Welcome to this post, where we are going to see how Venus, the main lending & borrowing platform of the binance Smart chain, works.

Venus is a very similar platform, with some differences, such as its own stablecoin, VAI and other aspects that it has besides the function of depositing funds in exchange for an annual % and being able to borrow.

So let’s see how it works, aspects to take into account and what aspects are interesting in Venus, since it is one of the platforms with more liquidity of all the BSC.

What is Venus

The Venus Protocol is designed to enable a full algorithmic money market protocol on Binance Smart Chain. The protocol designs have been designed and forked based on Compound[1] and MarkerDAO[2] and synchronized on the Venus platform giving the benefits of both systems in one.

Compound is a protocol like AAVE for lending with over collateral, with different cryptocurrencies that you can use both for depositing and borrowing. And on the other hand, makerDAO is a system for mining your stablecoin, DAI, in exchange for depositing funds in makerDAO like Ethereum or LP tokens that back the value of DAI. So, on Venus you will be able to deposit to get an annual %, borrow and mine their stablecoin, VAI.

In this guide we will focus on how the borrowing system works. If you have experience with AAVE or similar platforms, the operation is the same. In relation to VAI we will not go much into this aspect, since as you can see in the graph, more than a stablecoin, it is a cryptocurrency that fluctuates in price quite a lot, and is currently at $0.94, when it should be worth $1 almost always. It is worth as much as $0.75 at its lowest point. Although stablecoins tend to fluctuate at specific times when there are many drops, they never have sharp drops and it seems that the system behind VAI and the mechanisms that should tie its price to $1.00 are not working. Therefore, we will rather focus on the other part that can be interesting.

Dashboard

We will use dashboard to deposit as borrowing, as it seems to be the only way we have found for it. Although you can go to markets to see more detailed information and then go back to dashboard.

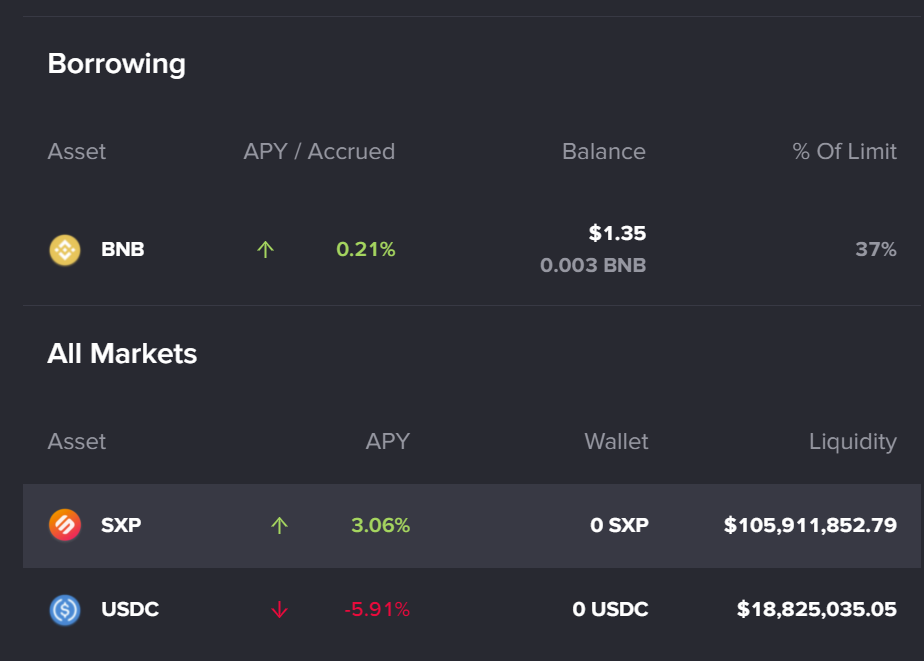

In markets, we find the information for any money market, both for when you deposit in supply, as well as for borrowing in borrow. The relevant aspects are the cryptocurrency in question, the total amount deposited in it, in total supply, the annual % you receive for depositing that cryptocurrency in venus in supply APY, total borrow is the amount currently borrowed, the annual % of borrowing that cryptocurrency in borrow APY, and liquidity the amount available left to borrow. Which is the difference between what is deposited, and what is borrowed. In Price you can find the price of the cryptocurrency, but it doesn’t really have much relevance.

The aspect that most highlights Venus and why it has a great use, is the wide variety of cryptocurrencies to deposit and borrow in a network such as the BSC, where commissions are very low. What makes that if you have BTC you can use it, or even Cardano, Chainlink, Dogecoin and many others. BTC being the one that has a large amount deposited, along with Ethereum and BNB.

Although I personally do not use Venus, I have been able to see some interesting options, and after seeing how they work we will cover why these types of lending platforms are used so much, despite sometimes giving less annual % than other platforms or options.

Supply

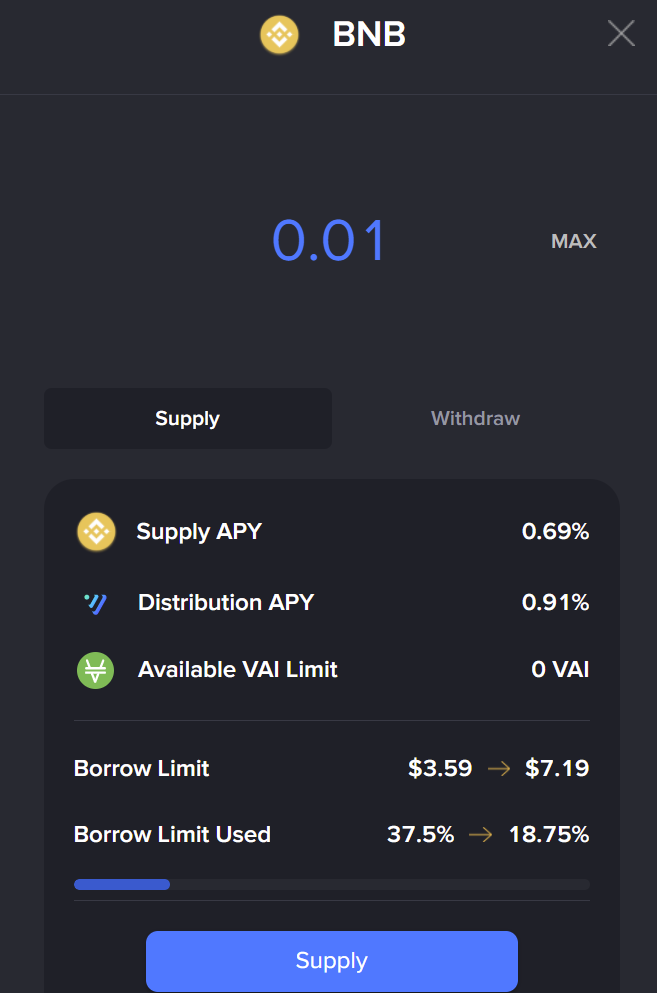

Once in the dashboard, we go down to the supply market. Here, we will select the cryptocurrency we want to place and use as collateral, if we later want to borrow. For example, with BNB. Simply indicate the amount, and underneath you will see the % you receive, usually there is a % of the cryptocurrency and another of XVS, which is the Venus cryptocurrency. This is because most of these platforms have incentives, and for depositing your cryptocurrencies you receive the % equivalent to what the borrower pays, and the incentives of the platform itself.

Below in borrow limit you will be able to see the amount you will be able to borrow at most with the cryptocurrency you deposit. And below if you have already borrowed, the amount you have available. Simply click on supply, confirm in your wallet and that’s it. Now in the dashboard you will see your deposit, with the annual % you are receiving and in balance the amount placed in $.

Borrow

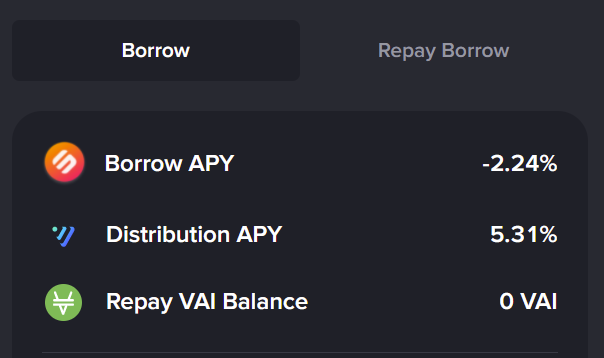

To borrow, the process is very similar, with some aspects to consider. We go to borrow markets, and select the cryptocurrency we want to borrow. You will see in APY that there are some cryptocurrencies with positive %. This is due to the incentives that the platform has for using it, both for depositing and borrowing. So you are going to get paid for borrowing. Always keep in mind that, if you have to pay an annual % for borrowing, but the annual % you receive with rewards from the platform is higher than the amount you have to pay. For example, with SXP right now as you can see below.

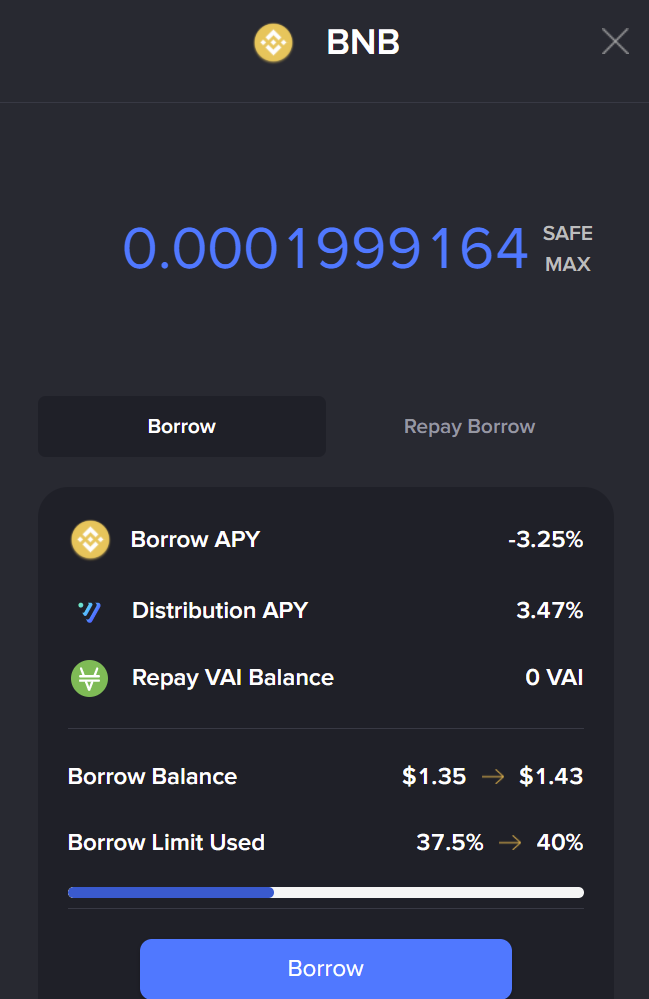

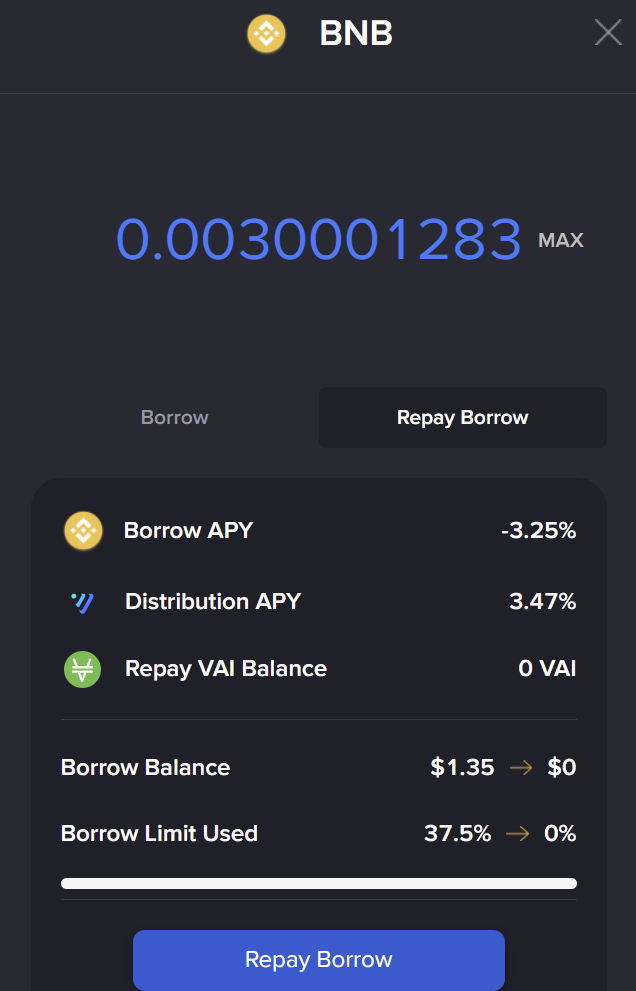

With this in mind, we select the cryptocurrency, indicate the amount we want to borrow. Below you will see the annual % you will have to pay and the annual % received as incentives. Below, one of the most important aspects is the borrow limit used, which will indicate the % we have borrowed with respect to what we have deposited. Keep in mind that if this bar reaches 100% our position will be liquidated, and we will lose the deposited cryptocurrencies. So, if you borrow, keep this in mind. Click on borrow and confirm in your wallet.

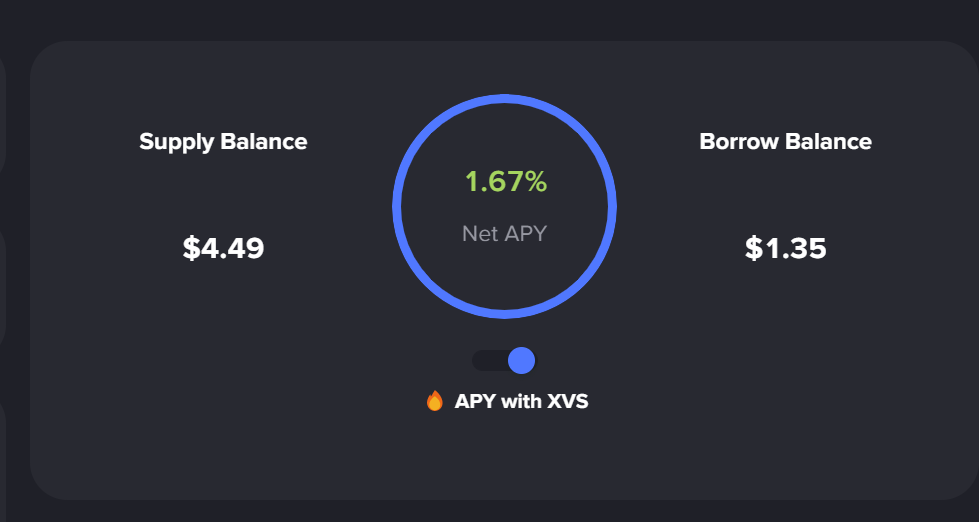

Now in the main panel you will be able to see the annual % you receive or are paying in total, with the deposit and the loan. The amount deposited and the amount you have borrowed. To repay your loan, simply reselect the cryptocurrency you have borrowed, and you will see the repay borrow tab.

The same goes for deposits, where you can go to withdraw at any time. With this, you will be able to deposit and borrow in Venus. Always pay attention to the collateral and avoid being liquidated and do not assume a risk that you cannot afford.

Vault

In vault we find the staking option of the platform. Here, you will be able to place VAI and receive XVS as a reward with at the moment 2.73%. We also find VRT and receive VRT as a reward, and finally XVS and receive XVS with 16%. The classic staking options that most lending and DEX platforms usually have in DEFI.

Why use Venus

As we have commented at the beginning, we are going to see some aspects of why Venus is used and not another platform where to place your Bitcoin and get a higher annual %, or any other cryptocurrency. Since many other platforms offer better annual returns.

The first thing to consider is the security that venus has compared to other platforms with less capital in them and more little known. But the aspect we wanted to comment on is the use of loans in DEFI.

One of the biggest uses it has is for taxes and to go short or make money if a cryptocurrency drops in price.

Every time you buy and sell at a profit you have to pay taxes in most countries and legislations. But what happens if you don’t sell, for example your Ethereum and deposit it in Venus and borrow USDT or USDC. Well, being a loan you can use the USDC and USDT, which you must then return to withdraw your Ethereum without tax implications. Since at no time you have sold your cryptocurrencies. It is a way to use your earnings without paying taxes. This if, with the risk of being liquidated if the price of Ethereum falls and you do not pay your debt. So if you want to use it, understand well how overcollateralized loans work and the risks it has to avoid being liquidated.

The other use is to go short in some cryptocurrencies that maybe we do not find in a centralized Exchange, or we do not want to use one of these. The idea is simple, if you deposit a stablecoin to make it simpler, and you borrow let’s say BNB. With the BNB you borrow you exchange it for a stablecoin, if the price of BNB drops, your debt or loan is less and therefore you will have to pay back a lower $ amount than you borrowed. This is a common use if you want to go short on a specific cryptocurrency in a decentralized way. The same happens if the price goes up, where you will have to overpay. So it is a strategy designed only when you think the price of that cryptocurrency is going to fall in value compared to the current one.

I hope it has helped you to know in more detail the operation of Venus, the main lending protocol in the BSC. Remember that, if you don’t have an account with binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies