In this guide we are going to see how you can buy Terra (LUNA) in an easy, simple and fast way. Currently, Terra is available on many different platforms, and in this case we will use the best cryptocurrency platform.

Whether you are going to use the same platform or others, the tutorial is going to help you to know all the necessary steps to get this cryptocurrency. After the detailed step-by-step guide, you can find more information about the project and this cryptocurrency, so that you have as much information as possible before getting it.

Where to buy Terra (Luna)

To buy Terra, the best option is to use the Binance platform. Although there are other exchanges where you can also buy Terra, Binance offers the best options and the largest variety of cryptocurrencies.

If you don’t have an account with Binance, you can create one here. Now I leave you with a video, so you can see how to buy Terra in the best and easiest way, step by step, so you don’t have any doubts.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies

Step by Step

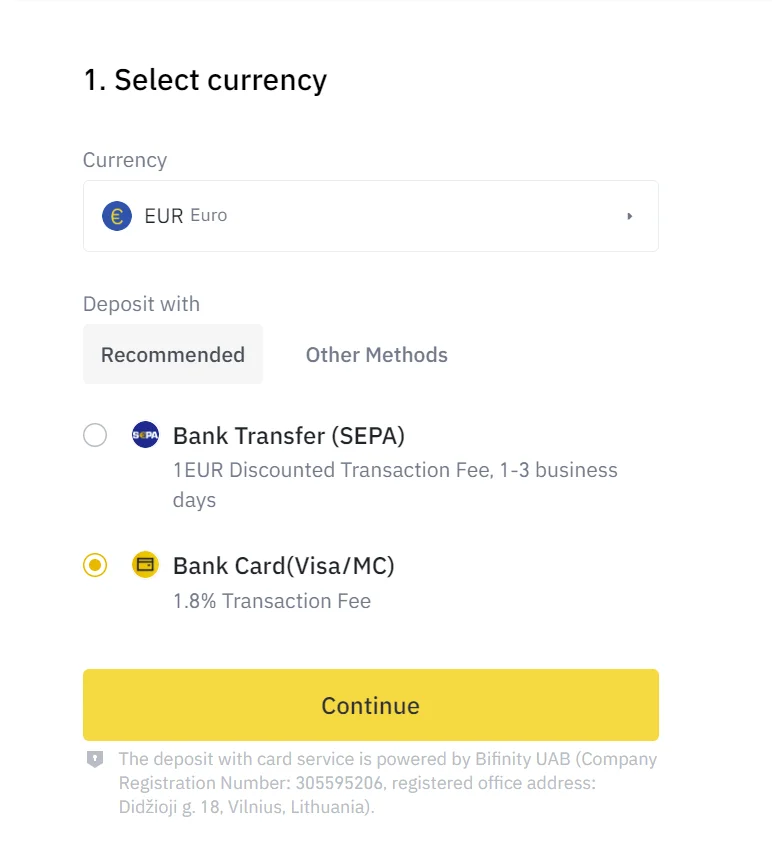

To buy Terra, the first thing you need to do is to log in to your Binance account, deposit your funds, either Euro, USD or another currency.

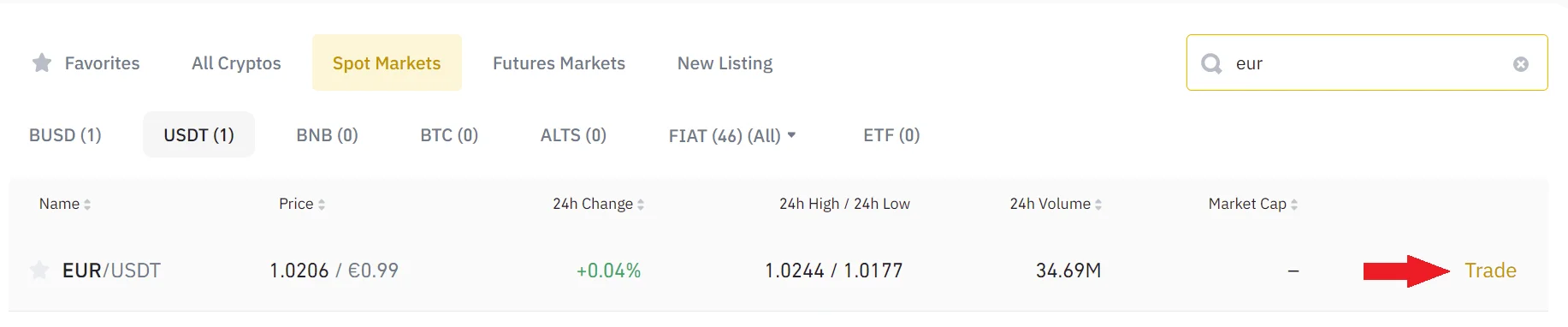

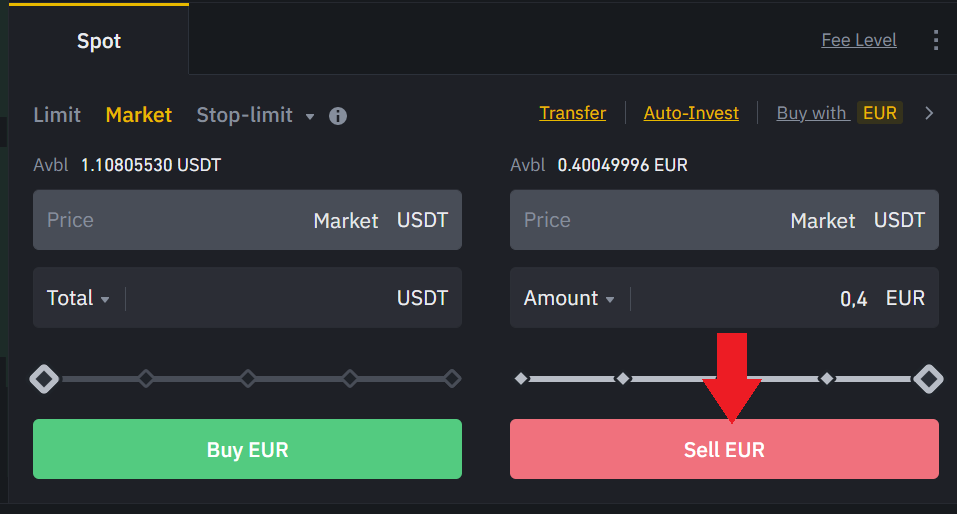

Once you have funds in your account, go to markets, and select your currency pair against USDT (Tether). You will then be able to buy Terra. Once you choose the pair, you have to go to sell, and indicate the amount you want to exchange your currency for USDT, and then buy Terra.

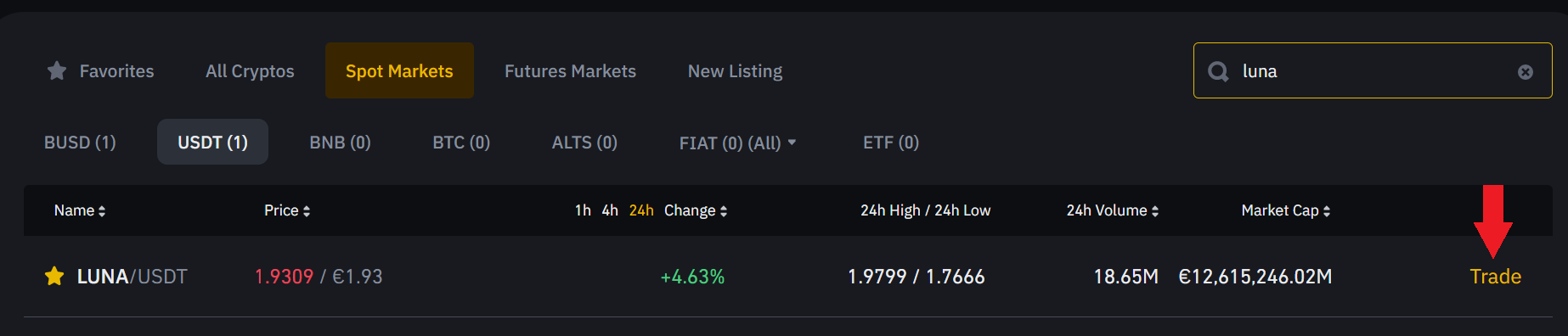

With the USDT purchased, you can go back to the main menu to see that you already have it in your account and the order has been executed. Go back to the market, and look for the LUNA/USDT pair, and click on it.

Here, you will see again the same buy and sell panel, where you have to go to buy, to exchange your USDT for the amount of Terra you want. Once you have chosen the amount, click on buy and you will have it.

If you go back to the dashboard, you can see how much Terra you have. Now, you can keep it in Binance to sell it whenever you want, or take it to a wallet for more security.

If you go back to the dashboard, you can see how much Terra you have. Now, you can keep it in Binance to sell it whenever you want, or take it to a wallet for more security.

The most used wallet to store your LUNA is Terra Station, a wallet created by the founders of the Terra project themselves. So if you want to keep your Terra in your own custody and not depend on any exchange like Binance, you can use terra station to send your LUNA there. You can find here a step-by-step guide on how to withdraw LUNA.

If you follow these steps, you can have LUNA in less than 5 minutes. Register today with Binance so you don’t miss your chance.

To summarize, the steps we have seen are as follows:

- Login to Binance or create an account if you don’t already have one.

- Deposit funds into your account (Card or wire transfer).

- Use the deposited funds to buy USDT (in my case using the EUR/USDT pair).

- Go to the markets and search for LUNA to find the LUNA/USDT pair.

- Go below and buy the amount you want by clicking on buy LUNA.

- Enjoy your new cryptocurrency

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies

FAQS

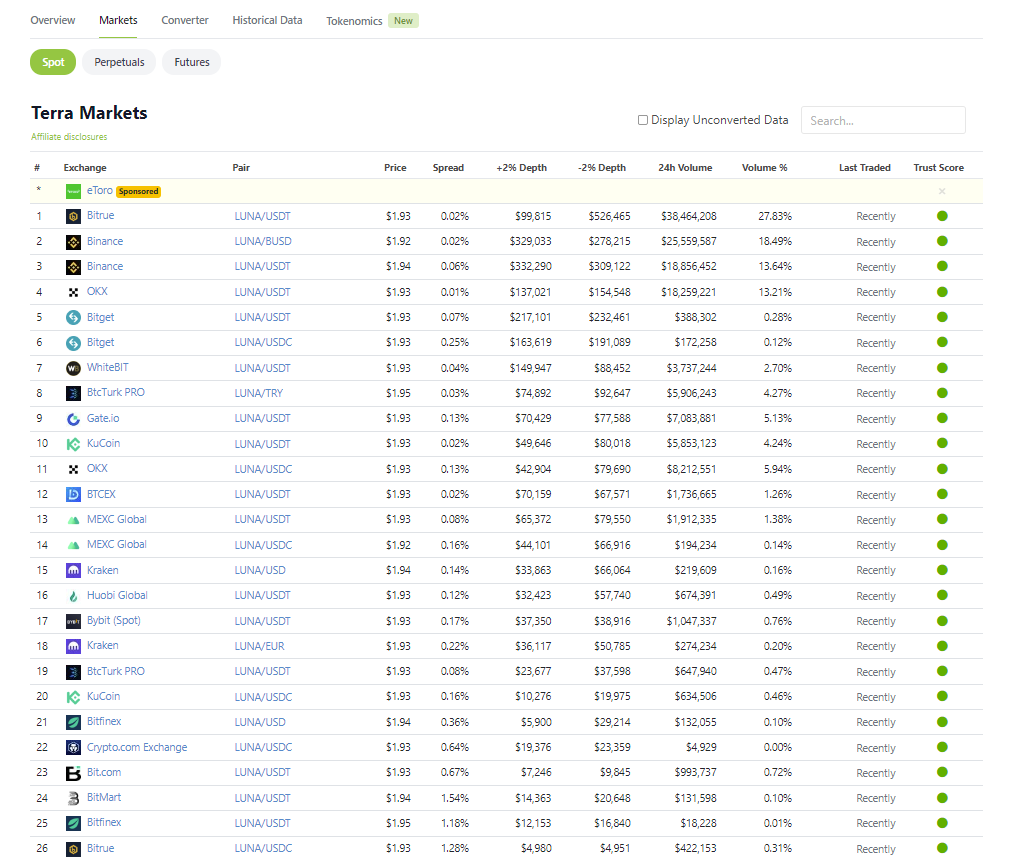

In this guide, we have seen how you can buy Terra with Binance, but there are other platforms to buy this cryptocurrency. To find out where you can buy Terra, it is as simple as going to coingecko or coinmarketcap and search for the cryptocurrency.

Once there, click on markets, and you will see all the platforms that have this cryptocurrency listed. To save you time, you can see the main platforms in the image below.

Currently there are no platforms focused solely on buying and selling cryptocurrencies where you can deposit funds with PayPal. Therefore, the only way to buy LUNA with PayPal is by using a platform that has cryptocurrencies and other assets such as stocks.

The only platform we have been able to find with these features is eToro. That allows you to deposit funds using paypal, and subsequently you can buy Terra (LUNA) within the platform. If you don’t have an account with etoro, you can create one here.

Note that in etoro you will not be able to withdraw Terra from the platform, as it happens in cryptocurrency platforms such as Binance, KuCoin or Coinbase.

To sell Terra, it is really very simple. You just have to perform the same steps as we have seen when buying, but go to the red sell button.

Look for the pair LUNA/USDT, and click on it. Go down to the center, and go to the red sell part. Enter the amount you want to sell Terra and exchange for USDT. Click on sell and you are done. You will have sold your LUNA and you will have USDT again.

Now with the USDT, if you want you can exchange them for your currency and withdraw the money to your bank account, or use the USDT to buy another cryptocurrency.

To withdraw Terra to your wallet, either in metamask or another wallet, you can follow the steps below:

- Go to wallet and wallet spot

- Search for LUNA and once you see it, click on withdraw

- Now you will see the Binance withdrawal panel

- Open your Terra Station wallet, and copy the address where you will send your tokens. In Terra station, next to the address starting with Terra1 you will see a button to copy the address.

- Enter the correct network to send the tokens to, in this case the Terra network.

- Enter the quantity and check all the information.

- With everything correct, click on withdraw and confirm with the confirmation codes.

- Your LUNA will now be on its way to your wallet.

In case you still have any doubts, you can visit this more detailed guide on how to withdraw funds in Binance on the Terra network.

In case you want to withdraw your funds to another platform, for example from Binance to KuCoin, the process is the same as we have seen in the wallet, with one difference.

In the step of opening the wallet to copy the address, in this case we will have to open the platform where we want to send the tokens. Here, click on deposit, and select Terra. Select the network you want to use to send the cryptocurrency, and you will see the address to copy.

With the copied address, go back to Binance and paste it. Indicate the same network as in the other platform. The other steps are the same as we have seen when withdrawing to your wallet.

In case you still have doubts, you can visit this more detailed guide on how to withdraw funds on Binance.

If you want to have your LUNA in the safest possible way, the best thing to do is to have them in a hardware wallet. In my case I used Ledger, and you can buy it here.

Ledger is the most used hardware wallet in the world and it will give you full control of your funds. It avoids the risk that they can hack the platform where you have your tokens, or even hack your computer and have access to your wallet. With a hardware wallet, without the physical object they will not be able to move your funds.

Besides having compatibility with the new Terra network after the collapse and creation of this new network. So you will not have any problem to store your tokens with this hardware wallet.

What is Terra (Luna)?

At the heart of how the Terra Protocol solves these problems is the idea that a cryptocurrency with an elastic monetary policy would maintain a stable price, preserving all of Bitcoin’s censorship resistance, and making it viable for use in everyday transactions. However, price stability is not sufficient for widespread adoption of a currency. Coins inherently have strong network effects:

A customer is unlikely to switch to a new currency unless a critical mass of merchants is willing to accept it, but at the same time, merchants have no reason to invest resources and educate staff to accept a new currency unless there is significant customer demand. For this reason, Bitcoin adoption in the payments space has been limited to small businesses whose owners are personally into cryptocurrencies.

Their belief is that while an elastic monetary policy is the solution to the stability problem, an efficient fiscal policy can drive adoption. In addition, the Terra Protocol provides strong incentives for users to join the network with an efficient fiscal spending regime managed by a Treasury, in which multiple stimulus programs compete for funding. That is, proposals from community participants will be vetted by the rest of the ecosystem and, when approved, funded with the goal of increasing adoption and expanding potential use cases.

The Terra Protocol, with its balance between fostering stability and adoption, represents a significant complement to fiat currencies as a means of payment and store of value.

First, we analyze the protocol and how stability is achieved and maintained, through the calibration of miners’ demand and use of the 1 Moon miner. Next, we delve into how stable mining incentives are adopted to smooth economic fluctuations. Finally, we analyze how Terra’s fiscal policy can be used as an efficient stimulus to boost adoption.

Multi-currency pegged monetary policy.

A stable currency mechanism must answer three key questions:

– How is price stability defined? Stability is a relative concept; what asset should a stablecoin be pegged to in order to attract the most people?

– How is price stability measured? The price of coins is exogenous to Terra’s blockchain, and for the system to function properly it is necessary for the price to be fed efficiently and resistant to corruption.

– How is price stability achieved? When the price of the coin deviates from the target, the system needs a way to apply pressures to the market to bring the price back to the target.

2.1 Defining stability vis-à-vis regional fiat currencies

The existential goal of a stable currency is to retain its purchasing power. Since most goods and services are consumed domestically, it is important to create cryptocurrencies that track the value of local fiat currencies. Although the U.S. dollar dominates international trade and foreign exchange transactions, for the average consumer the dollar presents unacceptable volatility against their unit of account of choice.

Recognizing the strong regionalities of money, Terra aims to be a family of cryptocurrencies that are linked to the world’s major currencies. Near genesis, the protocol will issue Terra pegged to USD, EUR, CNY, JPY, GBP, KRW and the IMF SDR. Over time, more currencies will be added to the list by user vote. TerraSDR will be the flagship currency of this family, as it exhibits the lowest volatility against any fiat currency.

TerraSDR is the currency in which transaction fees, miner rewards and stimulus grants denominated will be denominated.

However, it is important that Terra coins have access to shared liquidity. For this reason the system supports atomic swaps between Terra coins at their market exchange rates. A user can exchange TerraKRW for TerraUSD instantly at the effective KRW/USD exchange rate. This allows all Terra currencies to share liquidity and macroeconomic fluctuations; a drop in demand for one currency can be quickly absorbed by the others. Therefore, we can reason about the stability of Terra currencies in a group; in the remainder of this paper we will refer to Terra as a single currency.

As the Terra ecosystem adds more currencies, its atomic exchange functionality can be an instant solution for cross-border transactions and international trade settlement.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies