Welcome to this post, where we are going to see how balancer works, one of the main platforms to maximize your farming and get a better annual return.

Balancer is mainly located on the ethereum network, and was one of the first platforms to optimize LP Token farming and create liquidity pools for different protocols.

In this guide, we are going to look at the main aspects, how it works and the main advantages that balancer has over other similar platforms.

What is Balancer

Balancer is a community-driven protocol, automated wallet manager, liquidity provider and price sensor that enables decentralized exchange and automated token wallet management on the Ethereum blockchain and other EVM-compatible systems. Currently we can also find it on the Polygon and Arbitrum network.

Balancer pools contain two or more tokens between which traders can exchange. Liquidity providers place their tokens in the pools to collect exchange fees.

Balancer adopts great features to drastically reduce gas costs, supercharge capital efficiency, unlock arbitrage with zero token starting capital, and open the door to custom AMMs.

Balancer is a liquidity provider for different protocols, in addition to its own platform, where you can also exchange cryptocurrencies. But mainly, the use of balancer is to do farming with their LP Tokens, with very interesting pools that are unique or rarely seen on other platforms, and get a good return, mitigating risk.

In addition to having very competitive annual returns compared to other protocols, and being one of the platforms with more total value locked within its platform, with more than $ 3 billion (American).

Balancer is found in ethereum, polygon and arbitrum. Due to the high commissions that ethereum has, we will focus on the polygon network, which is accessible with small capitals. Although the operation is the same in the ethereum network, so if you want to use the ethereum network, this guide can also be useful.

The only aspects to consider are the different commissions, in ethereum they are much higher, and different pools and LP Tokens that you can find, as it is a different network.

Invest

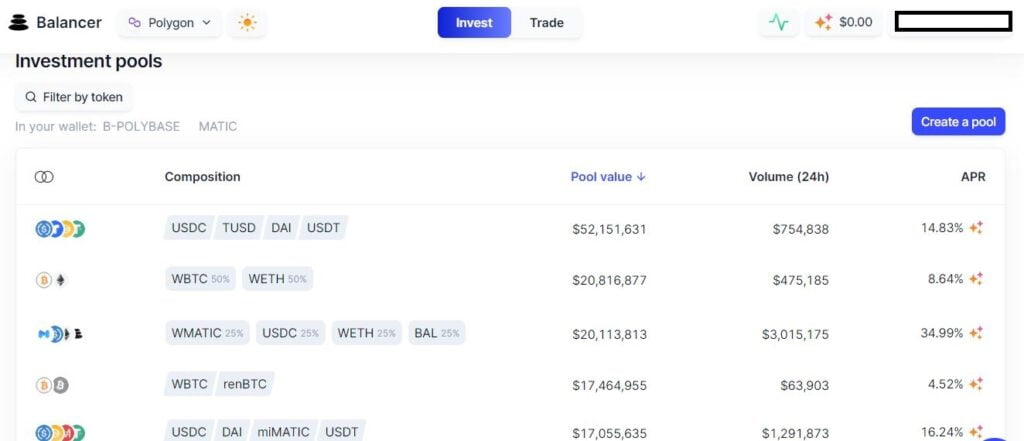

The main part of balancer is Invest. Here, is where we can deposit our cryptocurrencies in the pool we are interested in and get the APR that you can see on the right of everything.

The first thing to do is to connect your wallet on the top right and click on connect. If we go down, we will see the different pools. One of the most important aspects is where it says composition, where you will see the composition of each pool with their percentages. Balancer has excelled in creating pools that manage to reduce the risk of impermament loss, while offering a good annual return. Pools with 4 assets or more, and that each one is only 25% of the pool. However, we will look at this in more detail shortly. Pool value is the amount deposited in $, the volume in 24 hours that has had more to the right, and finally, the profitability that the pool is offering at that moment, on an annual basis.

For example, in the stablecoins pool, with USDC, TUSD, DAI, USDT with 14.34% APR. One of the main advantages of balancer is that you do not need to contribute all the cryptocurrencies in a pool. You can only place one, and it is distributed automatically. For example, in the stablecoins pool, you can only place DAI, without the need to buy the 4 stablecoins in the same proportion. The platform itself automatically makes the adjustment.

Click on the pool where you want to place your cryptocurrencies. Here, you will be able to see very useful information about the pool, such as the annual profitability it has been giving during the last month. In order to avoid seeing an annual % that is then greatly reduced, as can happen with other platforms. On the right you can see the % of each token in the pool.

To invest, simply click on invest, and here you will see all the cryptocurrencies in the pool. Indicate the amount of the cryptocurrency you want to deposit. Remember that you can deposit only one, it is not necessary to deposit all the tokens in the pool. Enter the amount, for example DAI, and below you will see the total, and the impact of the price. Click on preview, where you will see the total and the weekly profitability you can get. Click on invest, confirm in your wallet and you will have deposited your cryptocurrencies in balancer, and you will start to get the profitability indicated in the pool.

If we go back to invest, you will be able to see your pools in my V2 investments, with your balance and manage the pool to withdraw the profits or funds that have been generated.

When you want to withdraw your funds, click on the pool, and instead of invest, click on withdraw. Here, you can withdraw in two ways, with all the tokens in the pool, or directly to a token, which is much more convenient. Continuing with the example of the stablecoin pool, if you put 100$, balancer automatically put 25$ in each stablecoin, as there are 4 of them. When you want to withdraw, you can withdraw 25$ from each one, or directly 100$ from DAI or another stablecoin. This is very convenient to avoid having to make several transactions.

In withdraw indicate all tokens or the token you want to withdraw, indicate the amount, click on preview, withdraw, confirm in your wallet and that’s it.

Trade

In trade, we find a very simple panel to exchange cryptocurrencies, with very low price fluctuation, thanks to the large amount of liquidity that has balancer.

The trade part works like any other DEX, such as pancakeswap or uniswap, so we will not go into detail on how it works. The only thing we are going to highlight, that if you want to trade cryptocurrencies that are in the pool, there is very little price difference, even with high volumes due to the great liquidity it has. While in some DEX, it is possible that the exchange of tokens is not so favorable.

Advantages

Finally, as there are many platforms currently farming different LP Tokens, I would like to discuss some advantages and aspects that make balancer different from other platforms. The main advantages you can find are the following:

- Insurance

- High LTV or Total Locked Value

- Unique LP Tokens with

- low risk of impermanent loss

- High ease of use

Balancer offers an easy to use platform, used by many people and with a lot of capital behind and with some antiquity if we compare it with others, which gives much more security than new platforms.

Although the most remarkable are the pools of 4 or 5 tokens, each one representing 25% or 20% of the pool. If you do not know what is the impermament loss, you can find a guide on our website, to understand what we will now see.

Pools of 3, 4 or 5 tokens, where stablecoins are included, offer a very small risk of impermament loss, while offering a good annual return. For example, the WMATIC, USDC, WETH and BAL pools, with a 40% annual return.

One of the main risks of LP Tokens and farming is impermament loss when a token goes down or up a lot in price, and this can be seen using calculators when there are two tokens, especially if they both fluctuate and are not stablecoins. But adding more tokens, like this kind of pools, makes the risk of impermament loss, even if one of these tokens fluctuates, is greatly reduced. I recommend you to look for an impermament loss calculator of 4 tokens or more and you will see that, despite the price variations, the impermament loss is quite small. Which reduces the risk that these pools have, plus they offer a good annual return. And this combination of pools of 3, 4 and 5 tokens, with a low risk, and a good annual return, is one of the main reasons for the success of balancer.

I hope it has helped you to know how balancer works, one of the main platforms to provide liquidity and get a good profitability. Remember that if you do not have an account with binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies