Welcome to this post, where we are going to see how Nexus Protocol works and how you can use it to maximize your profits with bluna in Anchor Protocol.

Nexus allows us to automatically optimize and reduce the risk of using bluna and borrowing in Anchor Protocol, offering a good return to users who use it.

Let’s see the advantages, disadvantages, risks, and aspects to consider before using Nexus so you don’t make any mistakes. In addition to see how you can use this platform to place your Luna.

What is Nexus Protocol

The Nexus Protocol is the first yield aggregator on the Terra blockchain, functioning as a gateway to yield-generating strategies on Terra and, in the future, on other connected blockchains, including Ethereum, other EVM chains, the IBC and Solana.

Nexus’ mission is simple: as long as DeFi protocols continue to provide lucrative liquidity or token incentive programs to participants, Nexus is going to create vault or vault strategies that allow users to access these incentive programs and earn the returns available on them. Thus optimizing their performance.

In simplified form, Nexus is a farm optimizer, as we have seen in many other networks with platforms such as beefy finance. Its function is to optimize the annual % you can generate on a platform, to get a better return than if you were to use the platform directly.

They achieve this through Smart contracts and doing what is known as compound interest. Where most platforms you receive rewards that accumulate. Optimizers use the rewards to sell them and put the amount sold back into the farm or staking. This gives a better performance by using the rewards in an optimal way to maximize the annual % you can get.

In the case of Nexus Protocol, it currently works as an optimizer of Anchor Protocol. Where you can place bluna or Beth. Nexus will deposit the bluna or Beth you have deposited in Anchor, and borrow UST. With the USTs it will place them in Anchor to get 19.55%, and use the rewards you receive for borrowing in Anchor to buy more bluna and increase the amount of USTs it has borrowed. All this with a TVL or collateral value of 75% to avoid being liquidated, which is automatically adjusted by Smart contracts to maximize profits.

Vault

In vaults is where we will be able to place our bluna or Beth so that Nexus can make the strategy mentioned above. As you can see in vault, you can see the annual % in apr, which varies depending on the rewards and changes that Anchor can make. Also the total amount locked, and the amount they have borrowed. Also in LTV, you can see the Loan to Value that this strategy currently has.

Also, you will be able to compare the annual % achieved manually, using Nexus, and the annual % that Nexus has given in the last 7 days on the right of each vault.

Note that you will not be able to place Luna or Eth, but you will first need to change your Luna to bLuna or your Eth to bEth. For this, if you don’t know how to do it, you can see our anchor protocol guide where you will see how easy it is.

With bLuna, click on deposit. We indicate the amount, and click on confirm. Confirm the transaction in your wallet and that’s it. Now you will have deposited the bLuna to Nexus.

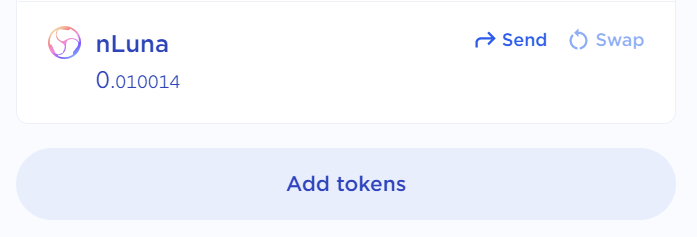

Once deposited, you will receive nLuna, which is equivalent to Luna and you will need to have in your wallet to withdraw the deposited bluna, so do not sell your nLuna. You may not find the token in your wallet, if so, click on add token, and copy the following contract.

Contract: terra10f2mt82kjnkxqj2gepgwl637u2w4ue2z5nhz5j

The nLuna token is the part that represents your participation in the Nexus bluna vault, so if you have 1 nLuna, you will be able to withdraw 1 bLuna from Nexus. Therefore, you should not sell them, without being aware that, if you sell them, you will no longer be able to withdraw your Nexus bluna.

If you go down in vault you will be able to see your position and the rewards will appear in reward. To claim them, simply click on claim, confirm in your wallet and that’s it. You will already have the rewards generated by your bLuna in Nexus.

Something very important to keep in mind is that the rewards are paid in PSI, the platform’s native token. As with many of these tokens, they fluctuate quite a bit in price, and usually downwards. So, you have to be aware of selling your rewards, because, if PSI drops in price and is worth 50% less, actually the annual % you are getting is half. So it is an aspect to consider, and that you must be aware of the price of PSI, and when to sell your rewards.

The process is the same if you want to use bEth instead of bLuna.

Farm

In farm we find the different LPs with the native token of the PSI platform, where you can provide liquidity with the annual % that you can see. As you can see, the annual % is quite high, but you have to take into account that the price of PSI fluctuates quite a lot, and that is why the apr are so high.

So, it has quite a lot of risk of impermament loss this type of LP tokens with PSI, and that is why, the rewards are so high with more than 90% APR. One of the positive parts is that the rewards for farming with these LP tokens are in PSI and Astro. Astro being the DEX Astropot token, and not having as much fluctuation as PSI.

It is a strategy with a lot of risk, but also with a good reward if it works out well and the price of PSI is maintained or does not lose much value.

Swap

Finally, in swap you can exchange any token of the platform, nluna, neth, ust with PSI. It is a more convenient way to avoid having to go to astroport or terraswap to swap platform tokens. The operation is the same as any swap you can find.

I hope it has helped you to know in more detail how nexus protocol works, and how you can improve your profitability in Anchor. Remember that if you don’t have an account with binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies