Welcome to this post, where we are going to see how Stader works, a way to optimize your LUNA staking thanks to this platform.

Currently there are different platforms where you can place your Luna in exchange for an annual %, such as anchor with bluna, but stader focuses on maximizing your staking rewards. Instead of placing your Luna in terra station and delegating to a validator, you can use stader with the different options and strategies it has to offer to get a higher annual %.

Stader is a fairly new platform, focused only on Luna staking, but it has very interesting options. Although it is a platform with little time, it already has almost 1 billion Luna dollars in its platform.

What is Stader

Stader is a staking platform based on non-custodied smart contracts that helps you to discover and conveniently access staking solutions.

Staking directly to a network such as Terra at terra station is often quite inefficient in several aspects. The main one, and the one that can be optimized the most, is to use the rewards you get to put them back into staking to get a better annual %. What is known as compound interest, and instead of getting 6% per year, doing this automatically we could get 7-8%. This is an example, not real data.

Besides using the rewards and putting them back into staking, the other problem that stader tries to solve and optimize are the airdrops. Luna being an ecosystem that has quite a lot of airdrops and there is a growing tendency to make airdrops to attract new users. If you don’t know what an airdrop is, how they work and much more, you can find a guide here.

Airdrops are often small amounts in the case of Luna that you receive every week or every few months, and therefore, often the cost of the transaction costs more than just the airdrop you receive. What stader achieves is to be able to use the airdrops to sell them and place the amount you get by selling in staking again, to increase the interest we get. Although you can disable this option or change certain parameters as we will see later. But basically, it is a way to increase the annual % by using the airdrops you receive to maximize your annual %.

These are two aspects that help stader to improve from the classic Luna staking with terra station as we will see now. Besides having normal staking, and liquid staking, which allows you to use the tokens you have staked with its liquid version, in this case, LunaX.

Stake Pools

The first option we find is stake pools. Here, we will first go to pools and we will currently see 3 different options. We find blue chip, community and airdrops plus. You will be able to see in APR the annual % that each strategy will generate. That apr is updated every 48 hours adjusting to the rewards you receive for staking Luna.

Although actually the APR you receive in the three strategies is very similar, there are some differences between them. The first one, blue chip, focuses on delegating the tokens to the validators that have the best performance and have been active for more than 6 months.

The second focuses on delegating your Luna to validators who contribute to the Luna community, either through new platforms, providing information or growing the community. It is a way to support validators who apart from validating and securing the Terra network, also contribute to the community. Whereas in blue chip, they may be validators who do not have any kind of link with the Terra ecosystem and only validate transactions to make a profit.

The third one, airdrop plus, will use our Luna to delegate it to validators who have their own platforms, and reward us by giving airdrops of their tokens. There are airdrops that focus only on users who delegate tokens with them, for example with orion.money, talis protocol or neptune finance. By choosing these validators over others, they reward us by giving airdrops of your native token from the platform they have developed. For this reason, usually the APR in airdrop plus is a bit higher.

You won’t be able to find much difference between the three strategies. So you can choose any of them. If you have an interest in Terra’s ecosystem and support it in some way, it is best to use the second strategy. While if you are only looking to maximize your profits, the first or third are better options.

To place our Luna, simply connect your wallet on the top right. Click on the strategy you are interested in, and indicate the amount of Luna you want to place. Click on deposit and confirm the transaction in your wallet. In this simple way, you will already have your Luna in staking.

In Strategies is where we can adjust what we want stader to do with the rewards or airdrops we receive when we delegate our Luna tokens. By default comes 100% to use it to buy Luna and reinvest it in staking. But you can adjust the % by clicking on change strategy, and moving the bar to indicate what amount you want to be sold automatically to buy Luna and reinvest and what amount you want to simply withdraw directly to your wallet and have access to those airdrops. Here it depends on your strategy, and if you think that airdrops can be worth more in the future than Luna.

In portfolio you will be able to see all the information of your Luna that you have staked and withdraw them at any time. To withdraw them, click on manage holdings, and in deposits click on undelegate. You will see that it can take up to 24 hours to withdraw them, as they are processed in 3-day periods. So you may have to wait this time to get your Luna back in your wallet. Although considering that using terra station, stop delegating you have to wait 21 days to get your Luna back, it is very little time.

Liquid Staking

The other option that Stader has is liquid staking with LunaX. This option is very similar to what you can find with UST and aUST, where LunaX appreciates in value with respect to Luna, in addition to having the liquid token to use it on other platforms or sell it at any time without having to wait for the time to stop delegating.

This token has the same operation as we have seen in stake pools, but with the difference that you have the liquid token in your wallet to use. The platform itself already does auto compounding of the airdrops and rewards you receive to give the annual % that you can see in APY.

Although as a negative aspect, when you want to stop staking your LunaX, you will have to wait 21-24 days to get Luna again. Although you can always sell it in astroport or terraswap for a slightly lower amount of Luna, but instantly. The operation is the same as bluna, where when you place your Luna in stake, the platform uses your Luna to delegate them and gives you LunaX. As the time to stop delegating is 21 days, when you want to change your LunaX back to Luna, you will have to wait this period of time.

However, you can sell it in a DEX if you don’t want to wait this time, and probably instead of receiving, for example 100 Luna if you wait the 21 days, you will receive 98 Luna when you make the swap in astroport or terrastation.

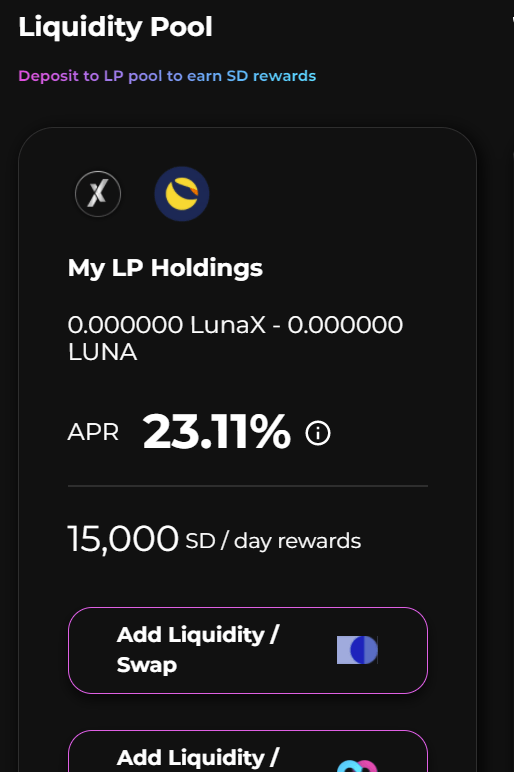

Although there are currently not many uses for LunaX, you can use it to create an LP with Luna, without risk of impermament loss and get an extra 23% APR currently as you can see in pools. So you can maximize your rewards by using your LunaX with Luna as an LP token. Surely in the future we will see other platforms such as lending platforms where you can use LunaX and have more use for the liquid token than currently.

To get LunaX, click on liquid staking, pools and here indicate the amount of Luna you want to use. Click on stake, and confirm in your wallet. Now in your wallet you should be able to see your LunaX. If this is not the case, click on add tokens under everything in your wallet, search for LunaX and add the token in your wallet. This way you should be able to see the amount you have.

To exchange your LunaX for Luna again, go to unstake. Enter the amount, click on unstake and confirm in your wallet. In this way, after 21-24 days, you will receive the Luna in relation to the LunaX you have.

SD Tokens

In SD tokens you will be able to staking the platform’s native token, SD with currently a 21% APR. Although the most used and interesting part are the different staking strategies with Luna that this platform provides.

I hope it has helped you to know how to maximize your Luna rewards and get better profitability by staking with stader. Remember that if you don’t have an account with binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies