Welcome to this post, where we are going to see how you can use the take profit and stop loss within KuCoin, to get a profit or mitigate your losses.

The Take Profit allows you to place a price where you can close your position with a profit, without having to be aware of the market. For example, if you have bought BTC at $60,000, you can place a TP (Take Profit) at $65,000, and if the price of BTC reaches that value, the platform will directly sell your BTC and you will get this profit, without the need to do it manually.

The Stop Loss allows you to place a price where to close your position with a loss, to mitigate your possible losses if the price of an asset falls in value. For example, if you have bought BTC at $60,000, you can place a SL (Stop Loss) at $55,000, and if the price of BTC reaches that value, the platform will directly sell your BTC and you will have this loss, without the need to do it manually and avoid losing more money if the price continues to fall.

The take profit and stop loss work in both operations of purchase (Long) or sale (Short), so the price that you indicate will depend on what type of operation you are doing.

Spot

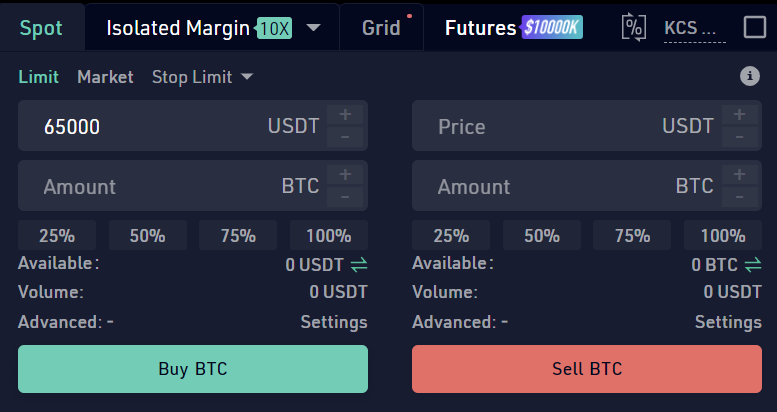

Unfortunately, KuCoin and other similar platforms do not have options to place TP and SL in Spot. Spot is the market where you buy and sell cryptocurrencies on a regular basis, unlike other markets such as futures, where you can use TP and SL in your positions.

In spot you can buy at limit or at market among other options different cryptocurrencies and have them in your portfolio, but as it is not a financial derivative, it does not have this option to place TP and SL in your purchased cryptocurrencies.

A solution regarding TP is to place limit orders at the price you would like to place your TP. For example, if you have bought BTC at $60,000, you can place a sell order for BTC at $65,000. This way, if the price reaches $65,000, the platform will sell your BTC and it will work in the same way as a TP.

This does not work in the case of SL, because if you place a sell order below the market price, it will simply execute and you will lose a %. In the case of using SL, you can use alerts to close your position in coinmarketcap if the price reaches a value, and receive a notification on your mobile, to go to the platform and sell your position.

How to Place TP and SL in KuCoin Futures

In Futures and other derivative products, such as trading bots if we can find the TP and SL options, being financial derivatives that require this option to mitigate risk and create a good investment strategy.

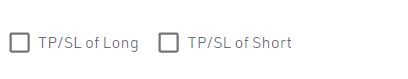

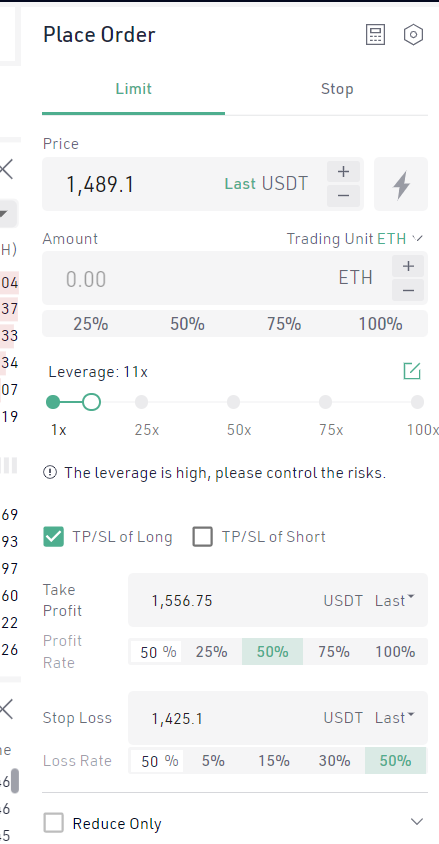

To find out if other KuCoin financial products have the TP and SL option, it is as simple as going to the trading panel of that product, and see if there is a box with the acronym TP and SL. If not, you most likely can’t use this option.

In futures pro, under leverage, you will see a TP/SL box. If you check it, you will be able to indicate both Take Profit and Stop Loss on the trade you are going to make. In KuCoin, you should check the TP/SL of Long if you buy (Go Long), and the TP/SL of Short if you sell (Go Short).

Also, note that if you do not enter the TP and SL when placing your order, you can go to positions and modify it if your trade is still active and has not been closed. Once the position is closed, the TP and SL are no longer of use. KuCoin makes it easy for you with % below, so you can estimate a % in TP and SL. If for example you want to close the position if you earn 25%, you can simply click on 25% and it will automatically indicate the TP, and the same with the SL.

To place the TP and SL, if you make a Long (Buy) operation, you must indicate a Take Profit above the price you have bought, and a Stop Loss with a lower price than the one you have bought. For example, if we buy BTC futures at $60,000, the Take Profit can be placed above, for example, at $63,000, and the Stop Loss below, for example, at $57,000.

In the case of going Short (Sell), you must indicate a Take Profit below the price you have bought, and a Stop Loss with a price above the one you have bought. For example, we sell (Short) BTC futures at $60,000, the Take Profit can be placed below, for example, at $57,000, and the Stop Loss above, for example, at $63,000.

So always keep in mind what kind of position you are going to open in order to place the TP and SL in the right way. I hope it has helped you to know how to place the TP and SL in the KuCoin platform. Remember, if you don’t have an account, you can create one below.

Platform: KuCoin

Min. Deposit: $30

License: Cysec

Very low commissions

Exchange with a wide variety of cryptocurrencies