Welcome to this post, where we are going to see how listing spy works, the usefulness of this platform, if it is reliable and how you can get the most out of it.

If you already know the platform and want to know if it is reliable and the returns you see are real, I recommend you to stay until the end. For those people who do not know the platform, let’s see a little introduction, as it is a type of platform that may interest you and you can find yourself, either this or other similar ones.

Before going on, mention that a part of the article are facts and how certain aspects work, and another part personal opinion after using the platform. But the experience and opinion of other users may be different.

What is listingspy

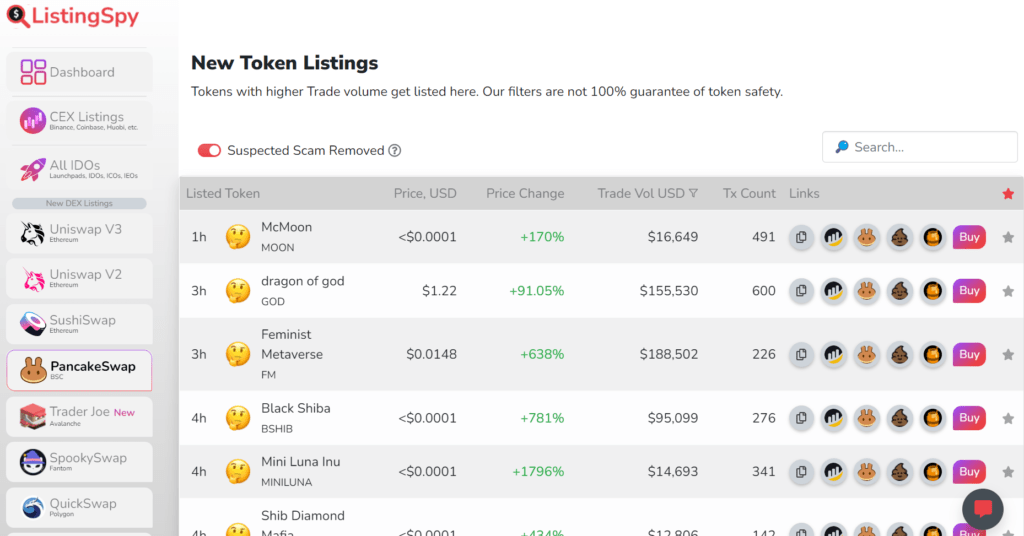

Listingspy is an aggregator of new tokens listed on centralized and mainly decentralized exchanges, such as pancakeswap, uniswap, trader joe, spookyswap, quickswap and many others.

Although mainly where there are more listings and more interest is in pancakeswap. The other DEX you can find listings of new cryptocurrencies, but a much smaller volume. There are also listings of new IDOs or ICOs and centralized Exchange, but what really gets more attention and more people use is the listing of new cryptocurrencies on pancakeswap.

If you go to their website in the pancakeswap section you can see new cryptocurrencies that have been listed, with more than an hour since they were listed, with their name. To see the cryptocurrencies listed in real time on pancakeswap, like accessing poocoin links, or buying the token on pancakeswap, you will need to use a subscription to the platform, on upgrade.

Are the returns real?

Now that we have introduced the platform, and you can get an idea of how it is, if not I recommend you to look at it, let’s see the aspects that generate more curiosity.

Everything we are going to see is our own experience after using the platform. To avoid losing your money in certain situations or to make you more aware of the risks involved. With this clarified, let’s get to the interesting part.

Are the returns real? No. Although it can be argued that they are, it is really impossible to buy at the right time and have that profitability. Besides, it would be unwise, since it would be necessary to review certain aspects to avoid being swindled. So, the returns are real, from a price movement point of view, but they are not achievable, if you are not the creator of the cryptocurrency or token itself. It is more of a marketing technique to make it look like you can get great returns quickly and easily.

Mention that the platform stresses that it is high risk, and even has filters to filter out projects that do not look like scams. In addition to links as honeypot where you can verify that it really is a token that you can sell once you buy it. Although all this, we will now see in more detail.

If you look at the returns, although we have said that they are not real, you may think, with half or 1/4 part of this profitability, I can earn a lot of money. But of course, there is a problem, you see the tokens after 1hour they have been listed, and they have already achieved the highest % of profitability. So let’s look at what subscriptions look like.

Upgrade

In upgrade, you will be able to access different functions, and we will talk about the standard one, which is the one we tested. Since you had access to panckaeswap listings instantly, without waiting an hour. Only if you could get half the profitability that you see in pancakeswap, in new token listings, I could make a lot of money. I guess that’s a thought we’ve all had when looking at those numbers.

So there is the standard plan, which gives you access to pancakeswap listings when they come out, and other features, but not relevant. The price is 0.03 ETH or 0.24 BNB. Depending on the price of Ethereum or BNB, that’s about $100 a month. Although what is $100 a month, if I can get returns of 400% or 1,000% on a cryptocurrency thanks to this access to real-time listings.

As you can imagine this is false. And let’s see why, you are actually more likely to lose money than make money using this standard subscription.

Mention that listingspy does its best to avoid filter scams, but just listing tokens with big fake returns if you don’t have a subscription, which are not possible to get, is not that ethical, and rather a marketing that creates false expectations. Making many users, including me, to subscribe for those false numbers. If only out of curiosity to see if it is really real those returns or you can get something similar with the subscription, by accessing the listings just when they come out.

How do the new cryptocurrency listings work?

Although this is on pancakeswap, I could see the same thing happening on other networks, on platforms like spookyswap, trader joe and any other DEX.

The main problem with listingspy and similar platforms, is that they create perfect platforms for scammers. Cryptocurrencies that are created and listed, and when users of such platforms invest, they make a rug pull or, in other words, disappear with your money. This is the case in 99% of the cryptocurrencies that are listed and for this reason, you will not be able to get the returns you see. Although we are now going to go into more detail.

But first, I would like to make a small reflection that I got after using this platform and other similar occasions. When something seems very easy, there is always something you don’t take into account.

If it were so easy, either it would have already been exhausted by other people, or it would not exist at all. It is easy to think when you see those returns without the subscription, that with only half or less, even with little capital you can earn a lot. But really the platform only shows you fake returns, and from projects that are not a scam. Which creates a bias that, although out of curiosity, makes you subscribe with a rather high price of 100$ per month. And you can see for yourself their wallet address both on eth and bnb to see when they are earning and how many people subscribe. One positive aspect of the blockchain is that you can see all the movements.

If this happens to you in other occasions or ideas, my recommendation is to start with little capital to validate the idea, for example, in my case to test how listingspy worked, I started with 10$ for each operation to see if it was really profitable or not before placing a higher amount, and avoid getting into FOMO.

Scams on pancakeswap and the BSC

After this small parenthesis, let’s go with the operation and mechanics of the new tokens. As we have commented, 99% of the new listings, are rug pull or scams that are going to go with all the money you invest in this token. And this, in large part is because they know that there are people who buy the tokens that appear on these types of platforms, and it is an easy way to scam and disappear in a few hours. If there were no people buying because only the token has been listed, there wouldn’t be so many scammers trying to abuse this.

I stress again, this is not the fault of the platform, and they have filters as well as warnings and guidelines to avoid scams. Still, even some cryptocurrencies that may seem reliable, end up being a scam.

The operation is simple, although there are different variants. The first is that you can buy and not sell. To do this, you can use the honeypot page, which you also find on listingspy, and paste the contract there of the token. It will tell you if it is a token that can be sold, or on the contrary, it is a honeypot and you will not be able to sell it.

This is the first filter to avoid the clearest scams or rugpull. Although even in tokens that are honeypot and literally can not be sold, you see users buying, or may be themselves to inflate the price, although this issue we will see shortly.

You will see that, sometimes, the honeypot is not that nobody can sell, but can only sell an address, and you see users selling, but they can only sell certain wallets, and therefore, you will not be able to sell it anyway.

This is the first filter. But, even if it seems all right, it doesn’t mean that they can’t remove the liquidity of pancakeswap and leave with the money. This is the most common option, and the worst, because you can’t predict it. You may think you are making money, and just can’t sell your token. This is the most common, because it looks like a token that you can buy and sell without problems, and all of a sudden, they disappear with all the money invested.

This happens in 99% of the tokens that appear in listingspy, and even if you use the filter of suspected scam removed, you will see projects that then remove the liquidity and make a rug pull. For this reason, the yields are false, and impossible to get. Since they are yields that refer to the price at which the token comes out, and a token that has just come out you can not know if it will be a rug pull or not. If you decide to start putting money into each new token, you will see how in most cases you will end up losing everything.

Although it may seem very attractive those profitability, out of every 100 tokens, 5 or less are not rug pulls, and there is no clear way to differentiate them, and even less, how much a token is listed.

Also, being new tokens, the money you could invest is very low, since if you invest 1,000$ in a token with little or almost no volume, you would move the price that much, and the same would happen when you want to sell it. So using more than $100 is a lot on some of these tokens, because of the low liquidity and volume they have.

Tricks of the scammers

Now that we have discussed the main aspect, if you still want to try to find those new tokens that are not rug pull or you are just interested in the topic, let’s see what tricks they do to make it look more reliable.

The first thing, you will be able to find many tokens with meme name, and doge, these are mostly scams and are usually even from the same people who make many different tokens. This is because of the patterns we will now discuss.

A main problem with listing a token with nothing behind it, is that no one buys or sells. Which does not generate confidence, and you don’t see the price or the green candle go up, besides trades on platforms like poocoin. This is as simple, as taking other wallets and every time they list a token, make several purchase operations, even if they are of little value, even less than 1$, it generates volume and it seems to be a token that there are interested people behind. But it’s really just them themselves with different wallets.

And this is obvious, when you see different tokens with meme names, that the first purchases are always the same amounts. They really don’t have it very elaborate, and you already see the same pattern in all the rug pulls that are listed.

Another possible case, although I have not been able to verify it, but after seeing different tokens of this style, it is something very likely, are in the tokens that directly you can not sell. These tokens, as they cannot be sold, or can only be sold by one wallet, you only see their price rise and green candles, which creates a false illusion to the investor. And surely, there are other wallets of the creators of the token to inflate the price, and make it seem that there is a lot of volume and interest. Since they cannot sell at any time, they do not run any risk of increasing their price by buying their own token with other wallets. Until they sell everything and disappear with all the money.

Why these scams happen

Although it is already a bit off topic, I would also like to comment on why this happens before going with the conclusions of the platform.

Mainly, because it is easy money, in small but significant amounts. This makes that nobody wants to investigate it, being few thousands of $, and the person who has lost usually are few hundreds of $ or in some case it will be 1.000$ or around. This in this type of rug pulls in new listings that make them in a few hours or a few days. Also, even if you manage to investigate, it is very difficult for centralized exchanges to collaborate to find the scammers, since they are small amounts.

In my experience, it is hard to estimate the amount of a rug pull, because of the above mentioned, where perhaps the scammers themselves have bought a relevant amount of the total with other wallets, and it is their money. For the short time I was there, I could see in spookyswap a rug pull of $70,000 in a matter of a few hours, and in pancakeswap $5,000 in every few hours. And considering that many of these tokens, do this several times in a single day.

Conclusions of listingspy

To summarize, listingspy is a platform with some utility, but with unrealistic marketing of what you can get. It is very likely that you will lose money, and I do not recommend you to use their subscription, besides it has a high price, if you are not going to get a return, I do not know what sense can have to pay 100$ at least per month. Still, if you are curious, I recommend you to use it yourself.

Although the platform has tools and filters to avoid and detect scams, it is impossible to detect most of them.

I hope it has helped you to know in more detail this platform, and all the aspects related to the new tokens listings. Remember, if you don’t have an account with binance, you can create one below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies