Welcome to this post, where we are going to see how abracadabra money works, a platform that has experienced great growth in recent months, due to what it offers.

With its MIM stablecoin, which can be used on many platforms and on different networks, abracadabra money is a platform similar to Maker, where they offer an algorithmic stablecoin, which is based on reserves to maintain its value to the dollar.

But unlike Maker, MIM is a stablecoin with much more diversified reserves, which offers much more security to its users and stability in the 1:1 value to the dollar. Whereas DAI, which is Maker’s stablecoin, is primarily backed by USDC.

What is Abracadabra Money

Abracadabra Money is a lending platform that uses interest-bearing tokens (ibTKNs) as collateral to borrow a USD-linked stablecoin (Magic Internet Money – MIM), which can be used like any other traditional stablecoin.

Currently, many assets, such as yVaults, have locked-up capital that cannot be used. Abracadabra offers the opportunity to use it and make a return on those assets.

It is a platform focused on two tokens:

Magic Money Internet (MIM): asset-backed stablecoin that you can mine using collateral from different assets, and leverage using MIM to generate a higher return on farming and staking. With a pool found in Curve, with a great annual profitability for being only stablecoins.

Spell: The farm token of the platform, which you can get by using the farming option in abracadabra, curve and other platforms are the pools of abracadabra. It is a token that you can staking and a part of the commissions that the protocol gets, when mining MIM, is distributed among the people who staking Spell. So, if more users use abracadabra money, the spell stakers benefit from it. Although currently the spell staking option is only available on the ethereum network.

networks

Currently, abracadababra money can be found in different networks, being the main one and where we find more farming, staking and variety options, the etheruem network. The networks you can currently use are:

- Ethereum

- Fantom

- Avalanche

- Binance Smart Chain

- Arbitrum

Although in some of the networks, there are hardly any options as it happens with Binance Smart chain, where there are no options for mining MIM, nor farming. So, we will focus on the ethereum network, although many aspects work the same way in the different networks.

Also, keep in mind the costs of using the ethereum network with the high gas fee. So, with a capital of less than $5,000-10,000, it is not worth using this network with abracadabra, as you will end up paying $500 or more in gas fee to mine MIM or do farming. With that said, let’s take a closer look at the platform.

Curve

Before we look at the farm and borrow options, one of the main reasons for abracadabra’s growth, and one of the biggest uses, is the Curve pools that are available with MIM.

This is because, on different networks, such as ethereum and Fantom, Curve has added a pool of 3 stablecoins, which includes MIM, fUSDT, USDC, which is the MIM2POOL pool. This pool in fantom, has become very popular, because it offers a 20% annual return on stablecoins, where you get Spell for farming these 3 stablecoins in abracadabra. Also, you can do farming of this pool directly on curve, and also receive the spell rewards that this platform offers.

In ethereum there is the MIM3POOL, which is composed of MIM, DAI, USDT and USDC that you can farm in Curve, and get rewards both in the platform’s curve token, as well as spell, being a pool that includes MIM.

In Arbitrum we also find a MIM+2CRV, a pool of MIM, USDC and USDT, which is offering 22% per year in abracadabra, where you will receive spell as a reward. If you are interested in curve pools, and abracadabra, you can find in each network, in the menu the available pools and in farming to get a good annual %.

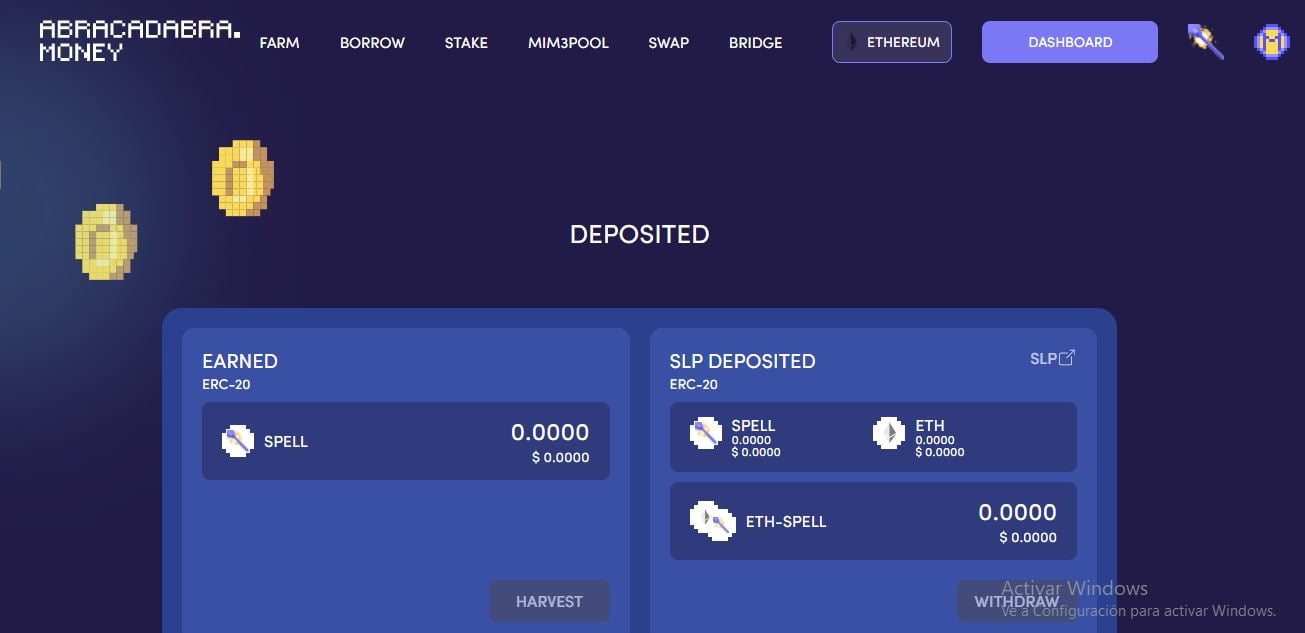

Farm

In farm, mainly in ethereum we find different farming options with LP Tokens, and Curve pools. There are some networks that you will not be able to find farms for the moment.

In farm you will see under each LP Token, which platform they use and you must create the LP, either Curve or Sushiswap usually. On the right the amount of spell received per $1,000 in that farm, so you can estimate what you can earn with the current annual %. Further to the right you can see the annual % you receive, and the TVL or total value locked in that pool within abracadabra.

To farm any pool, you simply must first create the LP Token in the platform that indicates you, either sushiswap or curve, and once you have it return to abaradabra. Click on approve, and confirm in your wallet. You will see the deposit button to deposit your LP Tokens and start receiving rewards.

You can withdraw your LP Tokens at any time by clicking on withdraw and you’re done. Note that the annual % you receive is in spell, so it is a farming token, but with some differences and advantages over tokens from other platforms.

Usually, the tokens you receive as a reward for placing liquidity on a platform tend to drop in price quickly, not having a great value beyond encouraging users to provide liquidity on that platform with a high annual %. But spell, you can use it for staking and receive a % of the commissions generated by the platform. So, spell has a value and usefulness, since, as the platform is used more, the more you will generate if you have your spell staked.

This mechanic has made spell since its launching of abracadabra money, instead of falling in price, has increased more than 10 times its value, as it has a real utility, beyond farming.

Borrow

In borrow we find the part where we can mine MIM, using as collateral our cryptocurrencies, and even use leverage.

To do this, in borrow you can see the different tokens you can use, in the ethereum network we find the largest variety of them. Before clicking on any token, we can find the following on the right:

COMPONENT -These are the components that can be used as collateral to borrow MIMs.

Total Value Locked (TVL) – Shows the total value of the components that are deposited in each market by all users.

LEFT TO BORROW – Shows how many MIMs are still available to be borrowed using that component. Once this number reaches 0, no leverage positions or new loans can be opened. To borrow more MIM, users must wait for that particular market to replenish.

INTEREST -This is the annualized percentage at which your debt will grow each year.

LIQUIDATION FEE -This is the discount a liquidator will get when liquidating a position that has been marked for liquidation.

Click on the one you want to use to use as collateral. First, decide the amount of the token to be used as collateral. Next, decide the amount of MIM to be loaned, either by typing in the numbers or by using the percentage buttons below.

The light blue SAFE indicator is a guide if we have set configurations that are high risk. The SETTLEMENT PRICE tells you the price of the component at which we can be flagged for settlements.

A settlement price of $0.75 means that, if your interest-bearing token drops to $0.75 or below, your position is at risk of being liquidated. The settlement price displayed is always linked to the interest-bearing token used to borrow MIM.

If you click on change leverage, you can use leverage when borrowing MIM. This is an automatic way to leverage yourself without needing to use the MIM you have acquired with your collateral, and go through the same process again. This way, the platform does it automatically for you. You can indicate the amount of leverage in choose your loops, where you can see the expected leverage, the estimated settlement price and the amount of MIM received. Keep in mind that the higher the leverage, the higher the risk of liquidation and only use this option if you are aware of the risks of using leverage.

Also, keep in mind that using a x2 can give you a significant amount of MIM, but as you use more leverage, the amount of extra MIM you get for that leverage is reduced.

When we are ready, we can press the ADD COLLATERAL AND BORROW button. This will remove our collateral token and place them in the contract, and we will receive the respective MIM tokens in our wallet.

You can use the repay feature to pay off your debt or decrease your leverage level and mitigate the risk of being liquidated on the repay button at any time. Whether you want to close the position or just decrease the risk.

Stake

In stake you can make staking of spell, only found in the ethereum network. As we have already mentioned, for staking spell, you will receive sSPELL, which is appreciated with respect to spell with the time and annual interest that you can see in staking APR. It is a form of liquid staking, which allows you to have sSPELL, in your wallet while you are getting a return on your spell, and to be able to use the sSPELL in other platforms or in abradacabra as collateral.

Liquid staking is a new form of staking that has become very popular in many platforms, because it allows you to use the tokens you have staked, at the same time you get the annual %. We could see it in other platforms like Anchor protocol with UST and aUST, where the token you staked is locked, and you receive another token, which appreciates in value over time with respect to the token you staked.

So, if you want to have spell again, you will see that when you change the sSPELL to spell, you will receive more spell than the ones you have staked.

Regarding swap and bridge, they work in the same way as the classic swaps and bridges, where you can move MIM from one network to another in an easy and intuitive way. Being a simpler aspect, we will not go into detail about this part of the platform.

I hope it has helped you to learn more about how abracadabra money works, and its main uses. Remember that if you don’t have an account with binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies