Welcome to this post, where we are going to cover how seedify works and whether it is worth investing the required amount to be able to participate in new project launches, which is probably what you want to know.

We are going to focus more on the profitability of the platform and the requirements to be able to participate in it, and not so much on how it works, as it is quite simple to use. To participate in seedify you will have to pass a KYC, as it happens when using centralized exchanges such as binance, since launchpads or new project launches are not allowed in some countries such as the US. So first make sure that your country allows this type of investment and you will be able to participate by passing the KYC, in addition to the other requirements that we will see.

What is Seedify

Seedify is a launchpad specialized in crypto games. Although at the beginning the project was focused on being a platform for launching new projects, with the growth and interest in play to earn games, it specialized in this type of games and projects to launch on its platform, until it became what it is today.

So nowadays we can find crypto game releases on this platform, where every few days there is a new release on the platform. Token launches, ICO’s or IDO’s, are private launches through a platform to secure funds to the project before going public to other exchanges, whether centralized or decentralized. It is the same operation as IPO’s on the stock exchange, but this time with a token or cryptocurrency, and with much less regulation behind it.

It is a way for investors to invest in a project before it is publicly available, and for the project to raise funds and start developing the project faster. The main problem with IDO’s or pitches, is the large number of scams that exist. Therefore, platforms such as seedify are responsible for monitoring all the information and only make launches of good projects and contrasted information, not just any project. This means that most of the time the projects have a great profitability for the investor.

In seedify we have seen launches of very well known games, such as bloktopia, which have given very high returns to investors who participated in that launch.

Requirements to participate – Tier System

Now that we have seen what seedify is and its function, let’s see how you can also participate in these launches with very high returns. Although later we will see if it is really profitable, and the tricks that if you do not look in detail you may not see or understand.

If you go to the seedify website, you will see three boxes with information if you scroll down a little, and one with the name of tier system. Here you can find all the information that we are now going to see. Keep in mind that these systems can change, as already happened if many new users enter, although at the moment, it takes several months with this system.

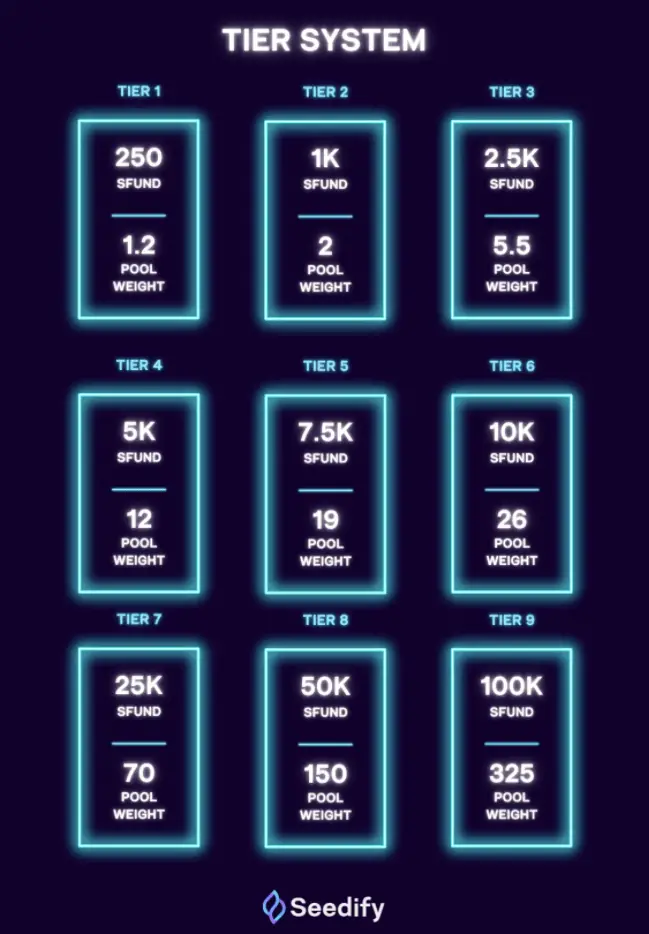

In order to participate in these launches, you must have an amount of your token, SFUND staked on your platform. Depending on the amount you have, you can have more tokens in each launch. You can see below an image with the different tiers.

As you can see, the lowest tier is 250 SFUND, although this tier works as a draw and you are not guaranteed an amount of tokens in the launch. Therefore, if you want to be able to really participate in each launch, you will have to go for the 1k SFUND pool, with a 2 weight in the pool. Although we will now go into more detail on how it works.

As you can see, the higher the tier, the more you will be able to buy in each release. Even so, you will need quite a lot of capital to get started. At the current price of 7,38$ each SFUND token, for the lowest tier with guaranteed participation, you will need 7380$ in staking, in case you want to go up one more tier, to tier 3, it would be 7,38*2.500= 18450$ in staking within the platform.

Once you have staked a minimum of 1,000 SFUND, remember that you must pass a KYC in order to participate. Remember to check that your country allows you to participate in this type of platforms before buying SFUND and staking them.

Amount available per tier or level

Although the amount you need just to start is high, 7,380$, if you can participate in launches that multiply their price by x4 or more, maybe it is not such a high amount. This is when the amount you will be able to buy in each launch comes in.

This will depend on each tier, the amount of pool weight it has, in the case of tier 2 it is 2, in the case of tier 3 it is 5.5 and the amount of users in that tier. The amount of pool weight assigned to that tier is divided by all the users of that tier to know the amount available in each launch.

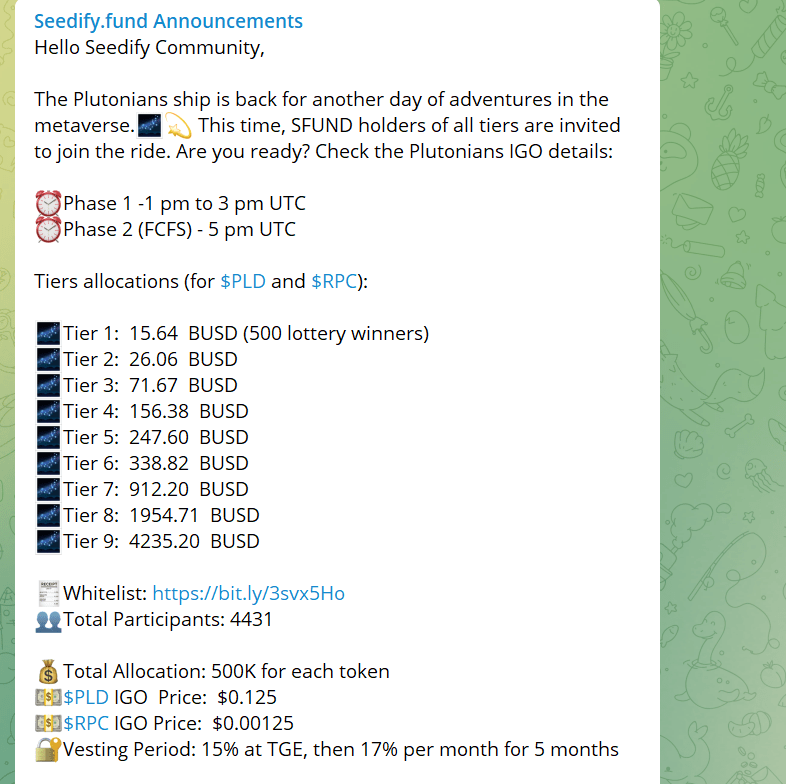

The formula is not very complex, but it can be difficult to calculate if we do not know how many users are in each tier. Therefore, the best thing to do is to go to their Telegram, where you can see in past releases the amount assigned to each tier. Although it does not mean that it is the same amount in each release, it is very likely to be similar and you can get an estimated idea of how much you can buy in each release.

Here, I show you the last one I have been able to find of delivery. But I recommend you to go to their Telegram if you plan to stake SFUND to be in a tier, and see the last releases that they have had to see if it has changed or if it is similar to the one you can see below.

We will focus on tier 2 and 3, since they are the most accessible and you have assured participation. The higher tiers are more profitable, but they are already capitals that few people can afford to use, and sometimes there is not such a big jump in the amount you can buy if you compare it with the amount of SFUND you have to deposit.

As you can see, in tier 2 it is 26,06 BUSD and in tier 3 it is 71,67 BUSD. These are very small amounts if you take into account the capital you have staked in the platform. Although it should also be noted that there are many releases each month, and therefore the amount you can use to participate, although small in each project, if you add the totals is not as low as it seems.

Also, it should be mentioned that sometimes, the tokens you get in the launch are locked and you can not sell them until after 3 months or they are unlocking a % each month, which means that you can not sell your tokens when the project goes public. And this, in some projects is good because its price keeps rising, but if it is a project that its price is falling, you will not have the profitability that you could think of when the project was launched publicly.

Is it worth it?

The most important question, and we are going to look at some calculations to be able to estimate whether or not the platform is worth it. It is possible that, if you looked at the projects with their launch price on seedify and afterwards, you might have thought that it is a great way to get great returns. But as we have seen, the amount you will be able to place in each launch is very small, if we compare it with the amount of tokens you will have locked. Besides the time you will have to keep the tokens blocked in each release for several months before you can sell them all.

Note that when you put your SFUND tokens in staking to be able to participate, you will also be able to get an annual % of the staking. The risk that really exists on this platform is if the SFUND token drops in price. Since you do not really spend in order to participate, but only have to buy the token of this platform. Even so, if you have to place $7,500 and per month you can get $500, it is a high risk for the profitability you can get.

Therefore, there are two important factors here, the amount of launches there are each month, and the average profitability they get. Since the amount that you will be able to buy, usually will always be similar. For this, I recommend you to look at the latest projects and make an estimate. In addition to see how many releases are being made each month. Keep in mind that not all releases will be profitable, and in some you may lose money. But on the other hand, there will be projects with very high profitability.

For example, with metastrike, at its launch a token cost 0.05$, and at its public launch, the token stabilized in the first hours at 0.70$. So, as you can see it is a return of x14 its price. But of course, if you have only been able to buy around 25$, it is not such a high amount, taking into account the amount you have placed in SFUND. Besides, you probably have only 15% of the total to sell, and the other tokens will be unlocked every month or every so often. This means that you must have enough liquidity to participate in the launches, since you will not be able to sell all the tokens you receive from each launch until several months have passed.

This is an example with a great profitability, but there are others that do not have such a good profitability or even that you can lose money. So you can look at other projects and the amount that are made on a monthly basis to make an estimate of what you can expect.

Also, if you think that the SFUND token is going to go up or hold, the risk is much lower, since you can participate in this kind of launches and when you want withdraw your tokens.

The most important thing is to see what amount you can get in exchange for the amount you should have locked. Because if you can get for example 2.000$ from the launches with the tier 2 of 7.380$, it can be profitable and interesting. But if on the other hand you get $1,000 or less, you are exposed to a risk with the SFUND token if it drops in price, for a small amount, compared to what you have invested. Although you can not really estimate the profitability that you can get, as each month may vary and depending on the projects that are launched, if it can be useful to get an idea and not get the wrong idea thinking that you can get more in a month than you have placed in SFUND.

I hope it has helped you to get a better idea of how seedify works and what you should consider before entering it. Remember, if you don’t have an account with binance, you can create one below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies