Welcome to this guide, where we are going to see step by step how you can buy Lido DAO in a few minutes following this tutorial.

You can find after the step by step guide more information about this cryptocurrency so that you have more information before you get hold of it. So let’s go first with the guide on how to buy Lido DAO.

Where to buy Lido DAO

To buy Lido DAO, the best option is to use the Binance platform. Although there are other exchanges where you can also buy Lido DAO, Binance offers the best options and is the most used exchange in the world.

If you don’t have an account with Binance, you can create one here. Now I leave you with a video, so you can see how to buy Lido DAO in the best and easiest way, step by step, so you don’t have any doubts.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies

Step by Step

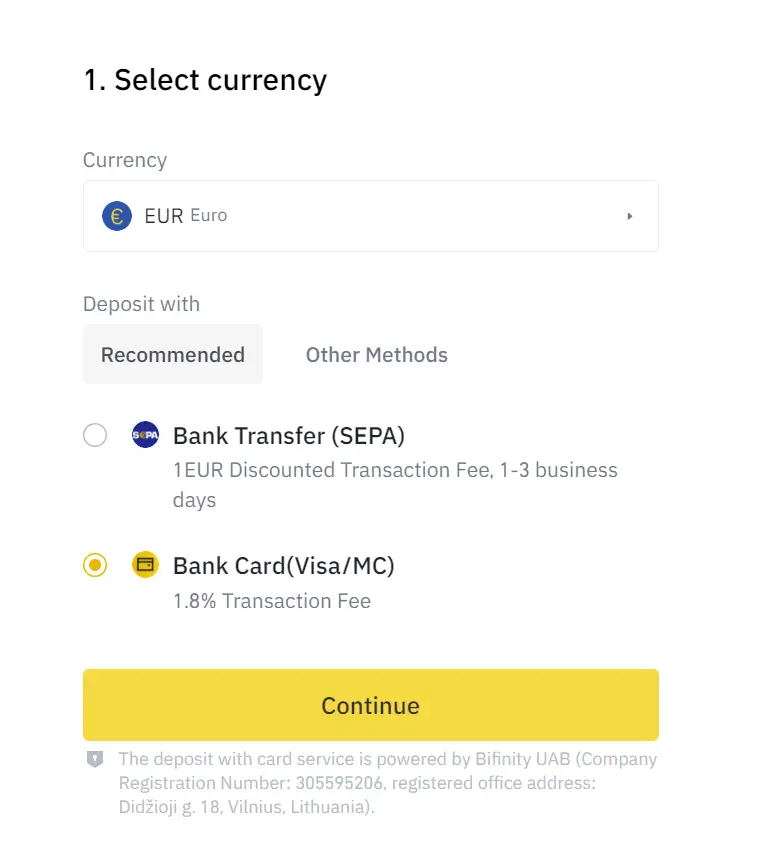

To buy Lido DAO, the first thing you need to do is to log in to your Binance account, deposit your funds, either Euro, USD or another currency.

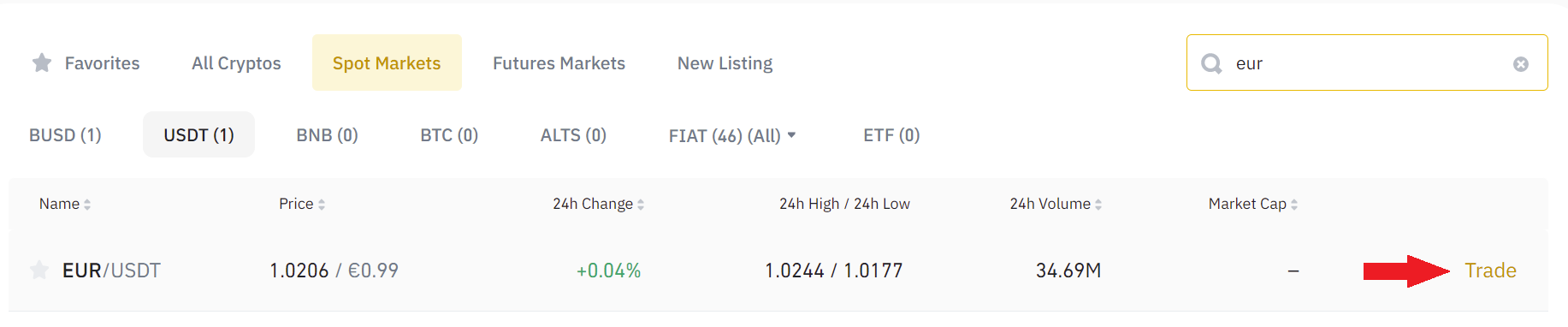

Once you have funds in your account, you must go to markets, and select your currency pair against USDT (Tether).

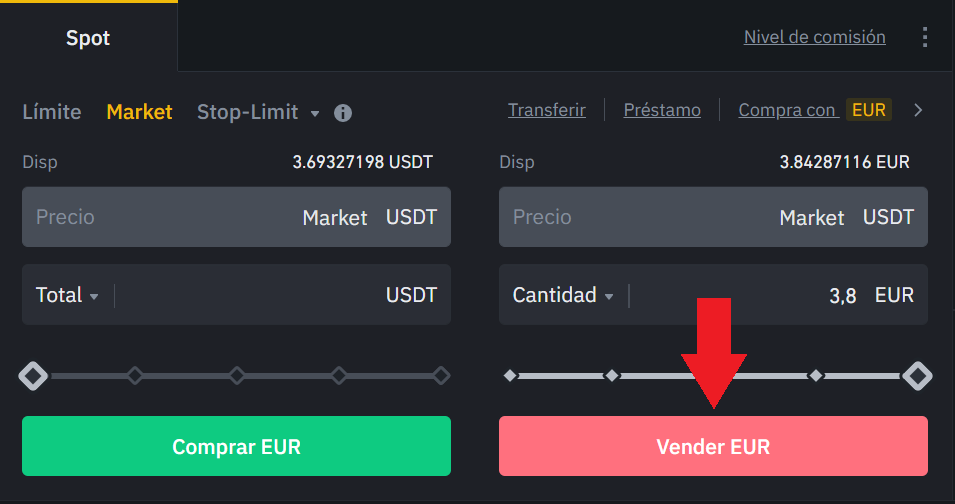

You can then buy Lido DAO. Once you choose the pair, you have to go to sell, and indicate the amount you want to exchange your currency for USDT, and then buy Lido DAO.

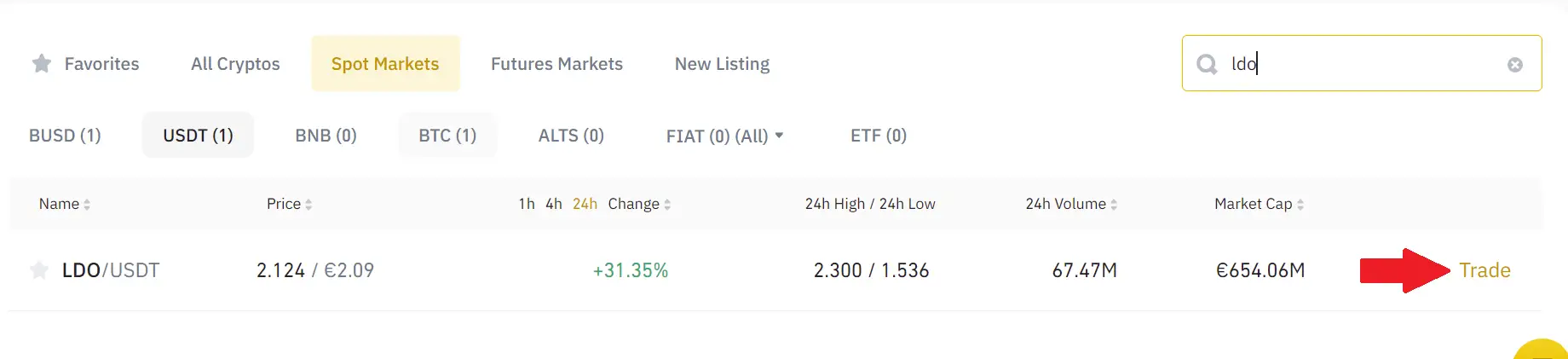

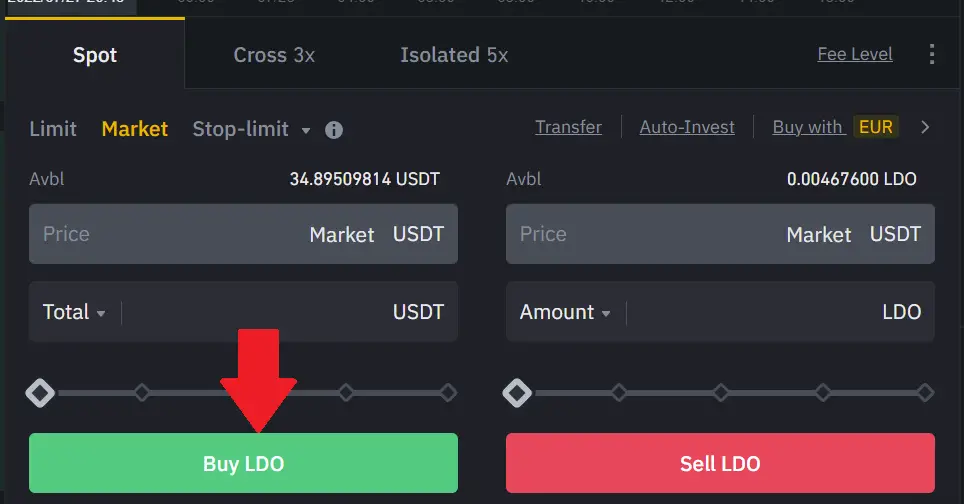

With the USDT already in our balance, you will be able to go back to the main menu to see that you already have it in your balance and the order has been executed. Go back to the market, and look for the LDO/USDT pair, and click on it.

Here, you will see again the same buy and sell panel, where you have to go to buy, to exchange your USDT for the amount of Lido DAO you want. Once you have chosen the amount, click on buy and you will have it.

If you go back to the dashboard, you can see how much Lido DAO you have. Now, you can keep it in Binance to sell it whenever you want, or take it to a wallet for more security.

The most popular digital wallet is Metamask, where you can withdraw your Lido DAO from Binance to keep it in Metamask for extra security. You can also use them in DEFI exchanges.

If you follow these steps, you will be able to have LDO in a few minutes. Register today with Binance to be able to buy this cryptocurrency.

To summarize, the steps we have seen are as follows:

- Login to Binance or create an account if you don’t already have one.

- Deposit funds into your account (Card or wire transfer)

- Use your deposited currency to buy USDT (in my case using the EUR/USDT pair)

- Go to markets and search for LDO to find LDO/USDT pair

- Go below and buy the amount you want by clicking on buy LDO

- Enjoy your new cryptocurrency

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies

What is Lido?

Lido is the leading liquid betting solution, providing a simple and secure way to earn interest on your digital assets. By betting with Lido, your assets remain liquid and can be used in a range of DeFi applications, earning additional returns.

Betting Fund. Protocol for managing deposits, betting rewards and withdrawals. A different one for each supported network.

st[token]. Unlike staked assets, Lido’s st[token] are freely transferable instead of being locked as in the case of native stakes. Lido allows users to trade staked assets to earn yield on yield by leveraging collateral, borrowing, yield farming and other types of Defi.

DAO. Lido’s liquid protocol management entity, responsible for choosing node operators, configuring protocol parameters and more.

To dive into the details of governance design and implementation, proceed to the DAO.

Node operators. entities that manage a secure and stable infrastructure to run validating clients for the benefit of protocols. They are professional providers of stakes that can ensure the security of protocol users’ funds and correctness of validators’ operations.

Ethereum is and remains the main focus of Lido. That has affected the organizational structure – governance is implemented through the ERC20 LDO token. Lido currently supports several PoS networks – when betting native assets with Lido, users will receive a st[token], which represents their [token] representing their deposit and rewards aggregated over time (penalties as well). The following networks are supported:

The protocols of the different networks inherit the architecture of their respective networks. This means that the designs of Lido tokens can vary significantly. Also the different protocols are maintained by different development teams. If you are interested in launching Lido on another network, please post your proposal in the research forum.

Liquid stakes

Problem Statement

Traditionally, staking in Proof-of-Stake (PoS) protocol-based projects has consisted of locking one’s assets into a project for a long time and expecting a fixed, predetermined staking reward in return. While it guarantees a return on staked assets much like a bonus, it also limits the opportunities to generate higher returns on those assets from the DeFi ecosystem. If you’ve staked all your cryptocurrency holdings, you can’t invest or trade more profitable cryptocurrency pairs on exchanges.

Solution

Liquid staking allows the st[token] to be used in other trading or investment opportunities so that the user gets the best of both worlds: a reward on their staked assets, as well as the returns from new trading/investment opportunities. Liquid betting introduces several key benefits to the:

Simplifying the betting process: no need to worry about hardware setup and maintenance;

Enabling rewards with as small a deposit as users desire (e.g. Ethereum requires a minimum of 32 ETH wagered);

Provide the st[token] as a building block for other applications and protocols (e.g., as collateral in lending or other DeFi trading solutions). Liquid staking gives an opportunity to maximize profit potential while having the best of both worlds;

Providing an alternative to exchange staking, solo staking and other semi-custodial and decentralized protocols.

Comparison with other staking options

Solo staking is great, but it has some disadvantages. Setting up a validator node requires pristine technical understanding, it brings with it a minimum deposit of 32 ETH in the case of Ethereum, the cut-off and offline penalties can become very severe if staking is handled incorrectly, and finally, the amount staked is locked for a significant period.

Solo staking is similar to other SaaS staking option in the sense that you have your own validation keys. However, with SaaS you must rely on a third party (usually centralized), which can act maliciously, attack or simply regulate itself. Going back to the Ethereum example, there is still a requirement for a minimum amount of 32 ETH wagered.

Alternatively, a scam can occur through centralized exchanges. Needless to say, cryptoassets and CeFi are not a good fit from a fundamental point of view. It is also worth mentioning the economic aspect – when wagering on some centralized entities, the user does not receive a corresponding token in return and, therefore, loses the opportunity to perform any further activity within DeFi or the same centralized entity, where the assets were wagered. Yes, the APR when staking on centralized exchanges may be higher, but with a significant amount aggregated within the centralized entity comes a huge potential influence to the ecosystem that was designed fundamentally decentralized.

By using a liquid staking solution like Lido, users can eliminate these drawbacks and benefit from secure, non-custodial staking backed by industry leaders. Liquid staking is unlocking the potential of PoS by giving users the ability to not only bet their assets, but to have the liquidity to use those assets in DeFi projects thereby not only increasing returns for the individual, but growing staking participation overall.

Security

Lido’s security is the highest priority from the time of its initial deployment, but users should still investigate the risks involved with Lido before committing to it. We are constantly working on improving security:

Using DAO for governance decisions and to manage risk factors.

Having multiple audits completed (see more).

Having a committee of elected, best-in-class validators to minimize wagering risk.

Allowing staking across multiple validators (i.e., Ethereum’s current staking mechanism only allows a single validator to be chosen).

Use of a non-custodied staking service to eliminate counterparty risk.

A set of attributes that we believe are important for protocol decentralization, and how Lido is performing against these goals, can be found in the scorecard.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies