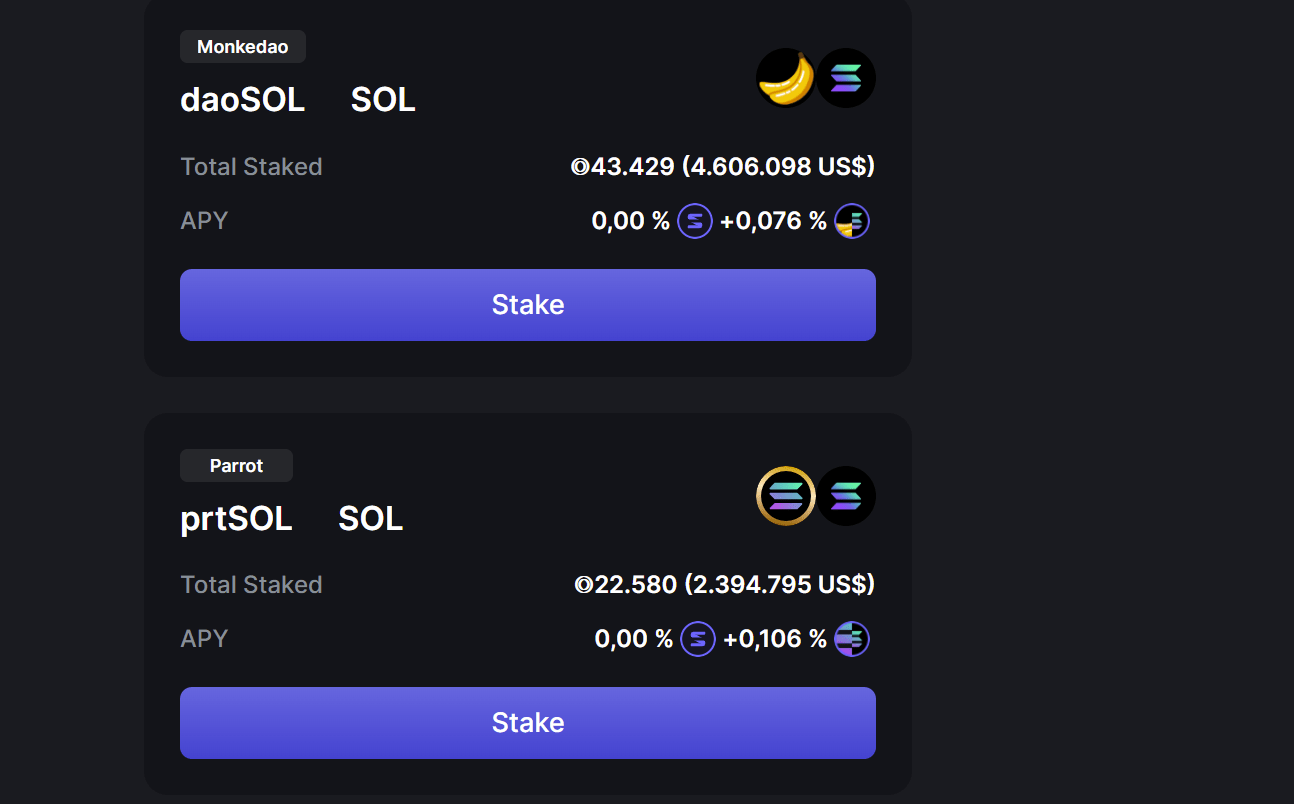

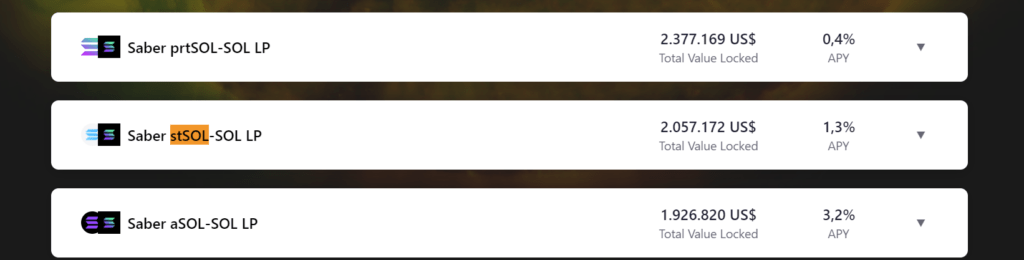

Saber is one of the main platforms to exchange cryptocurrencies in Solana and tokens from other networks. Here, we find different LP Tokens with no or very little impermament loss. For example, msol-sol and stsol-sol as main ones, although with a rather low % currently.

Although the annual % in saber fluctuates a lot and sometimes it can be a good opportunity. You can also see other pairs with higher annual %, such as daosol-sol, prtsol-sol, asol-sol, csol-cmsol among others. But always understand well what cryptocurrency it is and the risk it may have of losing its value linked to solana. Since many of these cryptocurrencies, are newer and have more risk of decoupling their value to SOL.

Still, Saber can be a good opportunity when it has higher annual % in msol and stsol. Keep in mind that 50% of your cryptocurrencies will be in staking when they are msol or stsol, and the other 50% will not, when they are SOL. Therefore, you must take into account the annual % you get for the LP, and the % you get with 50% of your tokens.

You can find Saber’s guide here.

Orca

With a very similar operation to Saber, Orca is a decentralized Exchange that has many liquidity pairs in Solana. And one of them is msol-sol. Unlike saber, we find a good annual %, with 3.15% at the moment. We also found scnsol-sol, with 2.49% per annum.

Scnsol is very similar to msol and stsol, but with a somewhat newer and less known platform. Still, it is a Solana liquid staking token, with $60 million in Solana on its platform.

As well as being one of the most used and reliable platforms out there in Solana. So it can be a very good option to place your msol-sol.

You can find Orca’s guide here.

Raydium

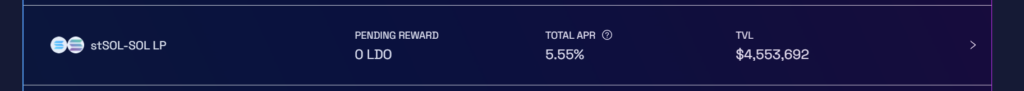

Raydium is the main decentralized exchange in the Solana network, and it also has an LP that is very interesting for farming. Unlike Saber or Orca, there is only one pair at the moment, which is stsol-sol. At the moment with a 5.55% annual rate, it is one of the best annual % currently available. Although it is very likely that this % will drop over time.

You will receive as a reward LDO, which is the token of the LIDO platform. However, you can sell the LDO you receive for SOL and stSOL and increase the amount you have in farms.

You can find the Raydium guide here.

Tulip y Sunny

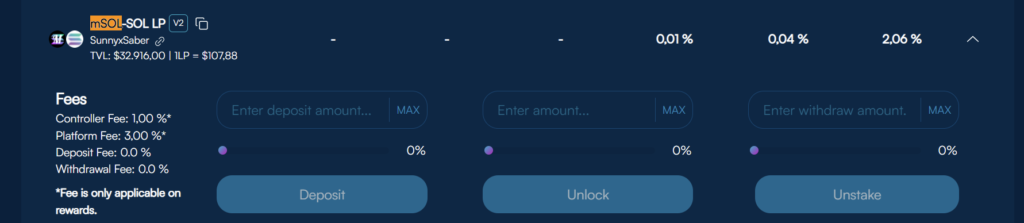

Finally, there are the farm optimizers. The most used and most reliable are tulip and Sunny. The optimizers take care of maximizing the annual % you get by reinvesting the rewards you receive and putting them back into the farming.

Therefore, you will almost always get a higher annual % using tulip or sunny than the platform where the farm is located, such as orca, saber or raydium. Although it is important to mention that you will not be able to find any farm from any platform.

Sometimes you will see a higher % in tulip or sunny, as each platform has its own incentives to attract users, but usually the annual % you will get using these two optimizers are very similar.

You can find the Tulip guide here.

Finally, we are going to name other platforms that you can investigate on your own and that are less known, but can offer good annual returns. Keep in mind that these platforms are riskier as they are newer, less known and with less capital in them than the ones we have seen.

- Aldrin stSOL-SOL (14,45% APR)

- Mercurial Finance (9,46% APR)

- Katana (14,88% APR)

- Psyfi (20,42% APR)

- Francium (5,90% APR)

- Larix (5,96% APR)

- Porto (8,63% APR)

These platforms have different operations, so before placing your SOL, take a good look at what each platform consists of and the risks associated with it. If an annual % is very high, it is because the platform or the way to achieve that profitability also has more risk.

LP Tokens with Impermament Loss

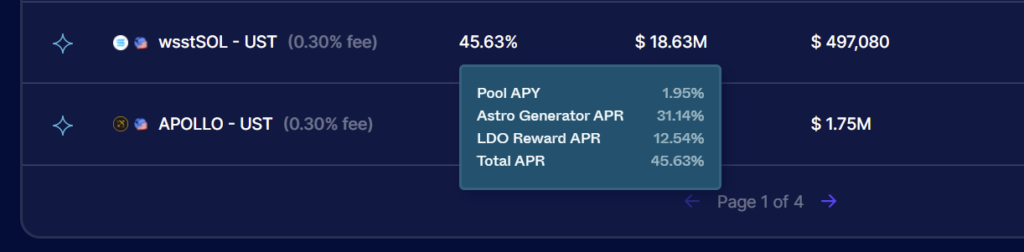

Finally, and leaving a bit of staking and farming without risk, I would like to highlight some farming options that can be very interesting. Despite the risk of impermament loss, the returns are higher and can be worth it depending on the type of investment you are looking for.

This type of farms are with SOL and a stablecoin, such as SOL-USDC, or SOL-UST, among many others. On platforms such as Orca or Astroport among others, we can find these pairs with 30-40% APR. Which is a much higher profitability than the 10-15% we get with Solana staking.

Now, you have to take into account the risks and disadvantages of this type of LP Tokens. Where on the one hand they protect you if the price of SOL falls, by having 50% in stablecoins with the LP, but on the other hand you stop earning as much if the price of SOL rises. For example, if the price of SOL drops 50% and you had $1,000 of LP SOL-UST, instead of having $500, you will have around $750. And the same if the price goes up.

It is a more conservative and less volatile way to get a good annual %. Where you don’t earn as much when the price of Solana goes up, and you don’t lose as much when it goes down. So, if you trust this cryptocurrency, but want to mitigate the risk while getting a good annual %, it is a great alternative.

Although we have named astroport or Orca, I recommend you to investigate Solana decentralized exchanges and other networks and you can see farming options with SOL and a stablecoin (USDC,USDT,UST, DAI) with 30-40% annually.

I hope it has helped you to know the best way to use your Solana and get the best possible profitability. If you want you can find here the guide to find the best staking and farming opportunities. Remember, if you don’t have an account with binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies