Welcome to this post, where we are going to see how it works and how you can use Osmosis, the main DEX in the Cosmos ecosystem.

Osmosis is the main decentralized Exchange for exchanging cryptocurrencies in the Cosmos ecosystem, and it has its own network to use its platform. Although the networks in the Cosmos ecosystem are interconnected and it is very easy to use funds between different networks.

What is Osmosis

Osmosis is an advanced automated market maker (AMM) protocol that allows developers to build custom AMMs with sovereign liquidity pools. Built with the Cosmos SDK, Osmosis uses inter-blockchain communication (IBC) to enable cross-chain transactions.

It is difficult to compare Osmosis to other DEXs, as the main difference is that Osmosis uses its own network. But it could be compared in its use to uniswap or pancakeswap, with the difference that Osmosis uses its own network. Although since all Cosmos networks are interconnected, you don’t really have the feeling or complication of using another network if for example you want to exchange your ATOM tokens.

A great feature of Osmosis is the low volatility of tokens and prices. Where sometimes in decentralized exchanges we see big price differences, or more than we would like, and Osmosis has a really low slipping tolerance, where the exchange between two assets is very accurate to the price they have at all times.

To use Osmosis we will need a wallet, my recommendation is to use keplr, which you can find a guide here, for its ease of use, and it is the most used wallet in the Cosmos ecosystem. With the wallet, and funds in your account, usually ATOM, that you can buy in the main exchanges, we are ready to use Osmosis.

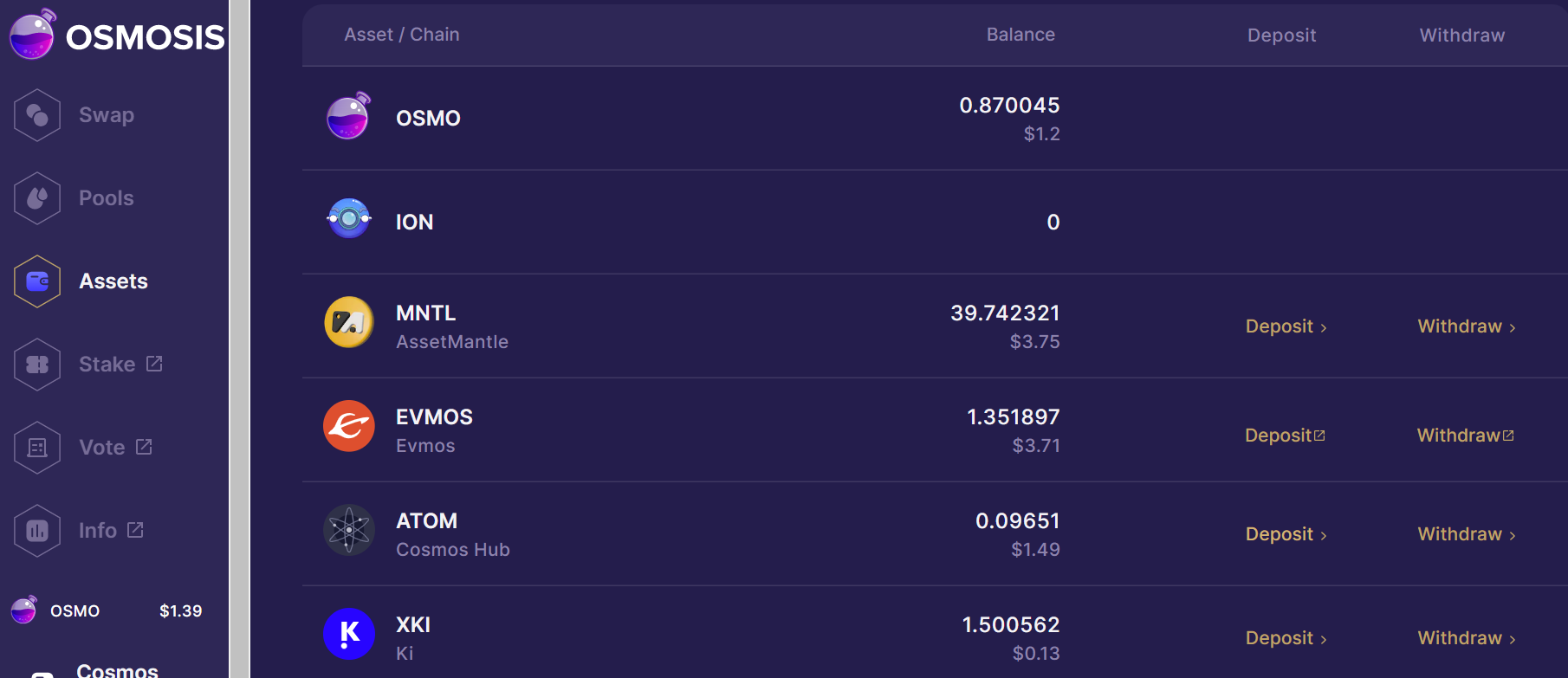

Assets

The first thing we are going to see is the assets tab. Remember to connect your wallet, below on the left. This is because, being another network, we must first deposit funds in this network, and for this we will go to assets.

The most common is to have ATOM, since it is the cryptocurrency that we can buy in Binance, kucoin and other exchanges, and withdraw it in the Cosmos network. To use ATOM, we must first deposit them in the Osmosis network, as they are different networks, although interconnected.

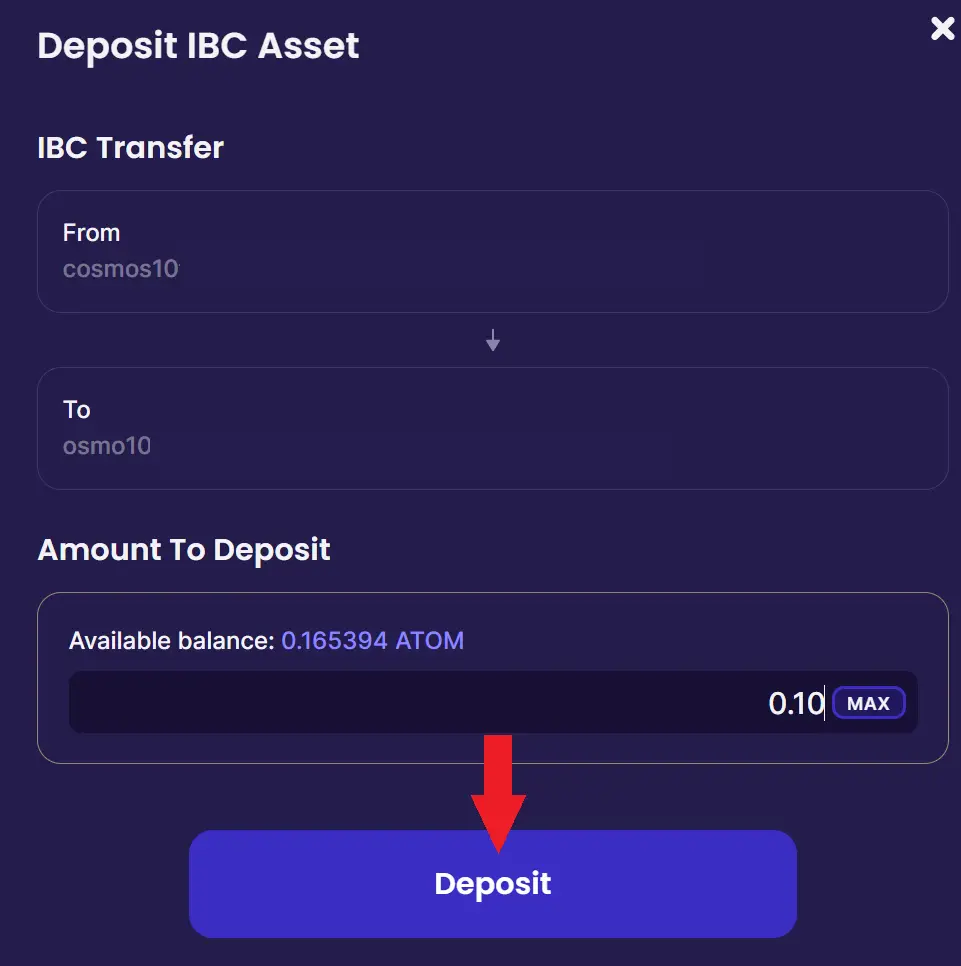

Although it may sound complicated, it is actually very simple. In assets, click on deposit, in this case and example in ATOM, you will see from the address of your Cosmos wallet and in to the address of your wallet in the Osmosis network. Enter the amount, click on deposit, confirm in your wallet and that’s it.

This way, you will be able to use the ATOMs deposited in the Osmosis network. The same happens with other tokens such as Luna or UST from the Terra network, or Crypto.com from the Chrono network.

Also, you can click on withdraw and withdraw the tokens you have deposited in the Osmosis network to its native network with the same process. By clicking withdraw, indicating the amount and confirming in your wallet. Depositing and withdrawing have no fees, only the transaction signing fee which is usually less than 1 cent.

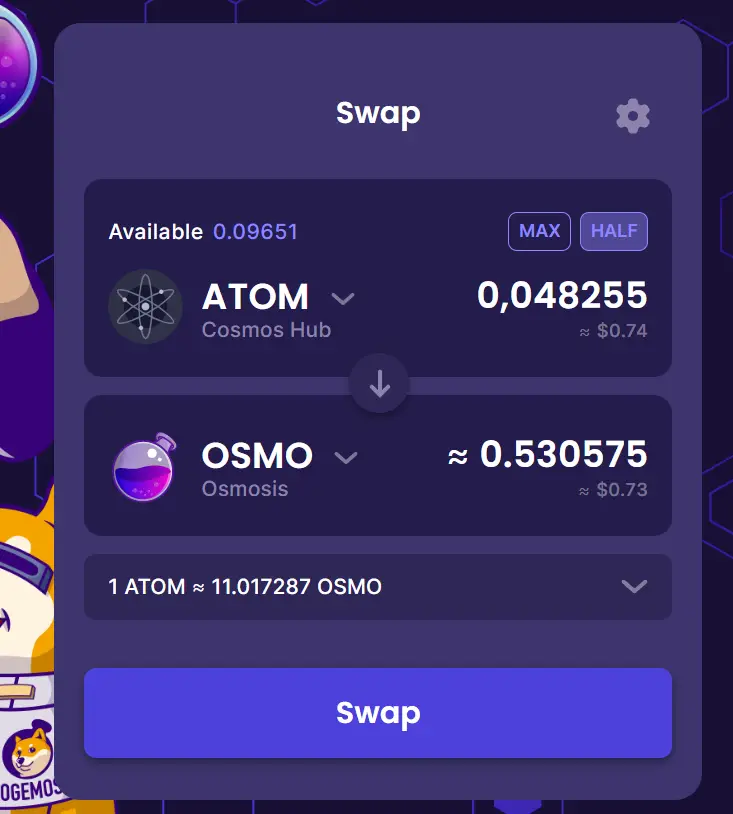

Trade

With the assets deposited, we can go to trade. Here, the operation is the same as any other DEX, such as pancakeswap or uniswap, in from we indicate the token we will use, in this example ATOM, and in to the token we want to get.

You can see the fee for making the transaction, which is 0.3%, and the estimated slippage, which is the volatility when making the exchange, where most of the time it is 0%. This is because of what we said above, that it is a DEX with very low volatility when exchanging tokens, which makes the exchanges much more accurate.

Click on swap, and confirm the transaction in your wallet. This way, you will already have your other token.

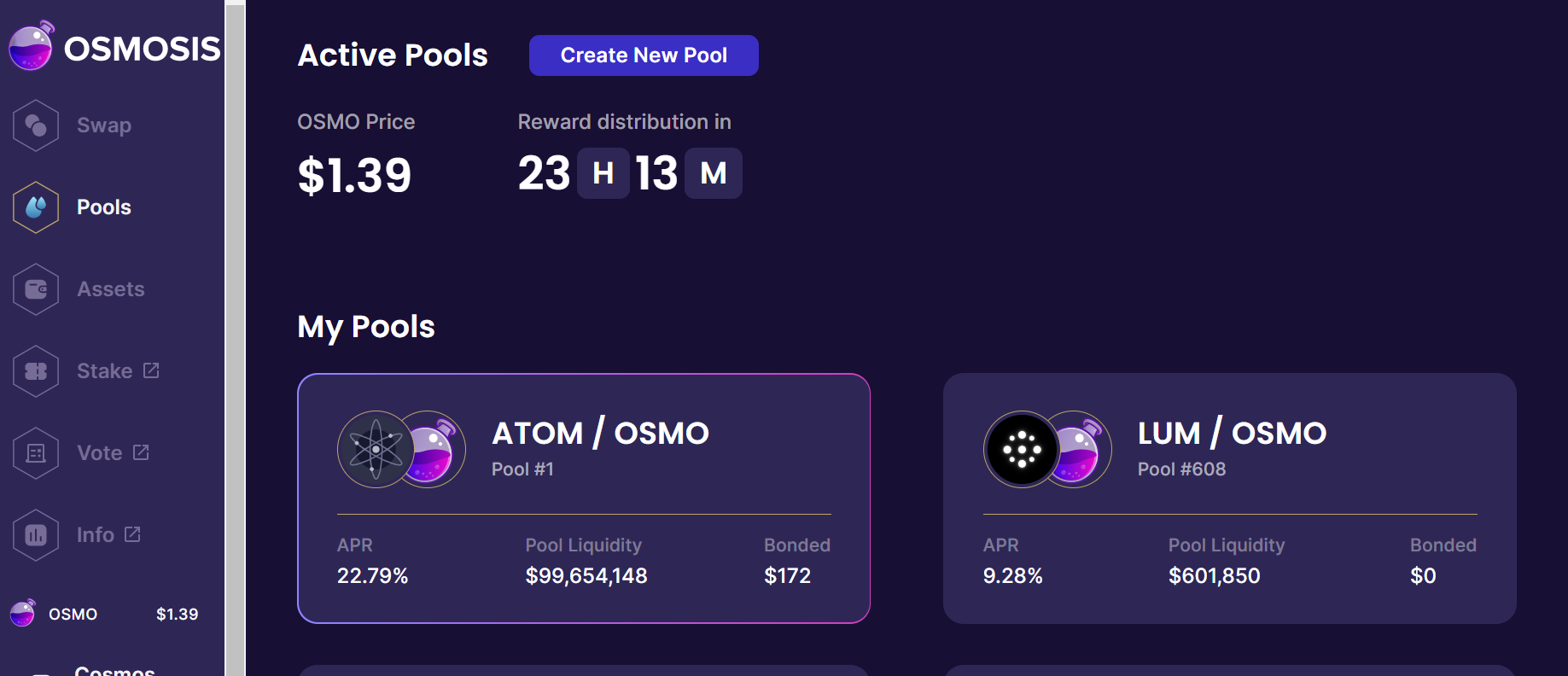

Pools

Here, you will be able to farm different LP Tokens from the Cosmos ecosystem, and get a good return for it. You can find pairs like ATOM/OSMO, ION/OSMO, EEUR/OSMO, UST/LUNA, UST/OSMO among many others. If you are interested in farming with LP Tokens, the returns you can find in Osmosis are quite good, taking into account the risk of impermament loss that the different LPs can have.

Keep in mind that the APR you see is the maximum you can get, which we will now see. The first thing to do is to create the LP Token. To do this, click on the pool we are interested in and at the top you will see an add/remove liquidity button, click there. Here, in add, we will indicate the two tokens with the same amount, and click on add liquidity. Confirm n in our wallet and we will have the LP created. You can also click on single asset LP, but the rewards are lower when only one token is placed.

With the LP created, click on start earning, and here we will have 3 options. The APR that we could see is if we indicate 14 days. The way it works, is that when we want to undo the LP Token, it is the time it will take to get the tokens back to our wallet. If we indicate 14 days, the annual % is higher, but we will have to wait 14 days when we want to remove the liquidity. On the other hand, if we select 1 day, we will receive less annual %, but we will be able to withdraw the liquidity in only one day.

Here, select the option that suits you best, indicate the amount of your LP, and click on Bond. Confirm in your wallet and you are done. This way, you will already have your LP Tokens generating the annual % that you can see.

The annual % you receive is directly to your Osmosis wallet, so every day you will see how the amount of Osmosis in your wallet increases. At the moment, there is no way to see what you earn with other platforms, what I recommend is to write down the amount of Osmosis you had in your wallet and see the amount you have at the end to see what you have earned.

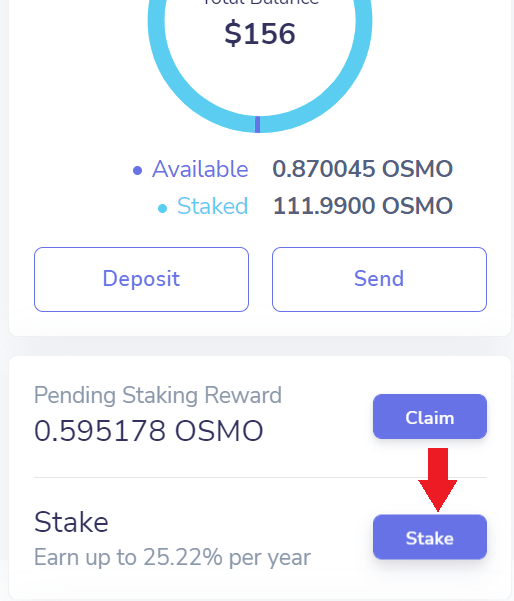

Stake

In Osmosis, you can also staking your tokens with the Keplr wallet. The operation is the same as the ATOM staking in the Cosmos network, in keplr, you can see the stake button and you can delegate your OSMO to a validator and get the annual % that you can see in stake, subtracting the commission that the validator takes. If you want to know more in detail how staking works in keplr and how to choose the best validator, I recommend you to look at the guide that you can find at the beginning of the keplr article.

I hope it has helped you to know in more detail how Osmosis, the main DEX of Cosmos, works. Remember that, if you don’t have an account with binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies