In this post we are going to see how you can buy Maple without paying high commissions. Currently, it is not listed on any exchange, but you can get it through the DEFI Uniswap exchange. If you don’t know how, let’s see it here.

If you want to learn more about this cryptocurrency, below we are going to see what Maple is so you can learn more about this cryptocurrency before you buy it.

Where to buy Maple

To buy Maple, we are going to use Binance and the Metamask wallet, for me it is the best option, but you can also use other wallets if you don’t use Metamask. Binance is going to be used to buy ethereum that we will need to buy Maple. Below you can see a step by step video to get rid of any doubts.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies

If you already have in your metamask Ethereum wallet to pay for commissions, you are simply going to have to head over to uniswap, and copy the Maple contract so you can find the token if it doesn’t show up in to. You can find this on Coingecko or coinmarketcap by searching for Maple or you can copy the contract from the Ethereum network just below:

0xb0c7a3ba49c7a6eaba6cd4a96c55a1391070ac9a

With this contract, you will be able to find the token, in from to exchange it for the cryptocurrency you want in Uniswap. You can also add the token in metamask and be able to see the amount you have once purchased.

It is currently listed on the exchange gate.io, which you can create your account below and buy without using uniswap in a simpler way.

Platform: Gate.io

Min. Deposit: $10

License: Cysec

New cryptocurrencies (ICO’s)

Growing exchange

Step by step

Let’s see in more detail how you can buy Maple. The first thing is to login to Binance, if you don’t have an account you can create one here. With your account, you must make a deposit to have funds and be able to buy ETH. You can deposit funds with your credit card, to have the balance directly and without having to wait.

With your first deposit, whether euros, dollars or other currency, you must go to markets, and look for your currency with respect to Ethereum (ETH). In my case, EUR/ETH. Here go to the red sell button, and exchange your currency, in my case euros, for ETH. We use ETH because the commissions on the Ethereum network are paid with this cryptocurrency. You can also buy USDT (Tether), but you must have an amount of Ethereum in your metamask wallet to pay for the commissions, which can be somewhat high depending on the day and time.

Once you have ETH, you must click on the cryptocurrency, and click on withdraw. Go to your metamask, and click on the address, you will see that an address is copied when you click on it. You must enter this address in Binance to withdraw your eth from Binance to Metmask. It is very important to indicate the ERC20 network, and the amount you want to withdraw. The commission is around 6-7$. Confirm that everything is correct and confirm the transaction.

Open your metamask wallet, and if you have configured the etherum network, it should appear in a few minutes the amount of ETH you have transferred. Metamask usually defaults to the ethereum mainnet, so you will not have to configure it as in other networks.

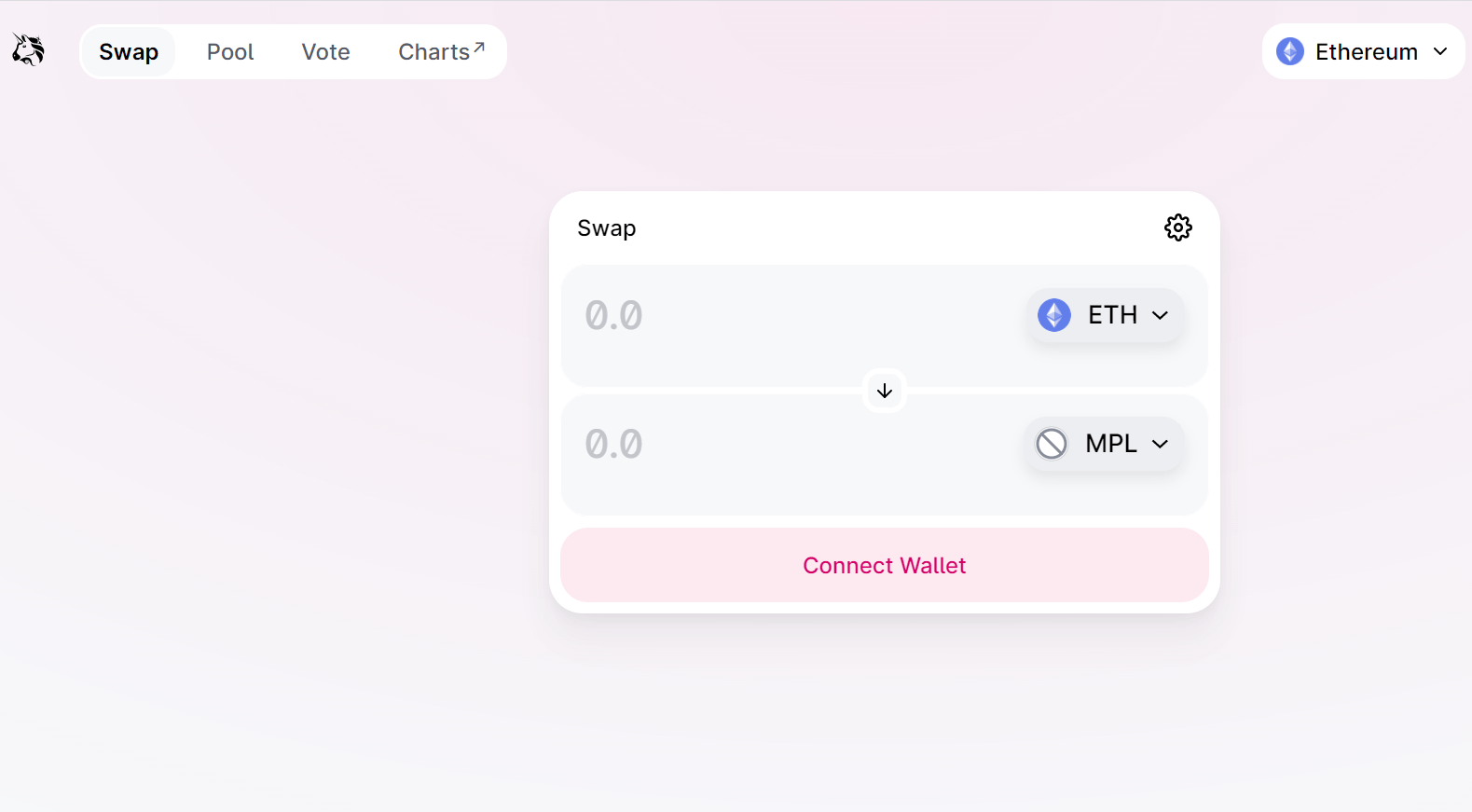

With this done, we must go to Uniswap. Here in from, we indicate ETH and to, the Maple token. If you look for it, you will not find it. In order to use it, you must copy the address of the contract and paste it. You can search for it in coingecko or coinmarketcap to see it, or you can copy it just below:

0xb0c7a3ba49c7a6eaba6cd4a96c55a1391070ac9a

With this, the Maple token should appear in order to be able to exchange.

Before clicking on swap, check that you have the settings on the wheel at 0.50% to avoid large fluctuations in the price when you buy. In case you have problems in making the transaction, I recommend you to raise the slipping tolerance so that you can make the transaction. This is common in times of high volatility.

With the correct settings, just click on swap, confirm swap and confirm the transaction in the metamask wallet. Keep in mind that the commission in uniswap in some moments or days, can be a bit high. If this is the case, I recommend you try to buy at times when there are fewer people using uniswap or quieter days, where commissions are usually cheaper, as there are fewer people using the ethereum network. Also, remember to leave an amount of ethereum for transactions in case you want to sell or send the cryptocurrencies to another wallet or Exchange.

To see Maple in your wallet, recopy the contract we used to detect the cryptocurrency. Go to add a token, custom token and copy the contract here. As you can see, it detects the token and you will see the amount you have.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies

What is Maple?

Cryptocapital markets

Unsecured lending to institutional borrowers

Lending or borrowing from a diversified group of institutional counterparties

Scalability

Access capital efficiently. Lending opportunities grow as borrowers build their track record and expand their business.

Sustainability

Generate DeFi performance from a diversified pool of accredited borrowers that are profitable and stable. Mitigate default risk with a buffer capital reserve.

Security

Audited by multiple third-party firms and collateralized with smart contract insurance. Collateral is held in non-custodied smart contracts and protected from automated settlements.

Expanding the digital economy through corporate credit origination.

Lender

Lenders generate yield by lending to major crypto institutions.

Pool Delegates

Pool Delegates oversee Lending Pools and assess Borrowers on commissions

Borrowers

Top cryptoinstitutions obtain unsecured loans through Maple to expand their businesses

Maple Finance is an institutional capital marketplace powered by blockchain technology. With a mission to redefine capital markets through digital assets, Maple expands the digital economy by providing undercollateralized loans for institutional borrowers and fixed income opportunities for lenders. The economic potential of the future will be fulfilled by harnessing global capital and applying it to the areas of greatest opportunity.

Maple offers borrowers transparent and efficient financing that is fully completed in the chain. For lenders, Maple offers a sustainable source of return through lending to diversified pools of premium cryptocurrency institutions. Pool delegates managing these pools perform diligence and set terms with borrowers.

The protocol is governed by the Maple token (MPL), which allows token holders to participate in governance, share fee revenue and secure loan pools.

Lenders can access reliable yield opportunities on Maple by depositing capital into loan pools. These loan pools are managed by experienced professionals, known as Group Delegates.

Institutional borrowers can access transparent and efficient funding up the chain with Maple, leveraging their reputation to borrow unsecured, without fear of liquidation and margin calls.

Pool Delegates perform due diligence and agree terms with Borrowers before funding loans from their designated Liquidity Pool.

Lenders earn a sustainable return through diversified exposure to premium cryptocurrency institutions and enjoy a “set and forget” solution as diligence is conducted by Pool Delegates.

Lenders – provide capital to a pool to earn interest from institutional borrowers, as well as any rewards associated with MPL loans.

Pool Delegates – credible experts who launch and manage Lending Pools. They each develop their own investment strategy and underwriting process to determine creditworthy borrowers.

Borrowers – institutions seeking capital to fund their operations and grow their business. Borrowers currently include hedging frequency traders, prop traders, market makers, exchanges and centralized lenders with a strong requirement for delta neutral strategies.

Stakers – Provide hedging to the Pools by wagering MPL tokens on the Pools to provide first loss capital. These tokens will be the first to be liquidated in the event a borrower defaults. Stakers receive a percentage of the interest earned by the borrower pool and rewards from MPL wagers.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies