Welcome to this post, where we are going to see the best Avalanche staking options available to maximize your earnings.

We will see the main ways there are in DEFI and other platforms to generate an annual % with your Avalanche and in which of them you can get a better annual %, and at the end of the year earn more. We will not focus on all the platforms that exist, nor on those less known or smaller ones that have a medium high risk, compared to the platforms we will see here.

Still, if you want to know on your own all the possibilities there are and platforms on your own, I have created a guide detailing the tools and aspects you should consider to find the best staking and farming opportunities for any cryptocurrency, which you can find here. So you can’t miss this guide if you want to be updated on the best opportunities.

Best place to Stake Avalanche

We will separate this guide into two categories, staking options and farming options without impermanent loss risk. In the end they are very similar strategies, but the second one can be more complex if you are new to DEFI and don’t understand some concepts. Therefore, we will start with the simplest part, and then we will go to some more advanced platforms or strategies, which, in general, can give you a higher annual %.

Although we will not explain basic aspects, in the second part you can get an idea of how the strategies work and the risks it has with the explanation you can find.

Mention that the annual % that you can see, is very likely to vary depending on how much you are watching this. Since in DEFI the annual % usually vary quite a lot. Even so, you can use it as a reference to see which platforms give a higher % compared to others, and it is very likely to remain so, even if the annual % are different.

With that said, it is time to get started.

Staking

Benqi Liquid Staking

Benqi is currently the only platform with liquid staking of Avalanche, a type of staking that we have seen in other networks such as Solana or Terra the success it has had, due to the great opportunities it opens with it.

In Benqi, if we go to liquid staking you can find the liquid staking option where you will receive sAVAX for your AVAX with a 7.20% APR at the moment. Where sAVAX appreciates with respect to AVAX in the annual % it has, in this case 7.20% per annum.

The main advantage of liquid staking is the use you can make of it in addition to the 7.20% you receive in token appreciation compared to AVAX. Besides not having your cryptocurrencies locked. Since sAVAX you can exchange it at any time for AVAX in a decentralized Exchange, although with a small difference of 1-2% than exchanging sAVAX for AVAX in Benqi.

You can use your sAVAX on platforms such as Anchor Protocol, Nexus, trader joe or pangolin to increase the annual % you can get, although we will discuss these strategies later.

You can find the Benqi guide in more detail here.

Anchor Protocol

Anchor Protocol has listed sAVAX on its platform so that you can deposit and borrow UST. Which gives an opportunity to generate higher annual % with your sAVAX. And this is one of the synergies and advantages of liquid staking, where we can use it as collateral and borrow to increase our annual % we get or to borrow stablecoins as UST.

In this case, we will focus on the most used strategy in Anchor, which is to deposit sAVAX, borrow UST and use the UST we have borrowed on Anchor’s own platform to get 19.47%. You can see that in Anchor, the name of sAVAX is wasAVAX, and this is because to pass the sAVAX to the Terra network from the Avalanche network, you must use a bridge, and your sAVAX will become wasAVAX. But they are really the same cryptocurrency in different networks.

Although it is a more complex strategy, by having to pass our sAVAX from the Avalanche network to Terra, we will be able to get an extra 4% with it. Keeping in mind the risk of being liquidated if we do not control our position or borrow too much UST.

Note that you will receive 19.47% on the USTs you have borrowed, but you must subtract the annual % you must pay for borrowing, which is currently 5.61%. This would leave you with 13.8% per annum. This % is with respect to what you have borrowed, and I recommend you be conservative and borrow around 30-40% of the value of sAVAX you deposit to avoid being liquidated. With this %, you would be getting an extra 4% per annum on your sAVAX. On top of the 7.20% that the token appreciates with liquid staking.

You can find the Anchor Protocol guide in more detail here.

Nexus Protocol

Nexus Protocol is also on the Terra network, and is a platform that optimizes strategies like the one you discussed above, to maximize the annual % and minimize the risk of being liquidated.

It is a very good option if you plan to use Anchor, and you want to use a platform that optimizes this strategy. Where you can deposit your wasAVAX for 5.39% per annum at the moment. So you would be getting 7.20%+5.39% per annum, 12.59% per annum in total.

The only extra risk is the platform itself, which is not as robust and large as Anchor. But on the other hand, if there is a big drop in the market and AVAX falls in price, you will not be liquidated if you use Nexus, as the platform adjusts the liquidation risk at all times using Smart contracts. Whereas in Anchor if you are not vigilant, your position could be liquidated.

You can find the Nexus Protocol guide in more detail here.

Aave and similar platforms

The next option we find is AAVE and similar lending platforms such as Benqi, Blizz or Trader Joe. Although AAVE is the main and most used of them all. Although it is not staking, it is still an option to generate an annual % very similar to staking. Where you place your AVAX, and you receive an annual % for it, since your cryptocurrencies are lent to other users who pay an interest for it.

So it is not staking, but it is a similar operation. Even so, you have to take into account that the annual % are usually much lower in this kind of platforms than in staking or liquid staking of Avalanche. Even so, there are interesting options where you can use for example your sAVAX, or if you want to use your AVAX as collateral for a loan, and get an annual % for it.

Right now, for depositing in AAVE V3, they are giving 1.95%+5.69% incentives, so that’s a total of 7.64% per annum. Although it is very likely that the annual % incentive (the 5.69%) will decrease over time and be lower. So, right now it is quite an interesting % if we consider that AAVE is one of the safest platforms in DEFI.

In the case of BENQI, one of the main lending platforms in the Avalanche network, they are currently giving 3.55% per annum.

If we look at Alpha Homora V2 we find a 4.33% APY for depositing our AVAX. Where this platform focuses on allowing users to use deposits to do leveraged farming within Alpha Homora.

Trader Joe’s Lend, which also has its own loan market, is AVAX with a 2.89% annual deposit rate.

On Blizz Finance, which is a fork of AAVE on the Avalanche network, we find 2.20% per annum. Being a less known platform than the previous ones.

Finally, mention MoreMoney where you can deposit sAVAX and get 12% per annum right now. Although it is a less known platform, and has a somewhat different operation to the lending platforms, where you use your collateral to borrow their stablecoin. So it has a little more risk than the previous ones.

You can find the Aave guide in more detail here.

You can find the Alpha Homora guide in more detail here.

You can find the Blizz Finance guide in more detail here.

Yield Yak

In relation to the platforms we have seen above, we find others such as yield yak, beefy finance or autofarm that are optimizers of other platforms. In the same way that Nexus Protocol optimizes your profits in Anchor, yield yak or similar platforms do it for different types of platforms.

In the case of yield yak, we can find vaults where we can deposit our AVAX and get a higher annual % than in Benqi or AAVE. These are the two options that we currently find, where in Benqi when using yield yak we will receive 3.7% per annum, and 8.9% per annum in AAVE.

In the case of Beefy, we found the blizz vault with 1.74% and AAVE with 2.05%. And in Autofarm we found the option of Benqi vault with 3.7%.

What these platforms do is to deposit the AVAX in the platform as you would do if you were going to use for example AAVE. And once you start receiving the rewards, they exchange them for AVAX and deposit the AVAX back into AAVE in this example. So, by doing compound interest you get a higher annual %, and so you can see that there is a % difference from depositing in AAVE to using Yield Yak. You could do it manually, but it would not be as optimal and in many cases you would spend more on gas fee than on the rewards you receive, especially with small capitals.

You can find the Yield Yak guide in more detail here.

Centralized Exchange

Last but not least, in this category, we find the centralized exchanges, such as binance, coinbase, kucoin, gate.io among many others.

In this case, I have been able to find a good staking option for Avalanche in Binance, with 11.24% in 30 days, 13.29% in 60 days and 21.63% in 90 days of blocked staking. Although in the case of flexible staking it is 3% per year. These are very interesting and quite high annual %, although we have to consider that we will have to have the tokens blocked during that time without being able to move them, or we will not receive the rewards. Therefore, they offer better annual % than in options we have seen before where you can withdraw your AVAX at any time.

Still, it’s a good option if you want to hold your Avalanche over the long term and are comfortable with your tokens on a centralized Exchange. Besides Binance, you can find Avalanche staking options on other platforms, and it’s a matter of looking at the major ones to see which one offers the best performance.

If you have an account in any Exchange other than Binance, I recommend you to look in the staking part to see if it has one, if it has Avalanche and what annual % it is offering. If you do not have an account with Binance, you will be able to create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies

LP Tokens without impermanent loss

With the appearance of liquid staking, in this case sAVAX, different farming opportunities have opened up with LP Tokens that have no or very small impermanent loss. This makes it very similar to staking, although somewhat more complicated if you are new and have never done farming with LP Tokens.

So I recommend you take a look at our guide to farming if you are totally new and don’t know aspects like impermanent loss or LP Token before putting your money into it.

We are going to see the different opportunities that there are at the moment with the LP sAVAX-AVAX, and it is very possible that in the future there will be more options where you will be able to do farming with this LP Token and get a good annual %. Also, surely there will be different LP tokens without impermanent loss with other platforms that offer liquid staking as we have already seen in other networks. So I recommend you to look if there are other options that can offer good opportunities and look in other networks like Terra or Solana if there are LP tokens without impermanent loss from Avalanche.

At the moment, we only found this LP with very little risk of impermanent loss. The operation is quite simple, you put 50% of sAVAX and 50% of AVAX. As they are assets with the same price, taking into account the annual % appreciation of sAVAX, the impermanent loss is very small. In addition, 50% of the tokens are sAVAX, which appreciates with respect to AVAX and compensates the impermanent loss.

So in the end, there is no impermanent loss with this type of LP Tokens. And this makes it very similar to staking. Although with a little more risk if sAVAX for any problem or failure, is detached from the price of AVAX, although it is very unlikely to happen.

Trader joe

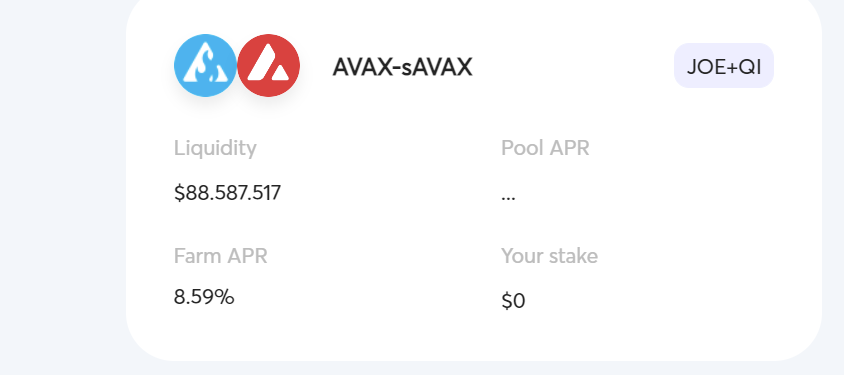

Trader Joe is the main DEX of Avalanche currently and has different LP Tokens, among them we find sAVAX-AVAX with an annual 8.59%. A pretty good %, and that beats the one we would have if we just put our AVAX in Benqi to get sAVAX.

The other DEX where we also find the sAVAX-AVAX pair is in kyberswap, with 16.25% per annum. Quite higher than what we have seen in trader joe. Although it is a less known platform and not as used as DEX in Avalanche. Still, it offers a good return with this lp.

Currently there are no other decentralized exchanges offering farming with this LP, but it is possible that in the future we will see pangolin or astroport on the terra network with this LP or similar on it.

You can find Trader Joe’s guide in more detail here.

Beefy Finance

Finally, and as we have seen above, we find optimizers to improve the annual % that you can get in Trader Joe. At the moment, we find the sAVAX-AVAX LP in beefy finance with 9.10% APY and 8.2% in Yield Yak.

Although it may seem like a big difference, many times it is due to calculation errors and they are usually very similar to the annual % they offer. So you can use both platforms if you want to maximize your annual % with this LP Token.

In the case of kyberswap, being a smaller and less known decentralized Exchange it does not have these integrations in platforms like beefy finance or yield yak, so you will not be able to find this farm in these optimizers.

Also keep in mind that using this kind of platforms adds an extra risk, by using another platform to do farming with that LP Token, instead of doing it directly in trader joe. And therefore you have an extra risk if there are any Smart contract or hacking issues on the platform you are using, be it beefy or yield yak. Although it has not happened on these platforms, it is a risk that is important to consider and see if it is worth it for the extra annual % you get by using them.

You can find the Beefy Finance guide in more detail here.

If you have made it this far, congratulations. To finish, I recommend you to look every now and then for new opportunities that will appear as new platforms appear in Avalanche or synergies with other networks. Especially in the Terra network it is possible that soon we will start to see different LPs and platforms using Avalanche and we will be able to get a good annual %. As is already happening with Anchor and Nexus Protocol with sAVAX.

This guide may not be updated at all times. Still, it will give you an overview of the different opportunities there are to use your AVAX tokens and where to look for new options as they appear over time.

I hope it has helped you to know the best way to use your Avalanche and get the best possible profitability. If you want you can find here the guide to find the best staking and farming opportunities. Remember, if you don’t have an account with binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies