Welcome to this guide, where we are going to take a look at how KuCoin leveraged tokens work and how you can make the most of this new functionality.

Leveraged tokens are not something new that kucoin has created, as we have seen other platforms such as binance or FTX offer this type of tokens first. Still, it’s a great option that kucoin users can now also use and mitigate the risk of leveraged trading.

But before we look at how to buy and sell these tokens, let’s take a look at what they are and how they work, as well as the main advantages and risks they have.

What they are

Leveraged KuCoin tokens are assets tradable on the KuCoin spot market, just like normal cryptocurrencies that leverage profits by going long/short on the asset in question. Let’s go with a better example, when the price of ETH goes up 1%, the price of ETH3L is going to go up 3% and the price of ETH3S is going to go down 3%. Unlike margin trading or futures trading, no collateral or margin maintenance is required to hold leveraged tokens without the risk of being liquidated. Although it should be considered that leveraged tokens can sometimes have high price volatility. So it is a risk to consider.

How it works

Each leveraged KuCoin Token is one share unit of a total leveraged fund. The fund manager ensures that the fund’s returns are equal to a specific multiple of the asset in question and that owners of the leveraged tokens can earn that specific multiple of token returns. When the price volatility on the opposite side exceeds the threshold, a rebalancing mechanism is used to hedge the risks and control the net loss.

Basically leveraged tokens are in their entirety a pool that allows the use of leverage without the risk of being liquidated.

The leveraged tokens have the long (buy) version with an L and the short version with an S. So if you think the price is going to go up, you will want to buy the ETHX3L, and if you think the price is going to go down you will want to buy the ETHX3S.

Benefits and risks

Before we go into more detail on how to buy or sell these tokens, let’s look at the main risks and advantages, starting with the good.

The main advantages are:

- No liquidation risk

- Option to go short (sell) with no risk of being liquidated

- Exponential gains of x3 if the asset price direction is correct

Risks:

- Lack of liquidity or price not in line with real value

- Unlisted tokens

- Low liquidity in some tokens for large volumes

Although we have already discussed the points, let’s go into more detail on them. First with the advantages, where we can trade with a x3 without fear of being liquidated and losing our money. Although if the price of the leveraged token falls a lot in price, we can lose almost all of our capital. But the good news is that if its price recovers to the same price in the future, as it will not be liquidated, we will have the same amount of capital again. Unlike when you use futures, when your position is liquidated you directly lose all your capital.

The other advantage is to go short (sell) without the risk of being liquidated. Where before you could only go short with futures and with the risk that if the price of that cryptocurrency went up a lot, you would lose your capital through liquidation. Now, if you believe that a cryptocurrency that has a leveraged token may fall a lot in price, you can buy the token with S (Short) and even if its price skyrockets at some point you will not be liquidated. A very good thing in such volatile markets.

In the case of the disadvantages or risks, we find the lack of liquidity or price not in accordance. This happens sometimes, where the price of the asset can go up or down, but the leveraged token does not reflect that rise or fall, either due to lack of liquidity or problems with the token or platform. So I recommend you first see how leveraged tokens behave before investing in them.

On Binance we have already seen some leveraged tokens delist, so they are no longer operational. Although the platforms give early warning, it is another risk to consider that some of the leveraged tokens may be delisted and you will have to sell them before then to recover the amount of capital that is there. This is a problem if it is a token that you wanted to hold for a long time and they are going to remove it from the platform, thus causing you to sell it early.

How to buy and sell leveraged tokens

In order to buy these tokens, we can go to the derivatives and leveraged tokens section to see all the tokens that are available. Here, you can find interesting information such as which ones are available, their price and the change in the last 24 hours. What we are interested in is the trade button on the right, we will click on the pair we are interested in.

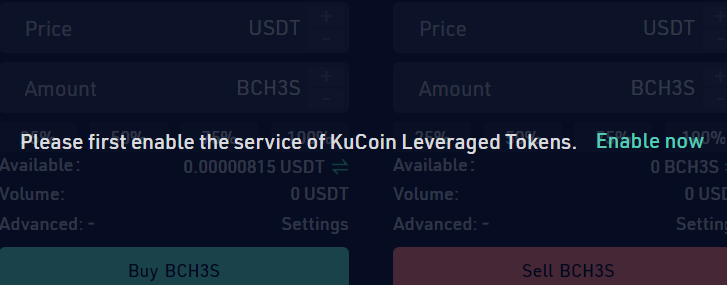

Here, we must go to the right side below, and click on enable now and confirm if we have not already done so in order to be able to trade this type of asset. With this, you only need to enter the trading password to be able to trade in the same way as in spot.

The operation is the same as buying and selling any cryptocurrency, as we saw in this guide. Where we indicate market or market if we want to run instantly, the amount and click on buy to buy or buy to buy that pair. And once you want to sell it, you must return to the same panel and go to the sell part.

Note that sell or sell you are going to sell the token, you are not going to go short (sell). To go short, you must select the token with the S and buy it. Although it’s a bit confusing, you are actually buying a token, even though its price increases when the value of that cryptocurrency drops. But it works exactly the same as when you buy any cryptocurrency in kucoin.

I hope this has helped you to learn more about how leveraged tokens work in kucoin. Remember, if you don’t have an account with binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies