Welcome to this post, where we are going to see how Tectonic, the main lending platform in the Cronos network, works.

Tectonic has become a fundamental part of the Cronos ecosystem, providing a type of platform that all networks need, lending platforms. They open up many possibilities for users to be able to make loans within the network itself, without having to use platforms outside the network.

Tectonic has more than 900 million deposits and more than 400 million in loans from users. It is one of the platforms with the highest LTV or total blocked value of all Cronos.

What is Tectonic

Tectonic is a decentralised, non-algorithm-based money market protocol that allows users to participate as liquidity providers or borrowers. Providers provide liquidity to the market for passive income, while borrowers can borrow liquidity on an over-collateralised basis.

Tectonic is a fork of AAVE, the main lending platform on Ethereum and other networks. As we have seen with many new networks, it is common to fork AAVE, as it is a robust and unhacked platform, to create a lending platform on that network. And this is the case with Tectonic. So if you have used AAVE or a similar platform, you will have no difficulty in understanding how it works.

Tectonic allows you to deposit your cryptocurrencies and receive an annual % for it. This annual % comes from users who want to borrow and pay interest on the loan. In the same way, the cryptocurrency you deposit, you can use as collateral or guarantee, and borrow another cryptocurrency, always respecting the maximum amount to avoid being liquidated.

But first, if you don’t know how to set up the Cronos network in Metamask and deposit funds, you can find the guide here.

Markets

The first thing you will see is the markets tab, where you will find all the main information on how it works. The cryptocurrency in question is on the left-hand side. We go further to the right with the total amount deposited in total supply, the total amount borrowed in total borrow, the % of use of that cryptocurrency, with respect to deposits and loans.

If we continue, we find the annual % for depositing that cryptocurrency in supply APY, and finally, the annual % for borrowing in borrow APY.

In the annual %, you will see two %, one in large, and the other in small with the Tectonic token symbol. This is because the platform has incentives to encourage users to use it. And therefore, the annual % in small, is what you will receive in the token of the platform, TONIC. So, to borrow, you’re going to have to pay an annual %, but you’re also going to get TONIC tokens for it, and sometimes the annual % you get is higher than what you have to pay. So, you’re getting paid for borrowing.

This is a mechanic we have seen in many lending platforms to incentivise new users to use them, and attract liquidity. Even in AAVE with the polygon network or Avalanche we have seen it.

One aspect I would like to highlight about Tectonic is the large number of cryptocurrencies it has, where usually in the new networks they usually have very few, the main token of the network and some more. But in this case, we find several stablecoins, along with ETH and BTC, which makes you can make interesting strategies in this network.

Supply

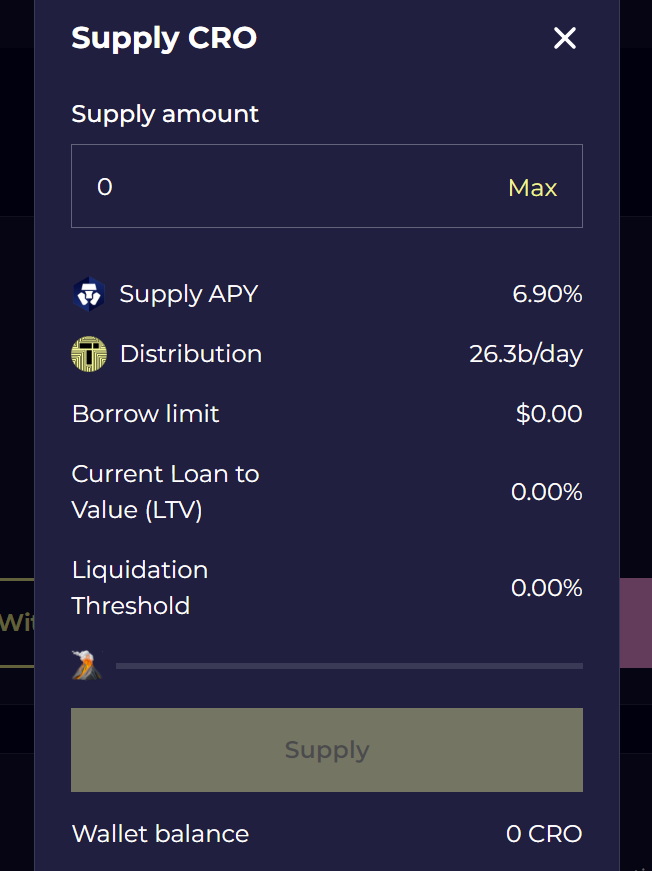

Now that we have seen the main thing, let’s see how you can deposit your cryptocurrencies. To do this, we will click on the one we are interested in. Here, you can find a lot of information that I recommend you look at, especially the collateral factor if you want to borrow later.

Once you have reviewed the information, click on supply, and first you must click on enable and confirm in your wallet. Now you can enter the amount, and click on deposit to confirm in your wallet and start getting the annual %.

To withdraw your deposit, you can click on withdraw and withdraw it at any time. However, if you have taken out a loan using that deposit as collateral, you must first repay the loan in order to withdraw your cryptocurrencies.

Borrow

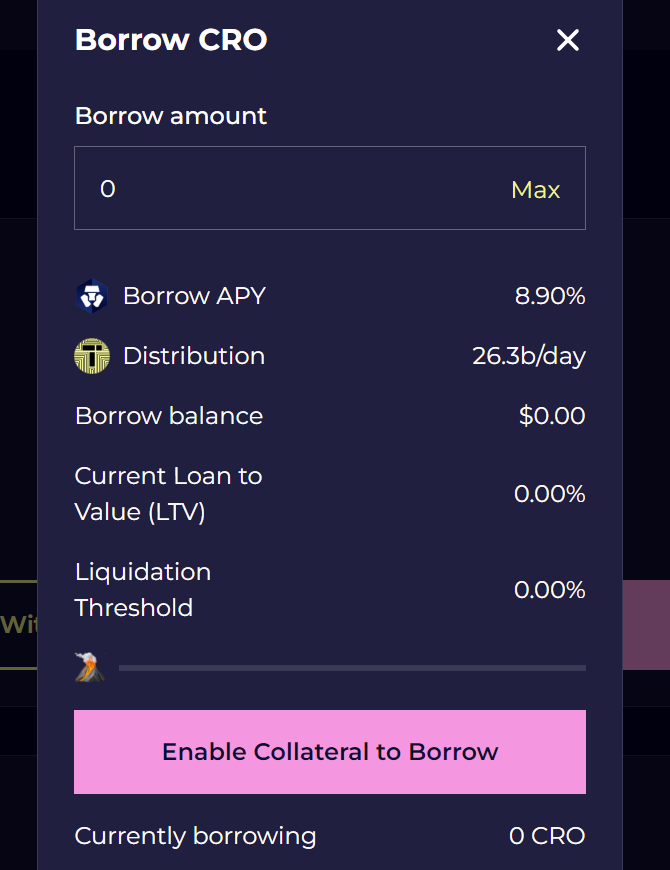

To borrow, the operation is the same, but going to borrow. However, we will have to take into account certain aspects. The first is the collateral factor, which is the maximum we can borrow in relation to our deposit. If for example we have deposited $100 in USDC, and we want to borrow BTC, if the collateral factor is 80%, we will be able to borrow up to a maximum of $80 equivalent in BTC.

Another relevant aspect is the liquidation penalty, which is usually 10%, meaning that you will be penalised 10% if your position is liquidated. When you click on borrow, you will see the LTV or current loan to value, and this value cannot exceed the liquidation threshold, or your position will be liquidated.

To avoid this, I recommend borrowing a small amount of the total amount deposited, or if an asset falls in price, you can deposit more funds or go to repay and pay part of your loan to avoid being liquidated.

In the dashboard, you can find all the information about your balance, both in annual %, as well as the risk you have at each moment and the LTV, which I recommend you pay attention to if you do not want to be liquidated. Also from here, you will be able to claim your rewards regarding the annual % you receive for depositing, and for borrowing with the TONIC token.

TONIC

Here, you can staking Tonic tokens, like many other platforms that have their own token, and receive xTONIC. By staking TONIC, you get part of the commissions generated by the platform, which is distributed among the users staking the TONIC token. In addition to helping to keep the protocol more secure.

I hope this has helped you to learn more about how Tectonic, the main lending platform in Cronos, works. Remember that, if you don’t have an account with binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies