Welcome to this guide, where we are going to see how you can do arbitrage in kucoin and how it works.

Arbitrage is one of the best ways to make a profit in the cryptocurrency world with very low or sometimes zero risk if done correctly. Although over time it has become more complicated and difficult to do manually.

What we will see serves both in kucoin and other platforms that encounter this type of situation. But first, let’s take a look at what arbitrage is.

What is cryptocurrency arbitrage?

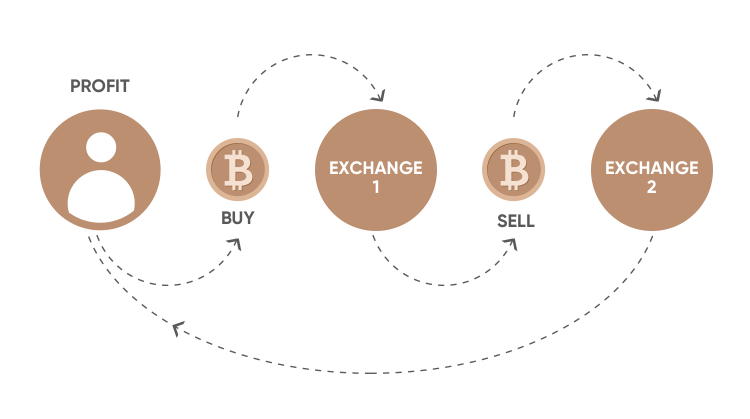

Cryptocurrency arbitrage involves buying a cryptocurrency on one platform and selling it on another for a profit. And this sometimes happens, where the same cryptocurrencies trade at different values on different platforms. Allowing users to arbitrage until the value rebalances.

The founder of FTX was one of the best known people to take advantage of these arbitrage opportunities to make a fortune in his early days. In 2018 he was arbitraging Bitcoin between American and Asian platforms with a difference of sometimes 20% of the Bitcoin price. However, there are currently no such good arbitrage options on a recurring basis.

Arbitrage arises because of how liquidity works in the cryptocurrency market, where each platform has its own liquidity and this affects the price of the different cryptocurrencies on that platform. Unlike the exchange, where all the liquidity is concentrated in a single institution.

How it works

Let’s look at a simple example to better understand how it works. On Binance Bitcoin is trading at $35,000, and on Coinbase it is trading at $33,000 due to a large volume of Bitcoin sales on Coinbase. So, to take advantage of the arbitrage opportunity, we are going to buy Bitcoin on Coinbase for $33,000, send it to Binance and sell it for $35,000, with a profit of $2,000. Although this is an extreme example and there is not usually that much difference, it can sometimes happen in smaller cryptocurrencies with little liquidity or that have a lot of volatility at specific times.

Arbitrage is still possible?

One question that many users may have is whether arbitrage still exists. The answer is yes, and it will always exist as long as there is separate liquidity on each platform.

This doubt comes from the fact that arbitrage opportunities are not the same as in previous years, due to the large number of bots and people who take advantage of these opportunities. And while it is true, there will always be new arbitrage opportunities.

But nowadays most of it is done with bots, and it’s hard to compete against them if you want to do arbitrage manually.

How to do it in KuCoin

In case you want to do arbitrage with KuCoin you have two options, create a bot for it or wait for moments of high volatility on this platform and try to take advantage of this opportunity. In times of high volatility is when the bots stop working or even due to moments of high volume you can also do arbitrage even if there are bots executing this type of operations.

At times when the market does not have a lot of volume, it is difficult for you to find arbitrage opportunities before a bot executes them and takes the profit. However, let’s take a look at a real example we were able to do so you can see how it works and how to proceed if you find a good opportunity.

Example of Arbitrage with KuCoin

Mention that this works on kucoin as other platforms that you can detect an opportunity. And also, that if you see differences between different cryptocurrencies, sometimes it is because the withdrawals or deposits of that cryptocurrency are not available, and therefore you will not be able to arbitrage.

Therefore, if you see an opportunity, first check that deposits and withdrawals of that cryptocurrency are available on both platforms. And now, let’s move on to the example.

At a time of great volatility and market decline, we saw a great arbitrage opportunity with USDN (Neutrino), where in KuCoin it was at a value of $0.84, and in the Waves Exchange, you could sell those USDN for a value of $0.90. The values are at specific times and fluctuated, so that at times in kucoin it could move from 0.80-0.90$ and in the Waves Exchange from 0.85-0.92$ approx.

With the two prices under control, and seeing that kucoin allows the withdrawal of USDN, let’s use 1,000 USDT as an example to see it better and buy USDN at the price found in KuCoin, 0.84$. So we will receive 1190 USDN with our 1,000 USDT in KuCoin.

Now, we will go to withdraw our USDN to the Waves wallet we have. Once they arrive, we will go to the Waves Exchange with our wallet connected and sell the 1190 USDN at a price of 0.90$ USDN per USDT. In this case, we would have 1071 USDT, getting a profit of 71$ each time we make this operation. Although always bearing in mind that the prices of kucoin and waves vary and the next time the arbitrage opportunity may be lower.

Here, we find that we have 1071 USDT in the waves network, and you cannot deposit usdt with this network in KuCoin. For this, we use the USDT to buy WAVES, the token of the network, and we can send it to kucoin. Once the waves arrive at kucoin, we exchange them for USDT and repeat the process.

The main problem in this case was the time it took to make the USDN withdrawal and then the Waves deposit, which was 30 minutes in total approx. Also, the risk of waves dropping in price while on the way to kucoin, although this has a solution.

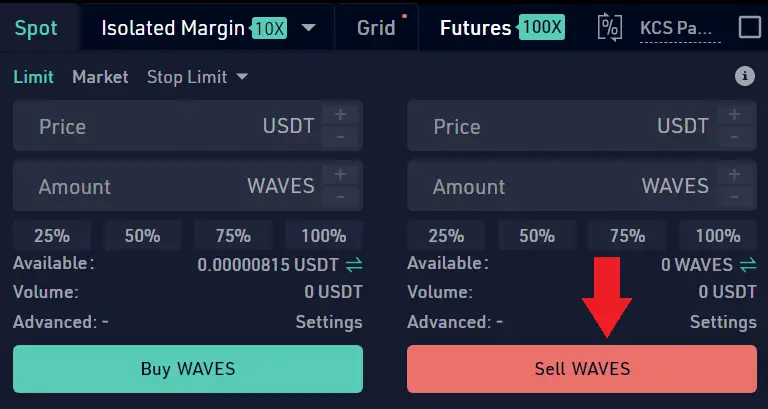

To protect ourselves from the risk of waves falling in value, we are going to use the kucoin futures and open a short trade on waves at the same value, the 1071 USDT. So in the event that waves when I get to kucoin has fallen in price and is now worth 1000 USDT, we will have the benefit of 70 USDT on the futures trade. It is one of the most common ways to mitigate risk, when you buy or hold an asset, to open a short position so that you are not affected by any price fluctuations.

Note that this is using a centralised platform with kucoin and a decentralised platform, which is the waves exchange. On decentralised platforms there are usually automated bots, so it makes it more difficult to have a good opportunity on this type of platform.

Risks

Finally, I would like to mention some of the risks of arbitrage that you should consider.

The first is the risk of losing money if it is not done correctly. As we have seen with the example, you can’t just buy and sell it to another platform. Because depending on the network, the timing and the platform, it can take time for the cryptocurrency to arrive on that other platform. And when it arrives, if it has fallen in price, you lose money. Therefore, you should always protect yourself by using futures or taking the risk that you may lose money.

Always try when you buy a cryptocurrency to take advantage of arbitrage, to open a short position (sell) of it, until you can sell it on the other exchange. This way you avoid being affected by price fluctuations.

Keep in mind that most arbitrage is done by bots, so you will hardly be able to anticipate it on decentralised platforms.

I hope this has helped you to understand how you can arbitrage in kucoin and the different risks to consider. Remember, if you don’t have an account with binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies