Welcome to this post, where we are going to look at the best BNB staking strategies currently available.

We will focus on those platforms that are most used and therefore have less risk, although it is possible that there are other less known platforms that offer a higher profitability, but with a higher risk. Even so, on most occasions it is usually more worthwhile to use the platforms we will look at.

We will look at both decentralized platforms that you will need to use a wallet such as metamask, as well as simpler options for newer users who have no experience using DEFI. In both cases, with similar returns.

It is worth mentioning that the annual % that you will be able to see will vary a lot, depending on when you are reading this. Even so, the platforms with a higher annual % are very likely to remain the same, even if the annual % is not the same. Since in DEFI, the % tend to fluctuate a lot over time.

If you want to know on your own all the possibilities there are and platforms on your own, I have created a guide detailing the tools and aspects you should consider to find the best staking and farming opportunities for any cryptocurrency, which you can find here. So you can’t miss this guide if you want to be updated on the best opportunities.

Best place to Stake Binance Coin

In this guide, we will focus only on staking options, as BNB does not have farming options that do not have the risk of impermanent loss, unlike other staking guides we have seen like Luna.

Even though there is no liquid staking in BNB and farms with two BNB LP Tokens with no risk, there are still several very interesting platforms that can offer you a good annual % for your BNB on it.

So let’s take a look at the main platforms for staking your BNB.

Venus

Venus is the main lending platform in the binance Smart chain, and where we can deposit our BNB in exchange for an annual %, sometimes quite interesting. In addition to using the BNB as collateral to borrow if we want.

At the moment, it is yielding 5.76% per annum, but usually the % is usually lower, around 2%. So keep this in mind, as the annual % sometimes varies quite a lot. Venus has more than 1 billion (American) deposited in its platform. So it is the safest option as a lending marketplace in the binance Smart chain.

Note that a part of the %, you will receive the token from XVS platform, and not BNB. Also, this platform is not really staking, as you are depositing your BNB to be lent, and the annual % is generated with the person borrowing. Still, it is very similar to staking, where you place your BNB to receive an annual % for it.

You can find the Venus guide in more detail here.

Alpaca Finance

Another platform with similarities to Venus and quite popular is Alpaca Finance. Here, you will also deposit your BNB to be lent, and receive ibBNB in return. The platform itself allows for leveraged farming, and it is mainly these users who will use the BNB you have deposited to get an annual %.

Right now, the annual % is 19.51% apy, but it is usually lower, so keep this in mind. Since at this time, there is a lot of BNB that has been borrowed, and therefore, the annual % goes up. Still, Alpaca usually offers some of the best returns when you deposit your BNB at around 5-6% per annum.

When you deposit BNB, you will receive ibBNB, which is a token that appreciates in value relative to BNB. It is a token similar to liquid staking, but in this case with the annual % you earn by depositing your BNB. With the ibBNB, you can go to stake and deposit it to get an extra annual %, where you will receive the Alpaca token for staking your ibBNB. You can also use it in AUSD as collateral and borrow the Alpaca stablecoin.

As you can see, receiving a token as deposit collateral, while getting annual %, allows you to make the most of your BNB on Alpaca’s own platform. Note that to withdraw your BNB from Alpaca, you will need to have the ibBNBs in your wallet, so do not sell or send them elsewhere, as they represent your BNB deposit in Alpaca.

You can find the Alpaca Finance guide in more detail here.

Valas Finance

Valas Finance is another lending platform, being one of the most used in the binance Smart chain, with more than 300 million $. It is a fork of AAVE, so if you have used AAVE before, the operation is very similar.

Currently, you can get 4.27% per annum for depositing your BNB here. Although 2.32% you receive is in the platform’s native token, VALAS, as an incentive for using their platform. It is very similar to what you can find in Venus, but quite simpler and with less TVL or total locked value within their platform.

Belt

Belt is a platform that runs farming and staking strategies on different platforms and has different cryptocurrencies that you can deposit, so you don’t have to do the strategy on your own.

Here, we find BNB with 5.21% per annum at the moment, and if we click on it, you can see which strategy it uses and the distribution of BNB tokens on them. Where at this moment, it deposits BNB in Alpaca, Alpha, Fortube and Venus to get the profitability it shows. In addition, you can see the distribution in % that it deposits on each platform. Where at the moment, there is 35.36% in Alpaca, 37.85% in Venus, 2.77% in Fortube and 23.95% in Alpha.

It is a way to have a more diversified strategy, with a good annual % using Belt. Whereas if you deposit on one of these platforms, you have more risk if something happens with that platform. This way, with Belt, you diversify the risk and your exposure to a single platform. At the same time you optimize to get a good annual %, with low risk.

When you deposit your BNB, you will receive beltBNB with a similar operation to Alpaca’s ibBNB. Where beltBNB appreciates in value compared to BNB. In addition, you will receive BELT tokens, the platform’s native token as an incentive.

You can find the belt guide in more detail here.

Beefy Finance

Another good way to get a good return with your BNB is to use farming optimizers such as Beefy Finance. This being the most used and the main one to optimize your rewards you get in other platforms.

At the moment, we find the venus vault with 3.12% per annum, belt with 5.31%. These platforms that we have seen previously, with beefy you will be able to get a higher annual %, although sometimes the annual % is different, it is almost always higher in beefy.

Another option is to use autofarm, which has Alpaca’s vault at 4.65% p.a. at the moment. Since the option to use an optimizer with Alpaca is not available with beefy finance. And autofarm although less known, is also a platform with quite some time in DEFI.

The optimizers, as their name indicates, use the rewards that you receive in the platforms such as Venus, and exchange them for more BNB to re-deposit the BNB in the farm or staking and thus get a higher annual %. For this reason, they are platforms that always tend to have higher annual % than the platform itself. By making compound interest on the rewards you receive on them.

You can find the Beefy Finance guide in more detail here.

Binance

Finally, we find the centralized exchanges, where we will focus on Binance, being the cryptocurrency of this platform. Although it is possible to find staking in other exchanges, they do not usually offer a better annual % than this one.

Binance has blocked staking with up to 12.99% for 120 days blocking your BNB, and a minimum of 5.86% for 30 days. Although during that period you will not be able to withdraw the BNBs to sell or exchange them. Otherwise, you will not receive the % it indicates. As its name says, blocked staking.

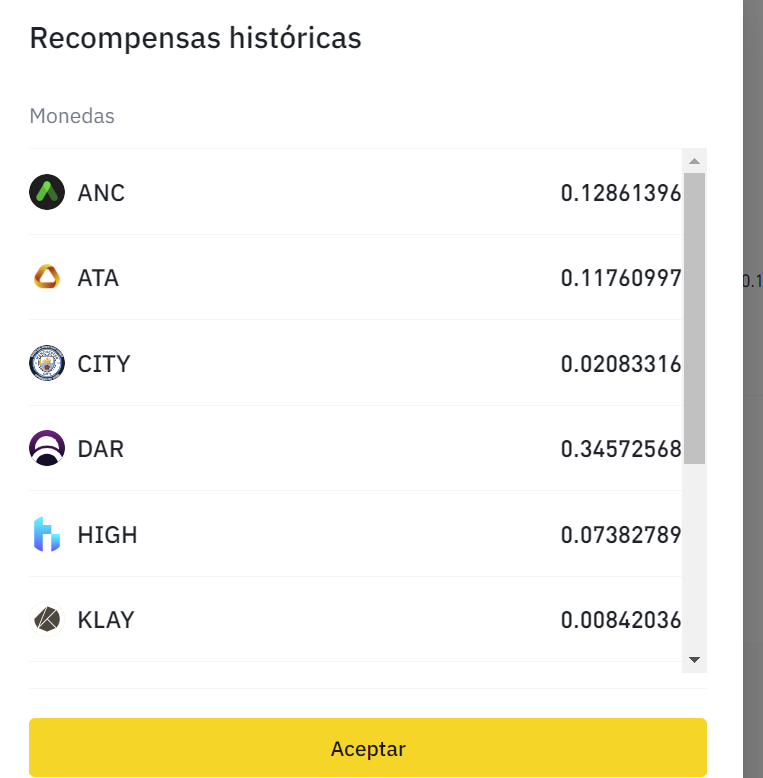

On the other hand, there is flexible staking with 0.35% per year in BNB Vault. But with flexible staking you will receive the airdrops or tokens that binance launches in launchpool, where by having BNB in staking, you receive tokens for it. So the annual % you receive is quite higher. Although it’s hard to calculate, and it depends a lot on the tokens you receive, if those tokens go up or down a lot in price, and when you sell them. But it is a way to keep receiving new tokens that are listed on Binance, at the same time you get 0.35% with your BNB and you can sell or move them at any time.

So it depends on what you are looking for and how long you intend to keep the BNBs in your portfolio to use a locked staking with more annual %, or a flexible staking and receive as airdrop of the tokens. If you don’t have an account with binance, you can create one just below to start staking.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies

Summary

Due to the way the Binance Smart chain and its BNB token work, there are no liquid staking or staking options outside of the platform that created the network, Binance.

Still, there are good opportunities that we have seen, and they are interesting. Alpaca being the one that usually offers the best annual % along with Belt. And if you want to use an optimizer, Beefy with Belt’s vault is a great option. You can also use Autofarm with Alpaca’s vault, although this platform is not as secure and not as capital intensive as Beefy.

Therefore, I recommend using Binance if you don’t want to get complicated and use a wallet. On the other hand, if you want to have your tokens without locking them and get a good annual %, the best option at the moment is Alpaca, being a platform that has been around for a while and can offer a better annual % than the others, as could be Venus. Since the leverage in farms within the platform, creates a lot of demand for BNB, and therefore higher annual % they are willing to pay, compared to Venus where it is a lending platform like Valas.

Also, mention that using Beefy finance or autofarm has an added extra risk, when using another platform, besides where the tokens are deposited to perform the strategy. So it is an aspect to take into account, to decide whether for example to use Autofarm or directly deposit in Alpaca Finance.

Finally, and leaving a little of the staking theme, you can also find good opportunities to farm with BNB-BUSD or BNB with any stablecoin. Although with the risk of impermanent loss. Even so, sometimes it can be interesting to farm with this type of LP Tokens, offering much higher returns, where for example, in Quickswap you can get 60% at the moment with BNB-BUSD. And in other networks or platforms, it is possible to find around 30-40% per year with BNB and one of the main stablecoins.

Compared to the 5% you get with BNB, and taking into account the impermanent loss, for certain risk profiles it may be a better alternative than simply staking with your BNB.

I hope this guide has helped you to know the main platforms where you can staking your BNB and maximize your annual profitability with these tokens. If you want you can find here the guide to find the best staking and farming opportunities. Remember, if you don’t have an account with Binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies